20 Best Payroll Companies Shortlist

Here's my pick of the 20 best software from the 34 tools reviewed.

The best payroll company is one that takes complex, error-prone payroll tasks off your plate, so you can spend less time calculating wages, fixing mistakes, or worrying about tax compliance, and more time focused on people.

Whether you're drowning in spreadsheets, navigating clunky legacy software, or starting from scratch, finding the right payroll partner can eliminate manual work, automate filings, ensure accuracy, and keep your team paid on time.

As an HR software reviewer and former payroll support person, I’ve reviewed hundreds of HR service providers, and I know how big a difference the right provider makes.

This guide will help you cut through the noise to choose a payroll company that fits your team’s needs, scales with your business, and frees you from payroll headaches for good.

You Can Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Payroll Companies: Comparison Chart

This comparison chart summarizes pricing details for the best payroll companies that made my shortlist to help you find the best payroll company for you.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global employees and contractors | Free trial + demo available | From $29/month | Website | |

| 2 | Best with integrated HR and IT management | Free demo available | From $8/user/month (billed annually) | Website | |

| 3 | Best for mobile-friendliness | 30-day free trial | Pricing upon request | Website | |

| 4 | Best for automated payroll and tax filing | 90-day free trial | Pricing upon request | Website | |

| 5 | Best for HR, payroll, and integrations in one | Free demo available | Pricing upon request | Website | |

| 6 | Best for hiring without local entities | Not available | From $199/employee/month | Website | |

| 7 | Best for mobile-friendly hourly payroll | Free plan available | From $20/location/month | Website | |

| 8 | Best for managing international teams | Free demo available | From $25 - $199/user/month | Website | |

| 9 | Best for industry-specific payroll services | 30-day free trial | From $40/month + $6/user/month | Website | |

| 10 | Best for enhanced US customer support | Free demo available | Pricing upon request | Website | |

| 11 | Best for small businesses | 30-day free trial | From $19/user/month | Website | |

| 12 | Best for US companies | 30-day free trial | From $4/employee/month + $17/month base fee | Website | |

| 13 | Best for offering international stock options | Free trial available | From $29/user/month | Website | |

| 14 | Best for entrepreneurs and SMBs | 14-day free trial | From $10/user/month | Website | |

| 15 | Best for payroll in India | Free demo available | Pricing upon request | Website | |

| 16 | Best for global payroll with built-in advisory | Free demo available | Pricing upon request | Website | |

| 17 | Best for reliable payroll expertise | Free consultation available | Pricing upon request | Website | |

| 18 | Best for employee self-service | Free demo available | Pricing upon request | Website | |

| 19 | Best for combined payroll and time-tracking | 14-day free trial | From $3.99/user/month + $19/month base fee | Website | |

| 20 | Best for support via PEO and EOR services | Free demo available | From $20/user/month (billed annually) | Website |

-

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Payroll Company Reviews

Here’s a brief description of the top 10 payroll companies that made it into my shortlist, including their main service offerings and other noteworthy features. I’ve also included screenshots to give you a snapshot of their software’s user interface.

Plus, I’ve included 10 more worthwhile companies below, if you’d like some extra options to consider.

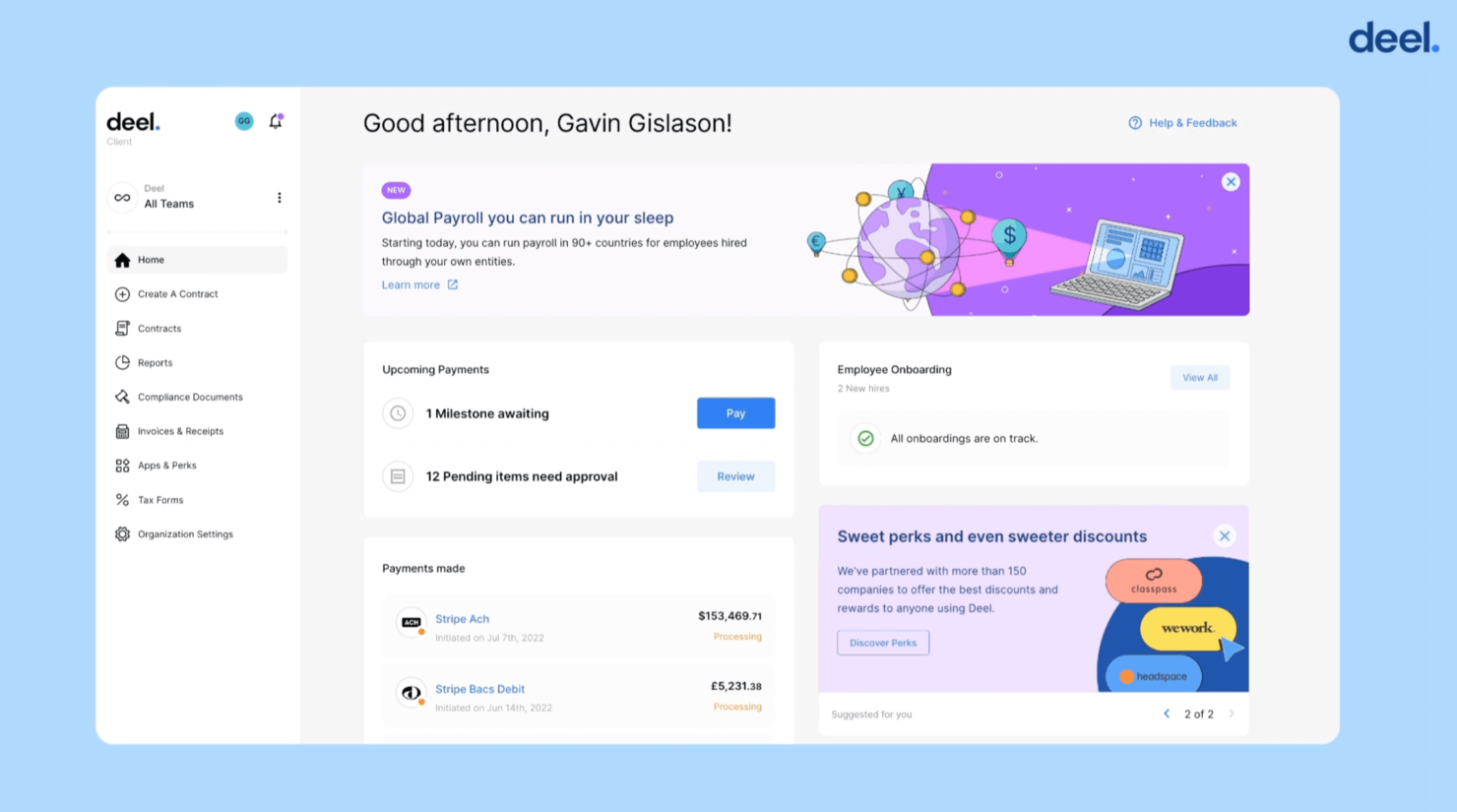

Deel offers global payroll and compliance services, focusing on international hiring and payments. They serve businesses of all sizes seeking to manage a distributed workforce.

Why I picked Deel: Managing international payroll can be complex, but Deel simplifies it by handling compliance, taxes, and payments across over 150 countries. Their platform lets you hire contractors and full-time employees without setting up local entities, saving you time and resources. With transparent pricing and 24/7 support, Deel makes global expansion more accessible.

Deel Standout Services:

Deel's employer of record (EOR) services let you hire full-time employees in other countries without establishing a local entity, ensuring compliance with local labor laws. Their contractor management system streamlines onboarding, invoicing, and payments for international contractors, reducing administrative burdens.

Software integrations are available with NetSuite, HiBob, Xero, Ashby, and Greenhouse.

Deel Target Industries and Specializations:

Target industries: technology, finance, marketing, education, and healthcare.

Specialties: global payroll, compliance, contractor management, employer of record services, and international hiring.

Pros and cons

Pros:

- Comprehensive compliance management

- No need to set up local entities

- 24/7 customer support

Cons:

- Not all features available in every country

- Pricing may be high for small businesses

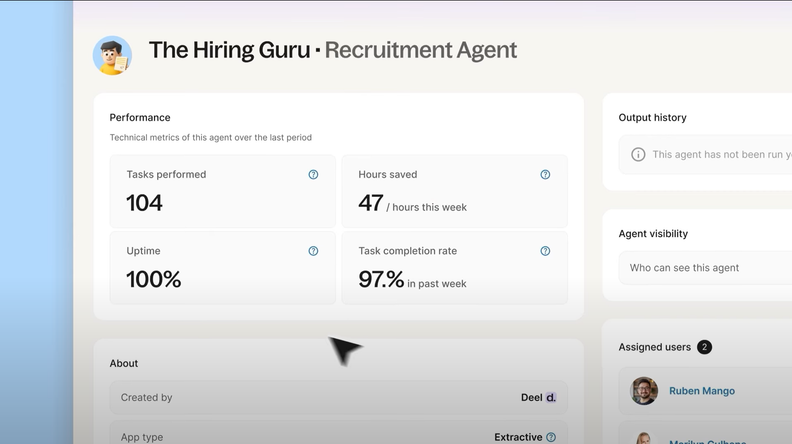

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

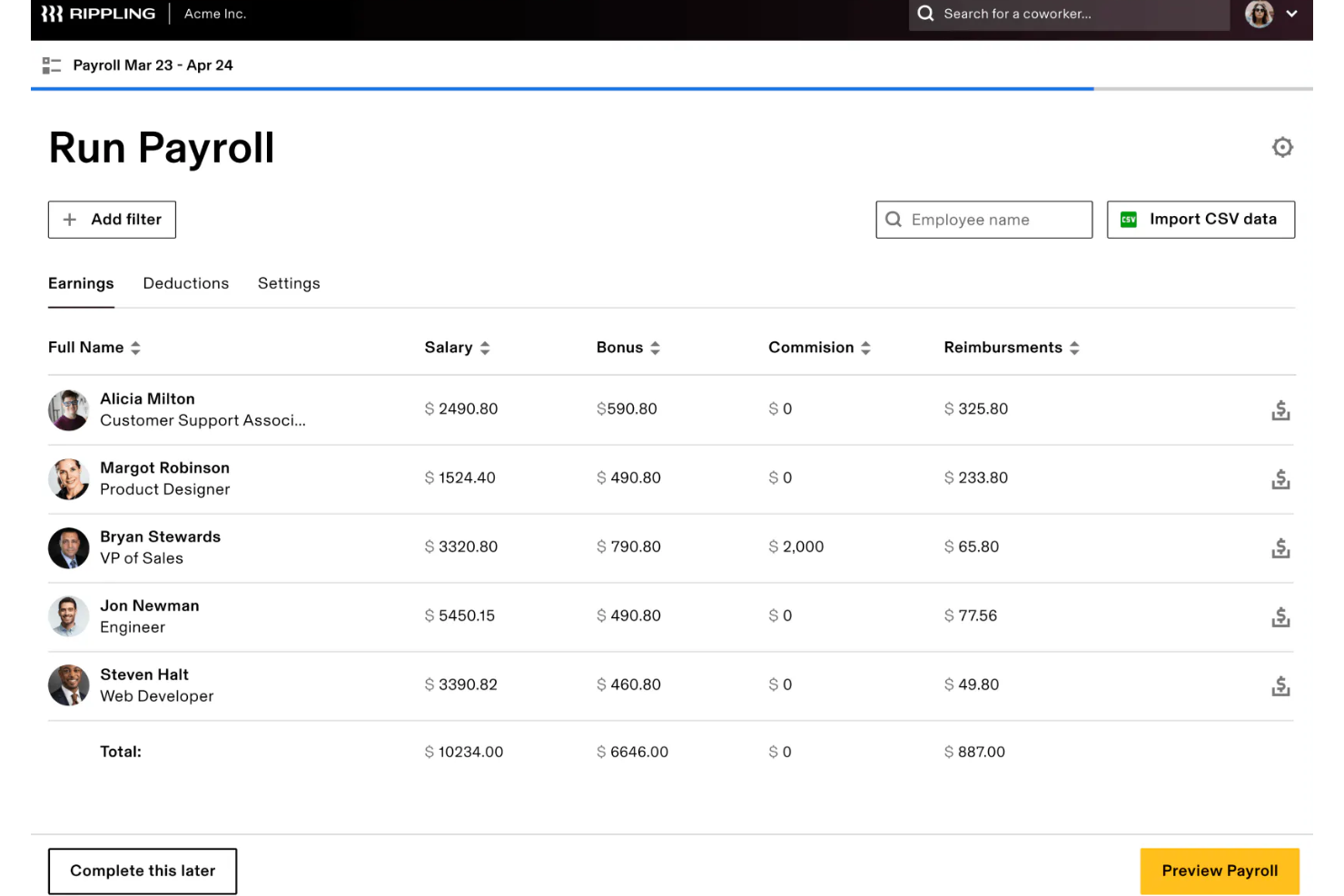

Rippling offers payroll, HR, and IT management services to help businesses manage employee operations more efficiently. It serves companies of all sizes, providing tools for payroll processing, benefits administration, and device management.

Why I picked Rippling: It lets you handle payroll alongside HR tasks, like benefits and compliance, all in one platform. You can also manage IT essentials, like device provisioning and app access, ensuring employees are set up to work quickly. This integration reduces the need for separate systems and simplifies your team's processes.

Rippling Standout Services:

You can use global payroll to pay employees and contractors worldwide in minutes, addressing the challenge of managing international teams. With automated tax filing, Rippling takes care of calculating, filing, and remitting taxes, so you don’t have to worry about compliance issues.

Software integrations include Google Workspace, Microsoft 365, Brex, Checkr, Jira, Carta, Slack, Zoom, PayPal, Salesforce, QuickBooks, and more.

Rippling Target Industries and Specializations:

Target industries: technology, retail, healthcare, education, and manufacturing

Specialties: global payroll, benefits administration, device management, compliance, and automation

Pros and cons

Pros:

- Supports global payroll for international teams

- Offers device management alongside payroll services

- Integrates payroll with IT and HR functions

Cons:

- Customization may require additional setup time

- Advanced features require add-ons

New Product Updates from Rippling

Rippling Now Integrates with Points North

Rippling's new integration with Points North automates certified payroll reporting, ensuring compliance with Davis-Bacon and prevailing-wage laws by synchronizing data in real time and reducing manual errors. More details at Rippling Blog.

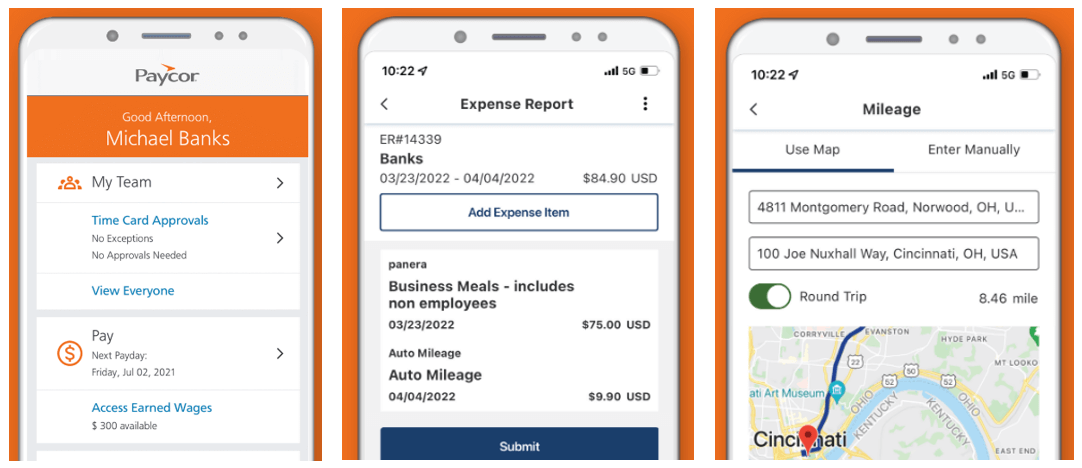

Paycor offers payroll services and solutions tailored to support HR, payroll, and workforce management needs for businesses of various sizes. Their services cater to small and medium-sized businesses, with a focus on simplifying payroll processes and improving efficiency.

Why I picked Paycor: Paycor integrates automated payroll tools that save your team time by reducing manual data entry and minimizing errors. Their mobile-friendly expense tracking lets you and your employees manage reimbursements easily on the go, which is ideal for remote or distributed teams. These features make Paycor a great fit if you're looking for efficiency in payroll management and expense handling.

Paycor Standout Services:

Paycor’s mobile app lets you process payroll, approve timecards, and review reports from anywhere, giving you more flexibility. The expense management tool helps your team track expenses, upload receipts, and manage reimbursements directly within the system, which simplifies operations for businesses with mobile or remote workers.

Software integrations are available with 140+ software applications through their Paycor Marketplace, including Center Expense Management, Certify by Emburse, CloudPay, HIRETech, Instant Pay, Rapid Disbursements, Payfactors, Netspend, and many others.

Paycor Target Industries and Specializations:

Target industries: retail, healthcare, nonprofits, manufacturing, and professional services.

Specialties: payroll processing, mobile expense tracking, workforce management, HR analytics, and compliance assistance.

Pros and cons

Pros:

- User-friendly interface for time and attendance

- Mobile app with payroll processing

- Frequent software updates

Cons:

- Some integrations require additional setup

- Customer support response times vary

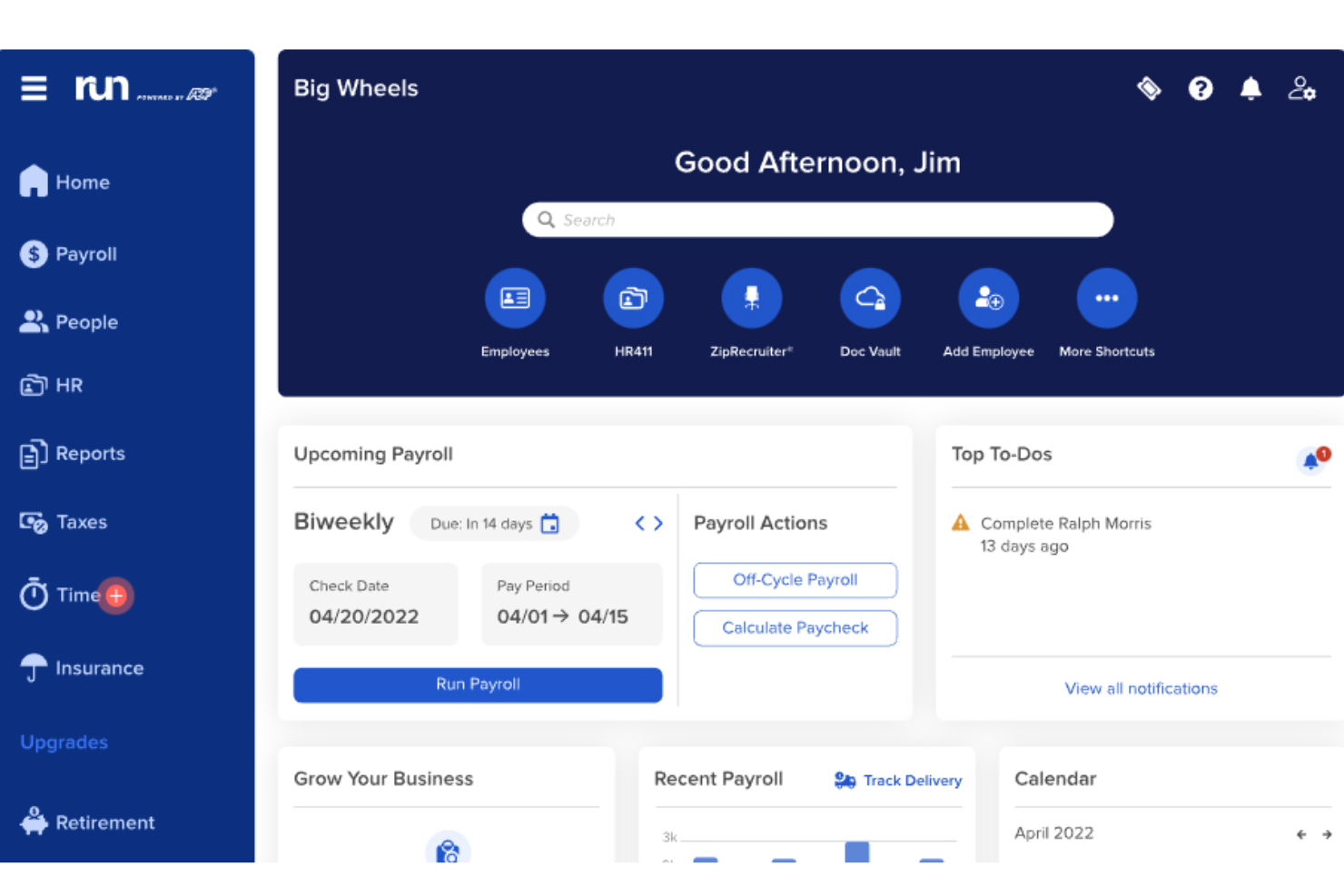

RUN by ADP offers payroll and HR services designed to support businesses of all sizes with their payroll processing and tax filing needs. Their solutions cater to small, medium, and large businesses, helping streamline payroll operations while ensuring compliance.

Why I picked RUN by ADP: ADP's RUN integrates automated payroll processing with tax filing to simplify payroll management for your business. You’ll also find tools that help with compliance, like real-time alerts and updates for tax regulations. Their intuitive platform ensures your team can handle payroll tasks quickly and accurately.

RUN Powered by ADP Standout Services:

RUN Powered by ADP includes automated payroll processing to ensure your employees are paid accurately and on time while reducing manual tasks. You also get automatic tax filing services that calculate, file, and pay payroll taxes for you, saving time and ensuring compliance with government regulations.

Software integrations include QuickBooks, Wave, Xero, ClockShark, Points North, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

RUN Powered by ADP Target Industries and Specializations:

Target industries: retail, healthcare, hospitality, manufacturing, and construction

Specialties: payroll tax filing, compliance, benefits administration, employee self-service, and reporting tools

Pros and cons

Pros:

- Integration with accounting software

- Mobile app for on-the-go access

- Easy to use for small businesses

Cons:

- Add-on costs for certain services

- Limited customization for larger enterprises

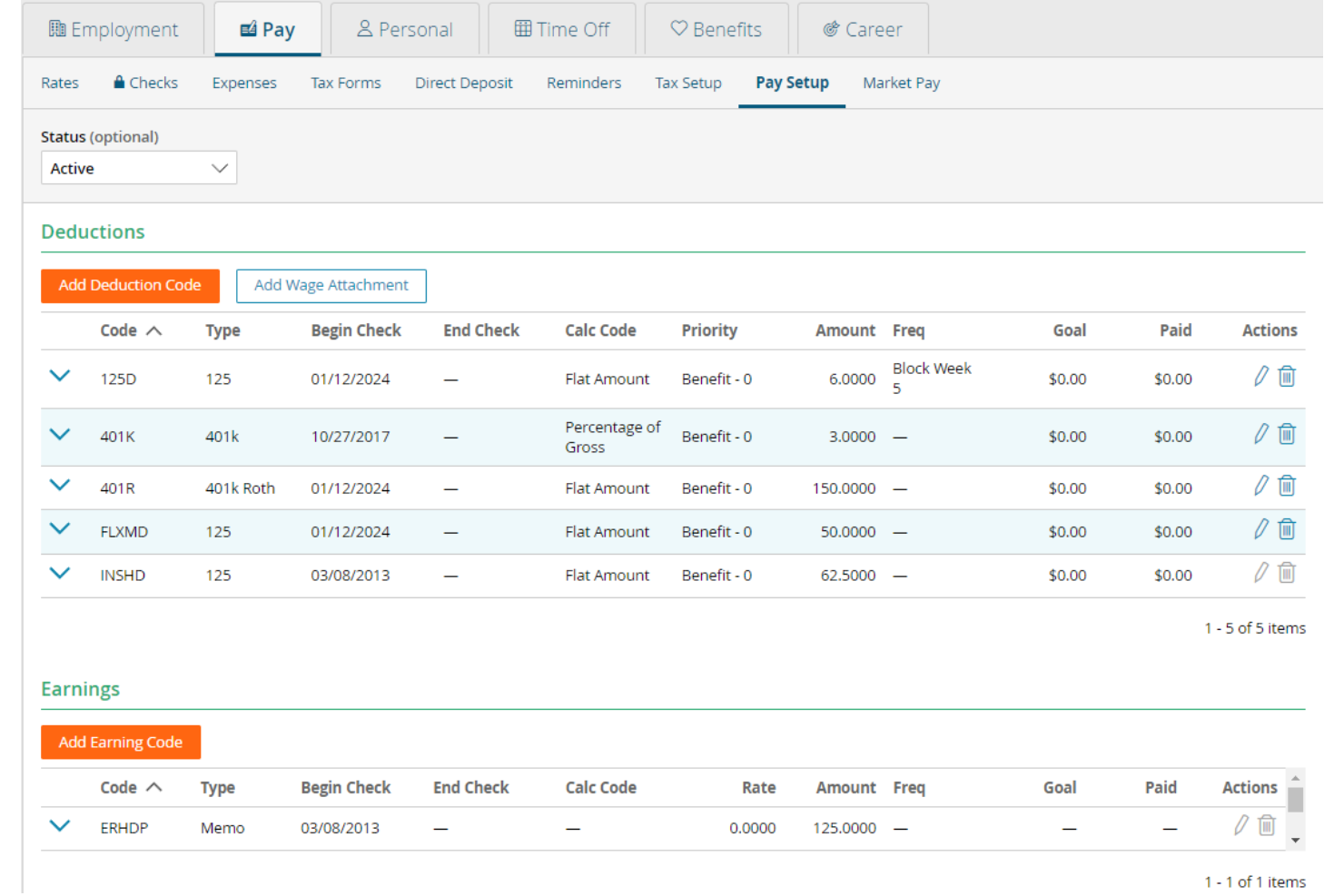

Paylocity offers payroll services that help midsized businesses manage and scale pay processing, tax filings, and employee payment options.

Why I picked Paylocity: I chose Paylocity because it combines powerful HR and payroll features into a single platform, making it easy to manage everything from benefits and compliance to employee pay and time tracking. Its extensive integration options, with over 400 third-party tools ranging from applicant tracking to collaboration tools, ensure it fits into your broader tech stack.

Paylocity Standout Services:

Their on-demand payment feature lets employees access wages early, solving cash flow challenges for your team. The automated tax filing system handles payroll taxes, reducing the risk of errors and keeping your business compliant with changing regulations.

Software integrations include ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Paylocity Target Industries and Specializations:

Target industries: retail, healthcare, manufacturing, education, and technology

Specialties: tax compliance, payroll flexibility, time tracking, benefits integration, and employee self-service

Pros and cons

Pros:

- Easy integration with other HR solutions

- Customizable reporting features

- Flexible pay options for employees

Cons:

- Limited international payroll options

- Occasional issues with mobile app functionality

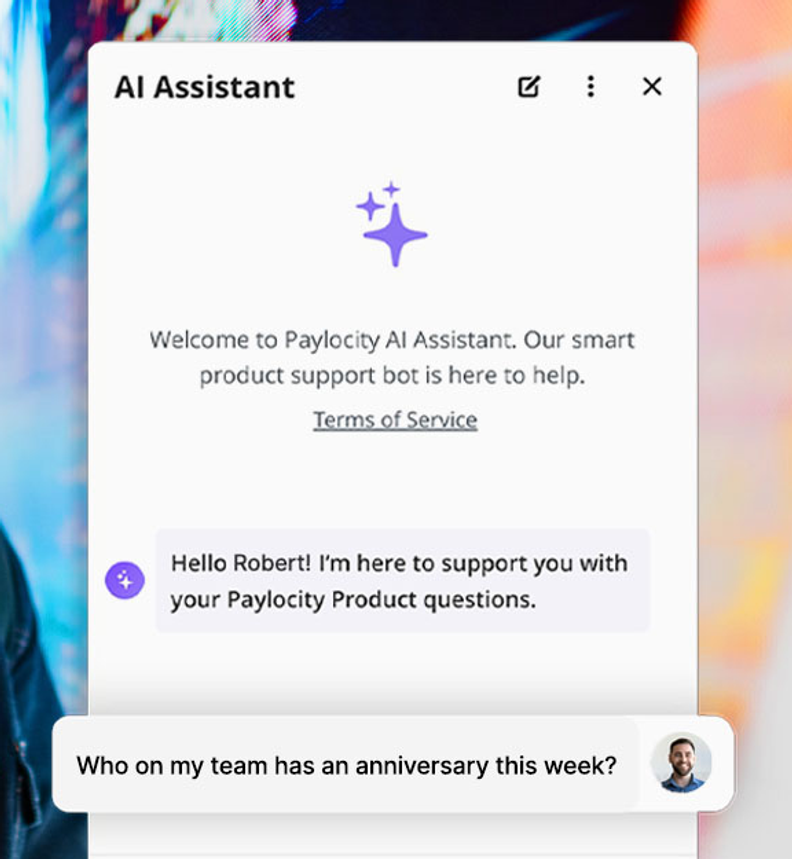

New Product Updates from Paylocity

Paylocity AI Assistant Update

Paylocity introduces an AI Assistant that transitions from questions to actions swiftly, enhancing user efficiency. For more information, visit Paylocity's official site.

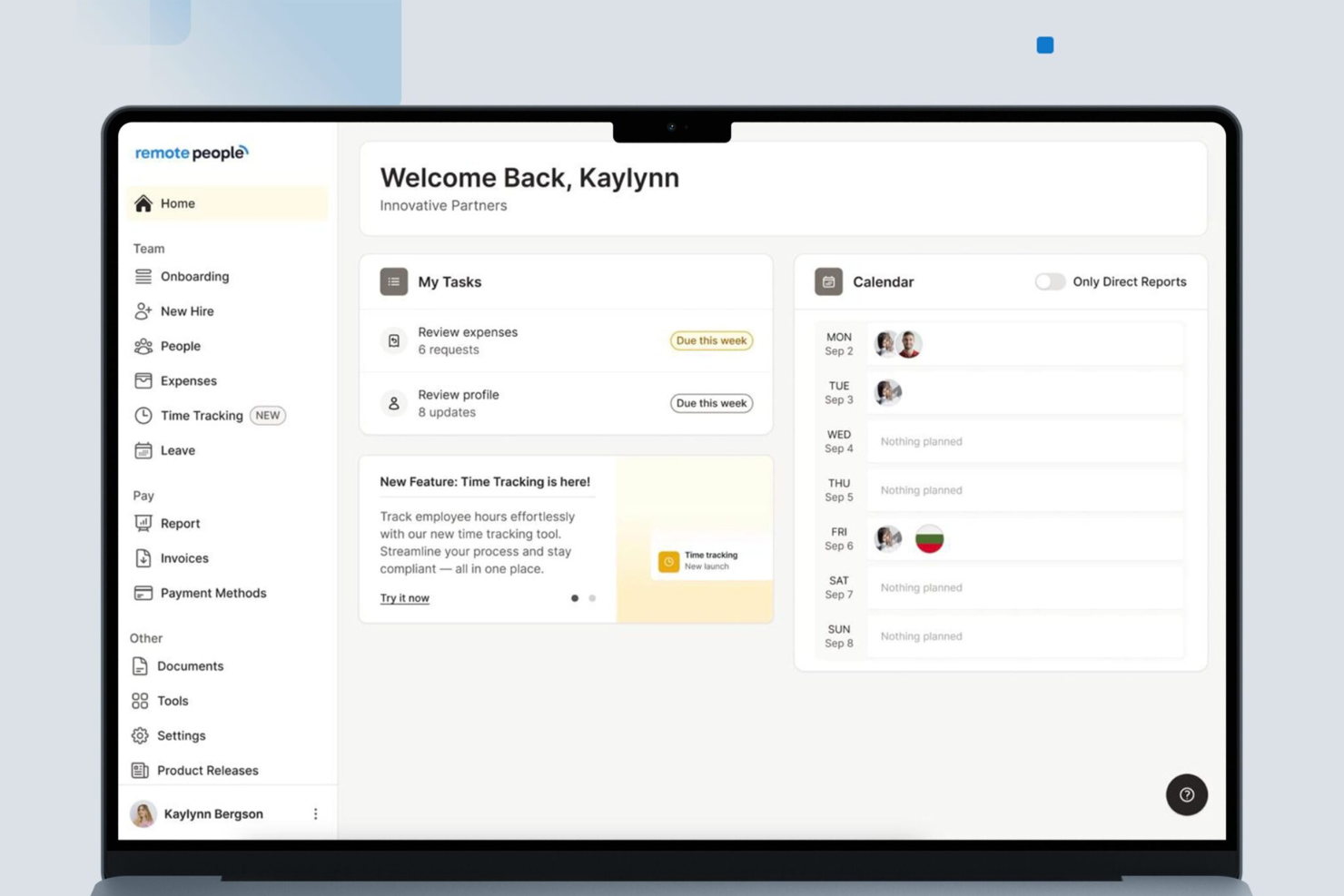

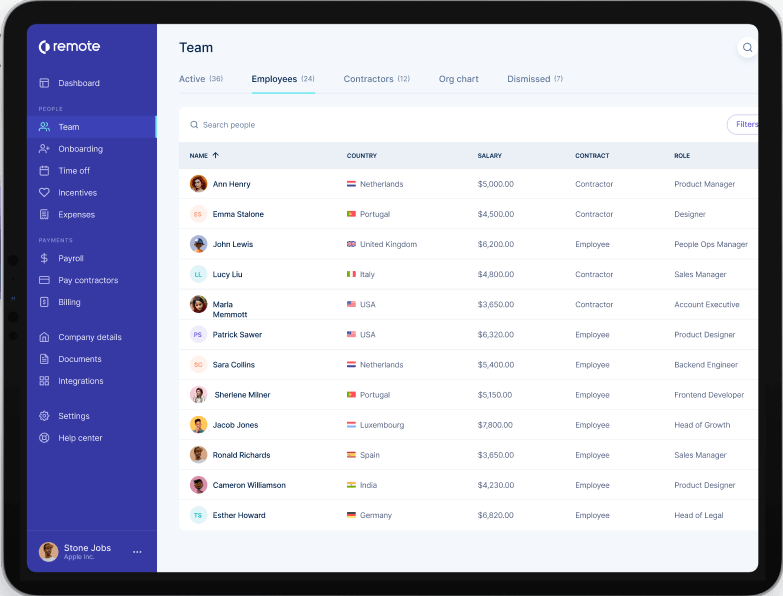

Remote People offers global payroll and compliance services, focusing on simplifying international hiring, payments, and contractor management. They serve businesses of all sizes looking to manage distributed teams across 150+ countries.

Why I Picked Remote People: Managing international payroll can be challenging, but Remote People streamlines the process by handling compliance, taxes, and payments in over 150 countries. Their Employer of Record (EOR) service allows you to hire full-time employees abroad without setting up local entities, saving time and reducing costs. With intuitive tools, transparent pricing, and a dedicated support team, Remote People makes global workforce management seamless.

Remote People Standout Services:

Remote People's Employer of Record (EOR) services allow companies to hire employees internationally while ensuring compliance with local labor laws and tax regulations. Their global payroll solutions automate payments for employees and contractors, and the contractor management system simplifies onboarding, invoicing, and cross-border payments. Additionally, they offer background checks, global salary insights, relocation assistance, and HR compliance tools to reduce administrative burdens and minimize risk.

Software integrations aren't presently listed by Remote People.

Remote People Target Industries and Specializations

Target industries: technology, finance, marketing, education, healthcare, and professional services.

Specialties: global payroll, compliance, contractor management, employer of record services, international hiring, and workforce expansion.

Pros and cons

Pros:

- Access to a vetted global talent pool

- Includes Employer of Record and PEO services

- Provides global payroll, contractor, and relocation support

Cons:

- No listed software integrations

- Limited publicly available customer reviews

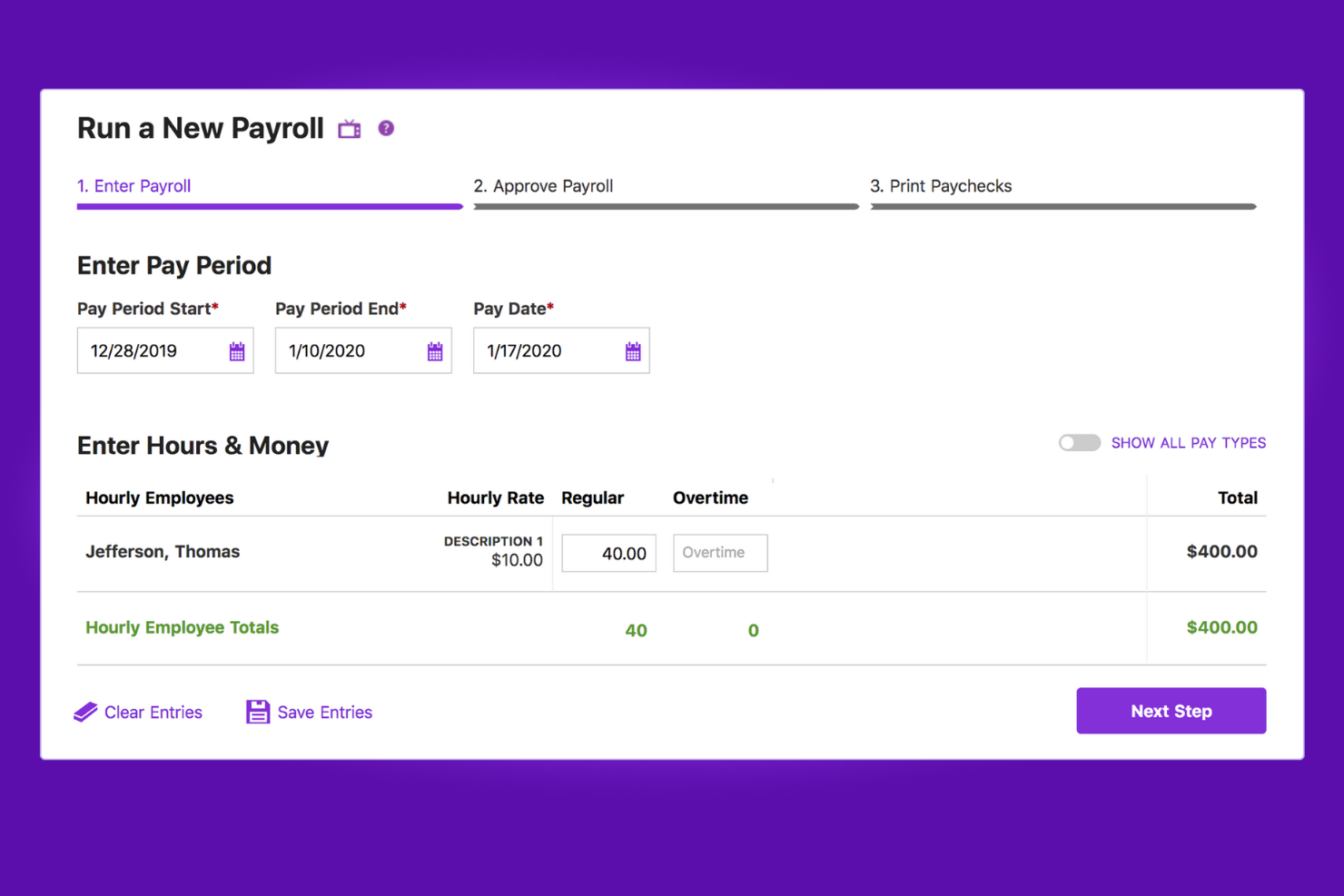

Homebase offers full-service payroll with built-in time tracking and scheduling, designed for hourly teams and small businesses. It’s especially useful for businesses that want to streamline timecards, automate payroll runs, and stay compliant—all from a mobile-friendly platform.

Why I picked Homebase: Running payroll for hourly workers can be chaotic, but Homebase simplifies it by syncing scheduling, time tracking, and payroll into one platform. It automatically calculates hours, overtime, breaks, and wages, and handles tax filings on your behalf. With features like next-day payroll and auto-payroll, Homebase helps busy managers skip manual work and stay focused on growing their teams.

Homebase Standout Services:

Homebase combines a time clock, timesheets, and payroll in a single platform to eliminate double entry and manual calculations. It supports automatic tax filing, direct deposit, and W-2/1099 generation. Optional features include tip management, earned wage access, and auto-payroll for complete hands-off processing.

Software integrations are available with QuickBooks, Square, Clover, Toast, Gusto, Shopify, and more.

Homebase Target Industries and Specializations:

Target industries: retail, restaurants, home services, hospitality, and healthcare

Specialties: hourly payroll, mobile time tracking, team scheduling, compliance automation, and small business workforce management.

Pros and cons

Pros:

- Automated payroll and tax processes

- Offers direct deposit into bank accounts or printable checks

- Time tracking for accurate payroll

Cons:

- Payroll functions are only available as an add-on

- No details on customization for specific business needs

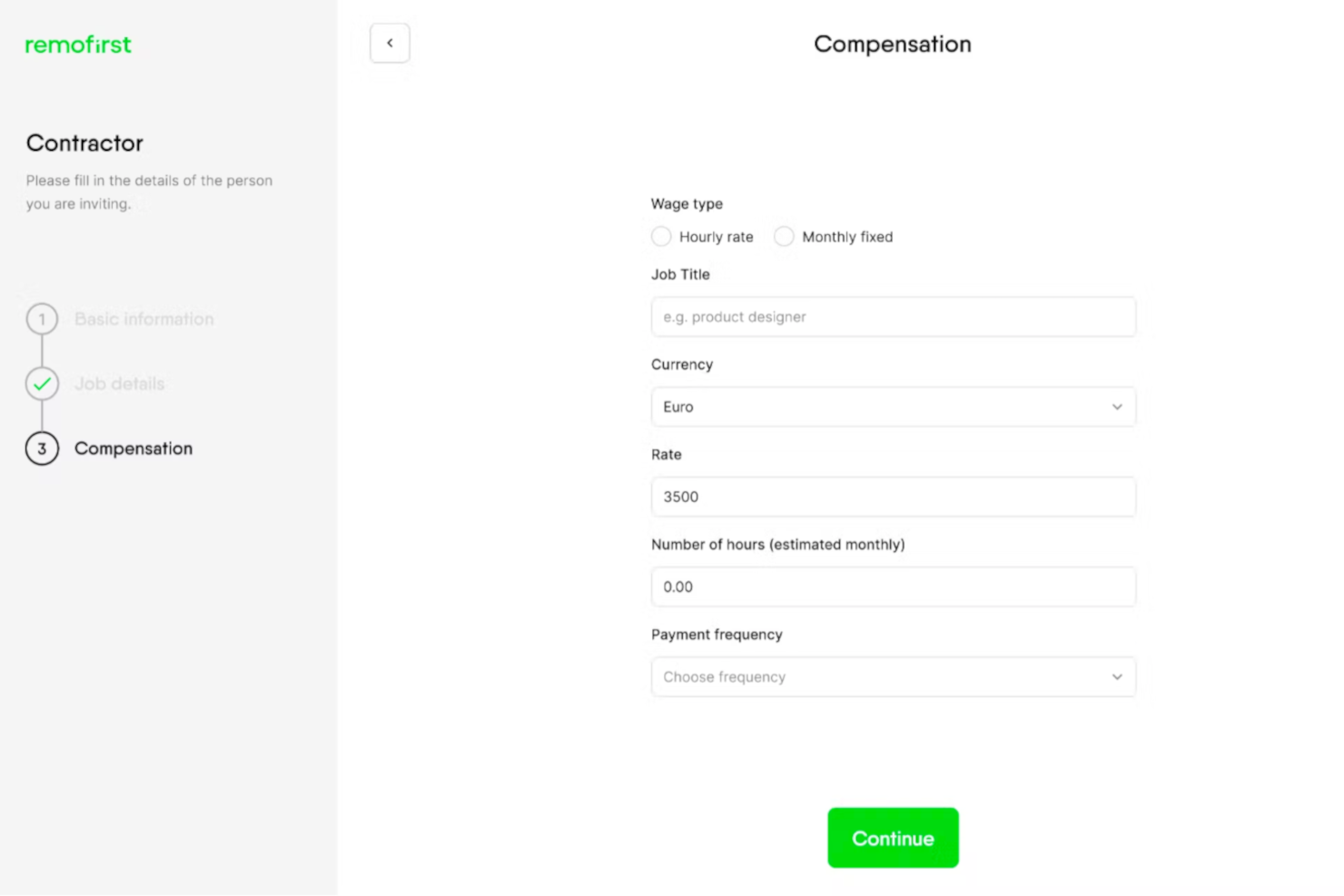

RemoFirst offers payroll services designed to support businesses in managing international teams. Their solutions focus on simplifying global payroll processes while ensuring compliance with local regulations.

Why I picked RemoFirst: Their platform makes it easy to manage payroll for employees across multiple countries. You can rely on their automated tools to handle compliance, payments, and reporting in one place. It’s especially useful for organizations that need to ensure accurate, timely payments to a diverse international workforce.

RemoFirst Standout Services:

Their automated compliance management helps you navigate the complexities of international payroll by keeping your team compliant with local tax and labor laws. They also provide multi-currency payment processing, so you can pay employees in their local currency without dealing with conversion headaches.

RemoFirst Target Industries and Specializations:

Target industries: technology, healthcare, retail, education, and consulting

Specialties: international payroll, compliance, tax management, reporting, and payment processing

Pros and cons

Pros:

- Easy to use for non-technical teams

- Responsive customer support team

- Offers multi-currency payment options

Cons:

- Lacks platform integration options

- May not suit small businesses with limited budgets

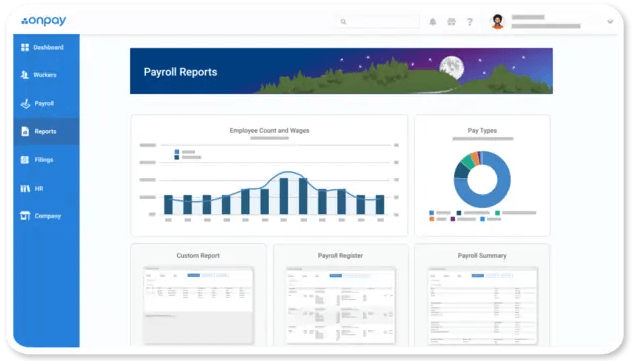

OnPay offers full-service payroll solutions tailored for small and medium-sized businesses. Their platform also supports benefits administration, HR functions, and compliance management for various industries.

Why I picked OnPay: Their industry-specific payroll services let you manage unique payroll needs, like compliance for restaurants or agricultural businesses, all through an easy-to-use platform. OnPay’s in-house insurance brokers can help your team find the right employee benefits without needing an external partner. This combination of payroll and insurance expertise can simplify HR tasks for your business.

OnPay Standout Services:

Their automated tax filing ensures that federal, state, and local payroll taxes are calculated, filed, and paid correctly. You can also use their benefits management tools to handle health insurance, retirement plans, and workers' comp directly through the platform, saving time for you and your team.

Software integrations are available with QuickBooks, Xero, When I Work, Deputy, Magnify, Mineral, PosterElite, and with the 401k retirement platforms Guideline, America’s Best 401k, and Vestwell.

OnPay Target Industries and Specializations:

Target industries: healthcare, retail, restaurants, agriculture, and nonprofits

Specialties: compliance support, benefits integration, multiple pay rates, employee self-onboarding, and reporting customization

Pros and cons

Pros:

- Access to HR support and compliance tools

- Industry-specific payroll compliance features

- Offers in-house insurance brokers for benefits

Cons:

- Limited integrations with accounting software

- Setup process may require manual adjustments

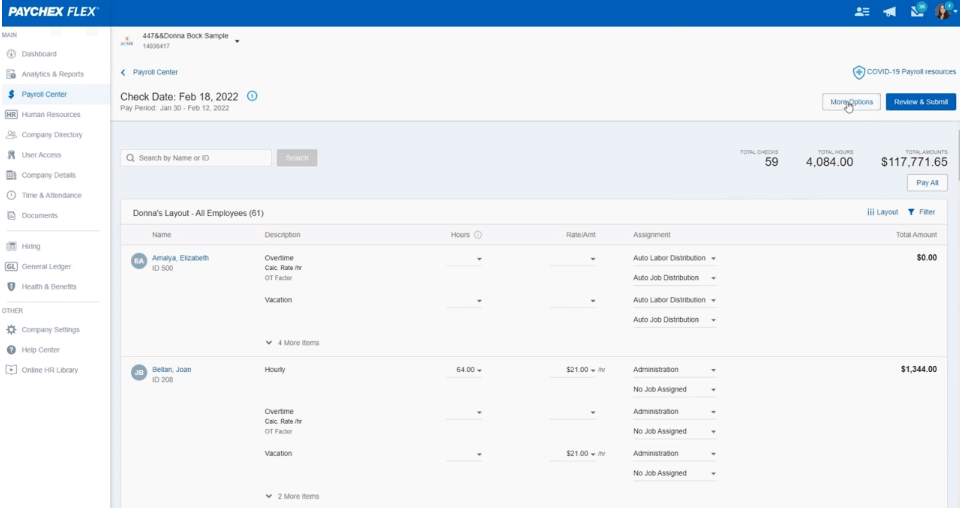

Paychex Flex offers payroll processing, HR, and benefits services tailored to the needs of businesses of any size, from self-employed solo entrepreneurs to small businesses, all the way up to organizations with 1,000+ employees.

Why I picked Paychex Flex: Paychex Flex emphasizes enhanced customer support with 24/7 access, which is particularly helpful for businesses with time-sensitive payroll needs. Their platform includes customizable payroll features that adapt to your business’s structure, reducing administrative hassle. Paychex Flex also offers tax filing services, ensuring compliance without requiring extra time or effort from your team.

Paychex Flex Standout Services:

Paychex Flex provides payroll tax filing services, which handle tax calculations and submissions, saving your team time and reducing the risk of errors. They also offer time and attendance tracking, allowing you to integrate employee hours directly into payroll for greater accuracy.

Software Integrations are available with 300+ commonly used applications, including BambooHR, Epicor, Infor, JazzHR, Microsoft Azure, Microsoft Dynamics, Sage, SAP, and many others. Plus, Paychex Flex has an API to support any custom software integrations you may need.

Paychex Flex Target Industries and Specializations:

Target industries: healthcare, retail, construction, education, and manufacturing

Specialties: payroll processing, tax compliance, employee benefits, time tracking, and HR administration

Pros and cons

Pros:

- Easy-to-use mobile app for payroll tasks

- Strong reputation for reliability

- 24/7 customer support availability

Cons:

- Limited flexibility in report customization

- Extra fees for some advanced features

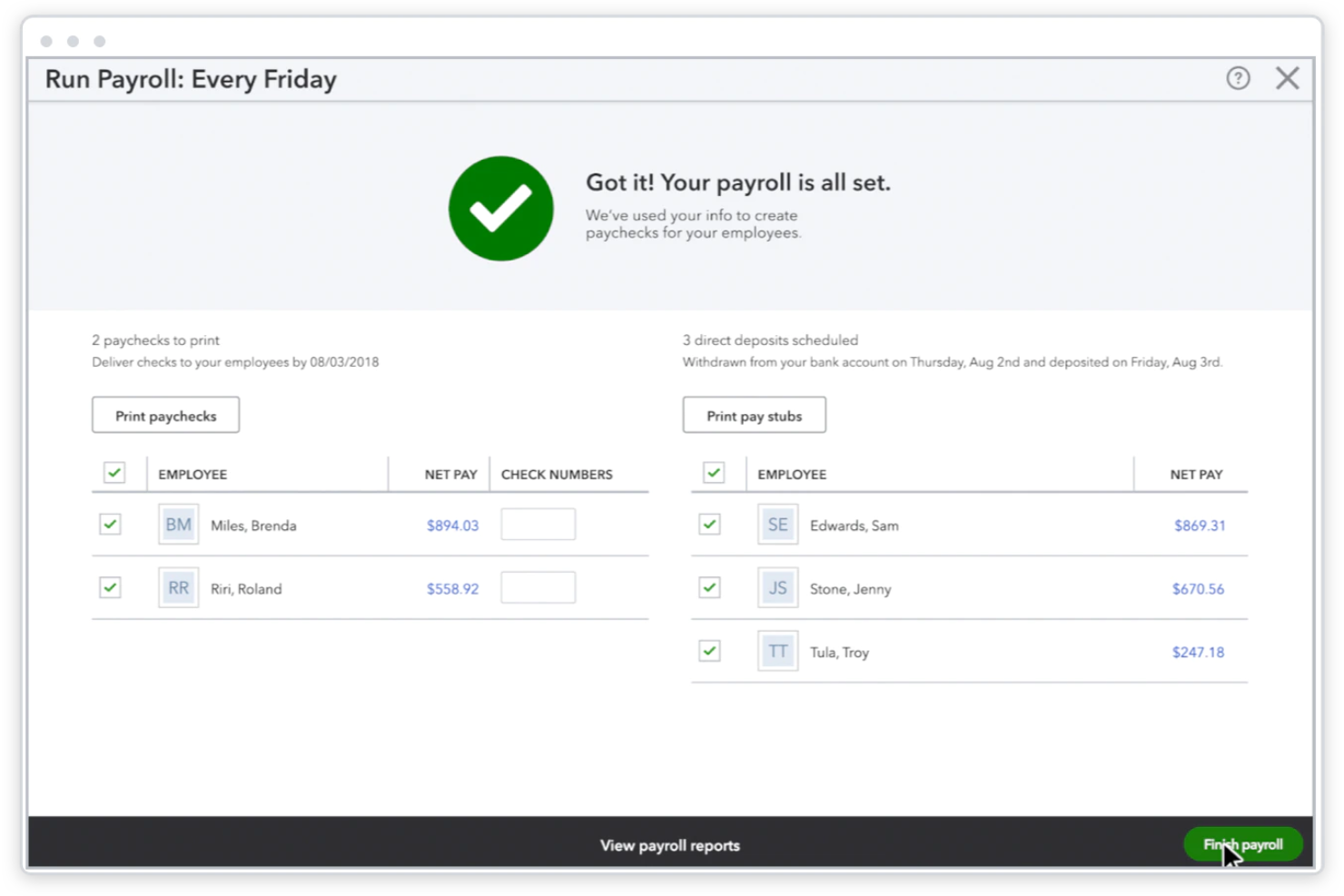

QuickBooks Online is a payroll management and accounting software designed to cater to the needs of small businesses. You can use it to manage your company's invoicing, expense tracking, payroll, and taxes. It's available in the US, Canada, Australia, and the United Kingdom.

Why I picked QuickBooks Online: The software can modernize your payroll processes by automating how pay is calculated and sent out to employees. It can also automatically calculate and deduct income taxes, and run your tax filings in all 50 US states. You can essentially set it and forget it when it comes to paying your staff. Of course, you can still review and approve payments before they're sent out.

Beyond its basic payroll features, it also facilitates garnishments, deductions, health benefits, and workers comp management. And, you can manage your expenses and receipts as well as invoices and payments through the same platform.

Integrations are available with over 450 business apps like Square, Stripe, Paychex, Insightly CRM, Mailchimp, Shopify, eBay, BigCommerce, Magento, Squarespace, Etsy, Katana, and ProjectWorks.

Pros and cons

Pros:

- Simplifies compliance, garnishments, deductions, and benefits management.

- Unified system for payroll, accounting, and expense management.

- Comprehensive payroll automation with built-in tax filing for all U.S. states.

Cons:

- Occasional syncing issues between accounting and third-party integrations.

- Some features only available on higher-tier plans.

Patriot Payroll is a full-service payroll and HR software solution built specifically for small U.S.-based businesses. Designed for ease of use and affordability, Patriot simplifies payroll processing, tax filing, and compliance while offering helpful add-ons for time tracking and employee management—all backed by exceptional customer support.

Why I picked Patriot Payroll:

Patriot Payroll stands out for its hands-on customer service and approachable, small-business-friendly design. Unlike many payroll systems that require extensive setup, Patriot acts as a concierge-style platform, guiding business owners through onboarding and ensuring payroll and tax compliance are handled accurately and on time.

I particularly value how Patriot’s full-service option takes care of federal, state, and local payroll taxes automatically—from calculations and filings to year-end reporting. This makes it ideal for small business owners without in-house HR or accounting expertise. If the service team needs additional information, they’ll proactively reach out, allowing users to stay focused on running their businesses rather than managing administrative details.

The platform also includes extensive educational resources—a standout feature. Its built-in library of articles, videos, and step-by-step guides helps users understand payroll best practices and tax obligations, making it one of the most user-friendly tools for first-time payroll managers.

For those seeking more functionality, Patriot offers optional add-ons like time and attendance tracking, HR management, and employee databases—all integrated within the same system for a seamless experience.

Patriot Payroll Standout Features & Integrations:

Features include automated payroll processing, tax filing and compliance management, and 2-day direct deposits. Patriot handles all federal, state, and local tax payments and filings, along with year-end W-2 and 1099 form generation.

The platform’s employee self-service portal allows staff to access pay stubs, tax forms, and direct deposit information anytime. Additional HR add-ons include time and attendance tracking and an employee information database, giving small businesses more control over workforce management without needing multiple systems.

Integrations are available with popular HR and accounting tools such as Intuit QuickBooks Online, GoCo, Plaid, Workforce.com, and WorkforceHub Time & Attendance, enabling flexible data syncing across payroll and business operations.

Pros and cons

Pros:

- Helpful educational content and guides for managing payroll and taxes

- Straightforward setup process ideal for first-time payroll users

- Excellent customer service

Cons:

- No international payroll or contractor management features

- Add-ons like time tracking and HR tools come at an extra cost

Remote Payroll is a global payroll and compliance platform designed to help businesses of all sizes hire, pay, and manage employees or contractors anywhere in the world. With a focus on automation, compliance, and transparency, Remote streamlines global workforce management through one secure, cloud-based system.

Why I picked Remote Payroll:

Remote stands out for its comprehensive global payroll and Employer of Record (EOR) capabilities, which allow companies to hire international talent without establishing a local entity. Its all-in-one approach simplifies what is typically one of the most complex aspects of global HR—paying and managing teams across multiple jurisdictions.

I particularly value Remote’s hands-off compliance and tax management. The platform’s network of in-country HR and legal experts ensures your business adheres to local employment laws, tax regulations, and benefits standards. This makes Remote a top choice for growing startups and distributed teams that want to expand internationally without the administrative burden.

Another standout feature is Remote’s equity management support—a rarity among global payroll providers. Their team helps you design and manage global equity and stock option programs, ensuring full tax and compliance alignment across different countries. This makes it easier to offer consistent benefits and incentives to international employees.

The platform’s secure HR hub consolidates employee data, contracts, and payroll records in one place, providing visibility and control over your global workforce. With everything from salary payments to benefits administration handled through one interface, Remote lets you focus on strategy while it manages the complexity of international employment.

Remote Payroll Standout Features & Integrations:

Features include global payroll automation, compliance and tax management, multi-currency payments, and EOR services in over 50 countries. Remote handles localized payroll and benefits, ensuring that payments are accurate, on time, and fully compliant with local labor laws.

Additional capabilities include HR document management, IP protection, and equity plan administration, allowing you to manage every aspect of international employment from one centralized platform. Remote’s detailed reporting and analytics features provide visibility into payroll costs, employee data, and benefits usage across multiple regions.

Integrations are available with 25+ software systems, including Airwallex, Bambee, BambooHR, Brex, Doozy, Float, GoodTime.io, Greenhouse, HubSpot, Lendis, Loom, Miro, Pinpoint, Ramp, Sapling, and Slack, with additional connections available through its API for seamless data synchronization across HR and finance systems.

Pros and cons

Pros:

- Integrated equity and stock option administration for global teams

- Secure, cloud-based platform with centralized HR and payroll data

- Strong compliance management with local legal and tax experts

Cons:

- Limited functionality for U.S.-only companies or single-country operations

- More complex pricing structure than domestic payroll solutions

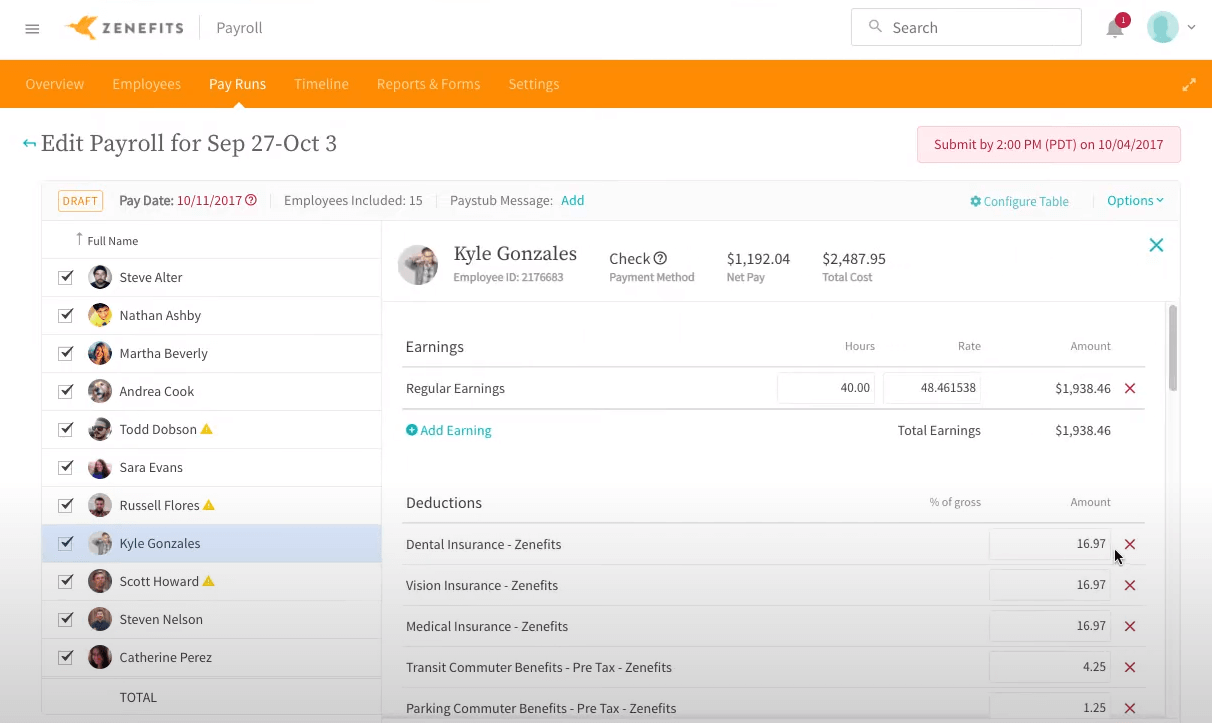

TriNet (formerly Zenefits) is a comprehensive HR, payroll, and benefits management platform designed to simplify workforce administration for small and midsize businesses. By unifying HR functions, payroll processing, and employee benefits in one cloud-based system, TriNet helps growing companies automate routine tasks and stay compliant while providing a seamless employee experience.

Why I picked TriNet (formerly Zenefits):

TriNet stands out for its all-in-one HR automation that connects data across benefits, payroll, and time tracking. This integration eliminates manual entry and ensures that key processes—like onboarding, PTO tracking, and payroll deductions—are automatically synced. Designed for entrepreneurs and small to midsize businesses, TriNet’s HR suite saves valuable administrative time while maintaining accuracy and compliance.

One of the most impressive aspects of TriNet’s payroll platform is its intelligent automation. Payroll administrators can take advantage of features like automatically prorated payments for mid-cycle hires, bulk earning uploads for bonuses or salary changes, and dynamic pay stubs that give employees a detailed breakdown of earnings, deductions, and benefits—accessible even from mobile devices.

The system also supports contractor payments, tip reporting, and wage garnishments, making it suitable for businesses with mixed workforces. Automated reminders and customizable pay stubs add flexibility and clarity, while TriNet’s compliance management tools ensure all payroll data aligns with federal, state, and local regulations.

TriNet (formerly Zenefits) Standout Features & Integrations:

Features include automated payroll processing, benefits administration, and HR management tools that sync seamlessly to eliminate duplicate data entry. Payroll functions support prorated pay, contractor payments, garnishments, and custom pay stub messaging for bonuses or commissions.

Other capabilities include employee onboarding, time tracking, compliance monitoring, and benefits management—all fully integrated within the same system. TriNet’s mobile app provides access to pay stubs, PTO balances, and benefit details, helping employees manage their HR needs on the go.

Integrations are available with over 40 leading business tools, including Asana, Betterment, Bonusly, Carta, CoPilot, Deputy, Embroker, Expensify, Google Workspace, Intuit QuickBooks, Microsoft Office 365, Next Insurance, Sidecar Health, Teladoc, T-Sheets, Truework, SixFifty, Slack, Xero, and Zapier, enabling data to flow seamlessly between payroll, accounting, and communication systems.

Pros and cons

Pros:

- Deep integration ecosystem with 40+ popular business and HR tools

- Strong compliance support for federal, state, and local tax requirements

- Automates complex payroll tasks, including prorated payments and bulk bonuses

Cons:

- Limited reporting customization compared to advanced HRIS platforms

- Payroll functionality is available only in the U.S. and select regions

Remunance is an India-based Professional Employer Organization (PEO) that assists global businesses in expanding their operations into India. They offer services such as talent acquisition, HR management, regulatory compliance, and infrastructure support, allowing you to focus on your core business activities.

Why I picked Remunance: One key reason to consider Remunance is its comprehensive payroll and local compliance services. They manage payroll processing and ensure adherence to India's complex labor laws and tax regulations, reducing the administrative burden on your team. This ensures your operations remain compliant, minimizing potential legal risks.

Remunance Standout Services:

Another advantage is their expertise in onboarding and offboarding employees. Remunance handles the entire process, from recruitment to exit formalities, ensuring a smooth experience for your staff. They also offer talent acquisition services that help you find the right candidates for your team, ensuring they align with your company's culture and requirements.

Software integrations are not listed on their website.

Remunance Target Industries and Specializations:

Target industries: Healthcare, construction, sales, customer service, consultancies, and agencies

Specialties: Talent acquisition, payroll, compliance, onboarding, contractor management, and subsidiary formation

Pros and cons

Pros:

- Access to a wide talent base

- Focus on compliance

- Good localized expertise

Cons:

- Less ideal for businesses wanting more control over processes

- Only for businesses building teams in India

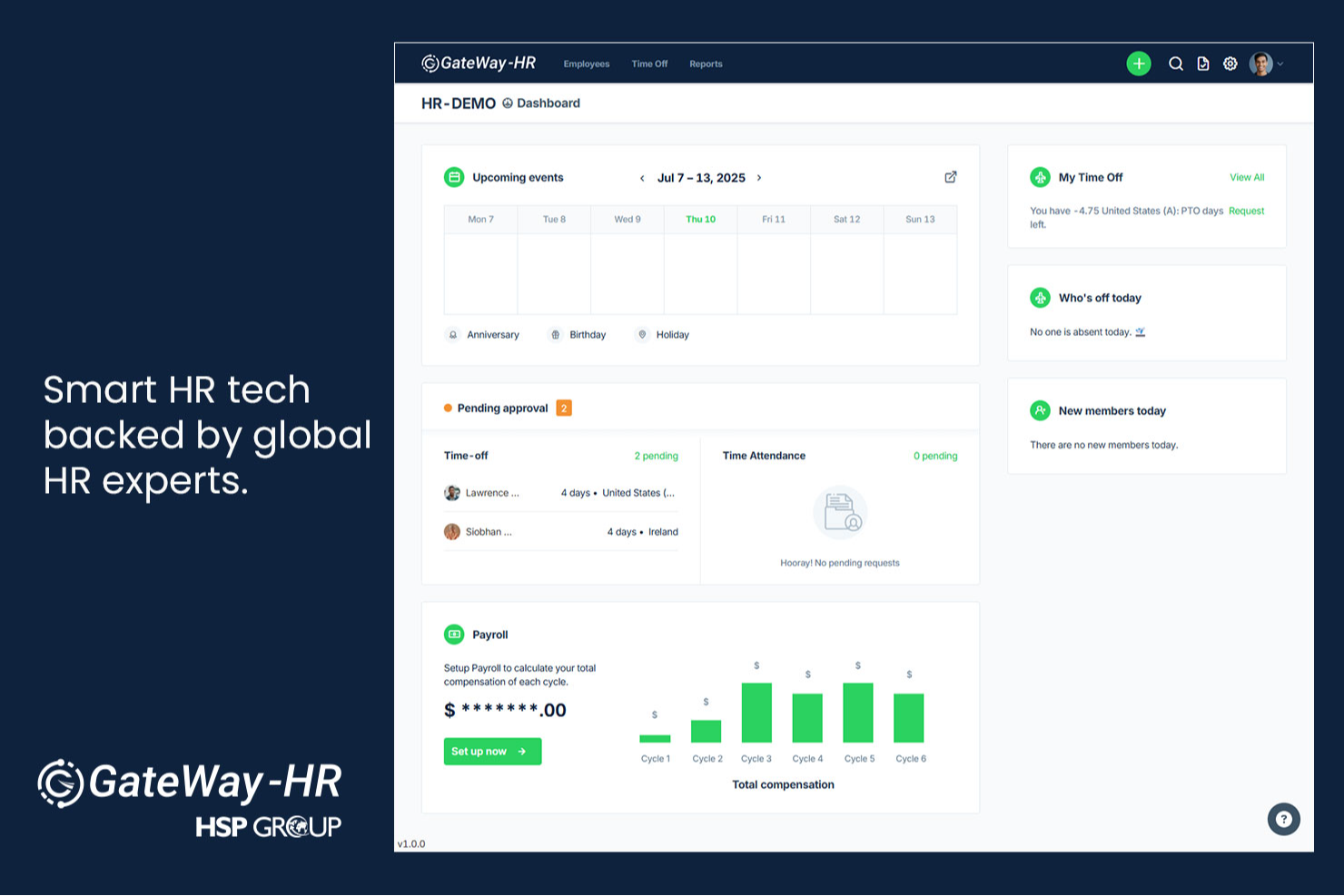

HSP Group combines HR consulting with global entity, payroll, and compliance support, delivered through its GateWay platform for full visibility across international operations. They’re a strong fit if you’re scaling globally and want one partner to manage payroll complexity, local compliance, and legal entity governance.

Why I picked HSP Group: I picked HSP because they don’t just run payroll—they help you decide how to run it. Whether you’re wondering when to transition from an EoR to a full entity, or how to navigate tax exposure in new markets, their consulting bench adds strategic depth most providers skip. If you're expanding operations, you’ll get local insight backed by global infrastructure.

HSP Group Standout Services:

HSP provides employer of record (EoR) services and entity setup support, plus project-based global payroll consulting for businesses entering new regions or reworking their current approach. The GateWay platform shows compliance progress and deadlines in real time. They also offer support for global mobility, HR documentation, and cross-border tax strategy.

Target industries: Technology, healthcare, manufacturing, logistics, private equity, and venture capital.

Specialties: HR compliance, payroll operations, entity management, employer of record (EoR), technical consulting, and tax advisory.

Pros and cons

Pros:

- Unified platform for global HR

- Smooth EoR-to-entity transition

- Real-time compliance tracking system

Cons:

- Integrations not clearly documented

- No pricing publicly available

myHR Partner specializes in payroll administration and other HR-related services, focusing on small to medium-sized businesses. They help organizations manage payroll processes efficiently while addressing compliance and administrative needs.

Why I picked myHR Partner: They provide end-to-end payroll solutions that take the burden off your team, ensuring accuracy and compliance with payroll laws. Their services include handling payroll calculations, tax filings, and direct deposits, making them a reliable partner for payroll needs. You can focus on your business while they ensure your payroll runs smoothly.

myHR Partner Standout Services:

They offer full-service payroll administration, where they handle everything from payroll processing to compliance and tax filings, saving your team valuable time and reducing errors. They also provide custom payroll reporting, giving you insights into payroll data tailored to your business needs.

Software integrations: myHR Partner can work with your existing payroll system. With expertise in over a dozen platforms, they often use ADP Workforce Now, Paylocity, UKG, Paycor, Paychex, and more.

Target industries: retail, healthcare, education, manufacturing, and nonprofit

Specialties: payroll processing, tax compliance, reporting customization, employee pay support, and direct deposit services

Pros and cons

Pros:

- Provides tax filing assistance

- Friendly and knowledgeable customer support

- Flexible solutions for small businesses

Cons:

- Limited integration options

- Support limited to business hours

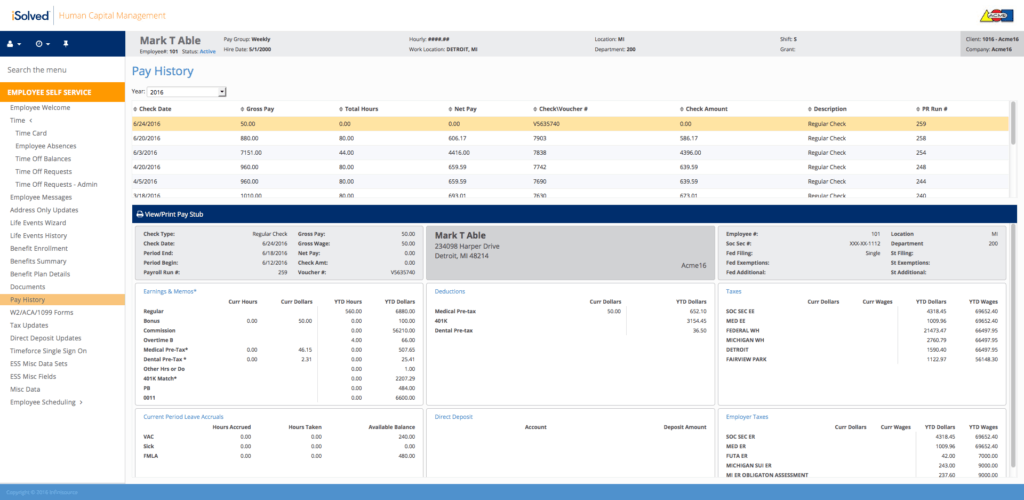

PayUSA is a cloud-based human capital management (HCM) platform designed to simplify HR operations for small and mid-sized businesses. It offers integrated solutions for payroll, time and attendance, hiring, HR, and employee benefits, streamlining administrative workflows and ensuring compliance across multiple jurisdictions.

Why I picked PayUSA:

PayUSA stands out for its all-in-one HCM functionality that directly integrates time and attendance data with payroll processing, eliminating the need for manual data transfers. This tight integration ensures accuracy and efficiency across the employee lifecycle—from onboarding to payroll and benefits administration.

One of its biggest advantages is its automated payroll tax management. PayUSA automatically prepares tax liability reports, withholds appropriate amounts for federal and state obligations (including unemployment, social security, Medicare, and disability insurance), and handles multi-state filings with ease. This makes it an excellent option for organizations with employees in multiple locations.

Employees also benefit from a self-service portal that gives them 24/7 access to pay stubs, tax documents, and benefits information. This self-service functionality reduces administrative strain on HR teams while empowering employees to manage their own information securely.

PayUSA supports multiple payment methods, including direct deposit and pay cards, and provides flexible configuration options for unique payroll needs—such as garnishments, bonuses, or retroactive pay adjustments.

PayUSA Standout Features & Integrations:

Features include automated payroll processing, multi-state tax filing, employee self-service, and time and attendance integration. The platform also offers HR management modules for onboarding, performance tracking, and benefits administration, allowing HR teams to manage their entire workforce from a single interface.

The time-tracking integration ensures accurate pay calculations and reduces manual errors, while detailed reporting tools help administrators track payroll expenses and ensure compliance.

Integrations include a wide range of HR and accounting software, allowing for seamless synchronization between payroll, HR, and financial systems (specific integrations vary by business needs).

Pros and cons

Pros:

- Supports multiple payment options (direct deposit and pay cards)

- Employee self-service portal for pay stubs and personal data management

- Automated multi-state payroll tax filing and reporting

Cons:

- Reporting customization options could be more advanced

- Fewer third-party integrations than some competitors

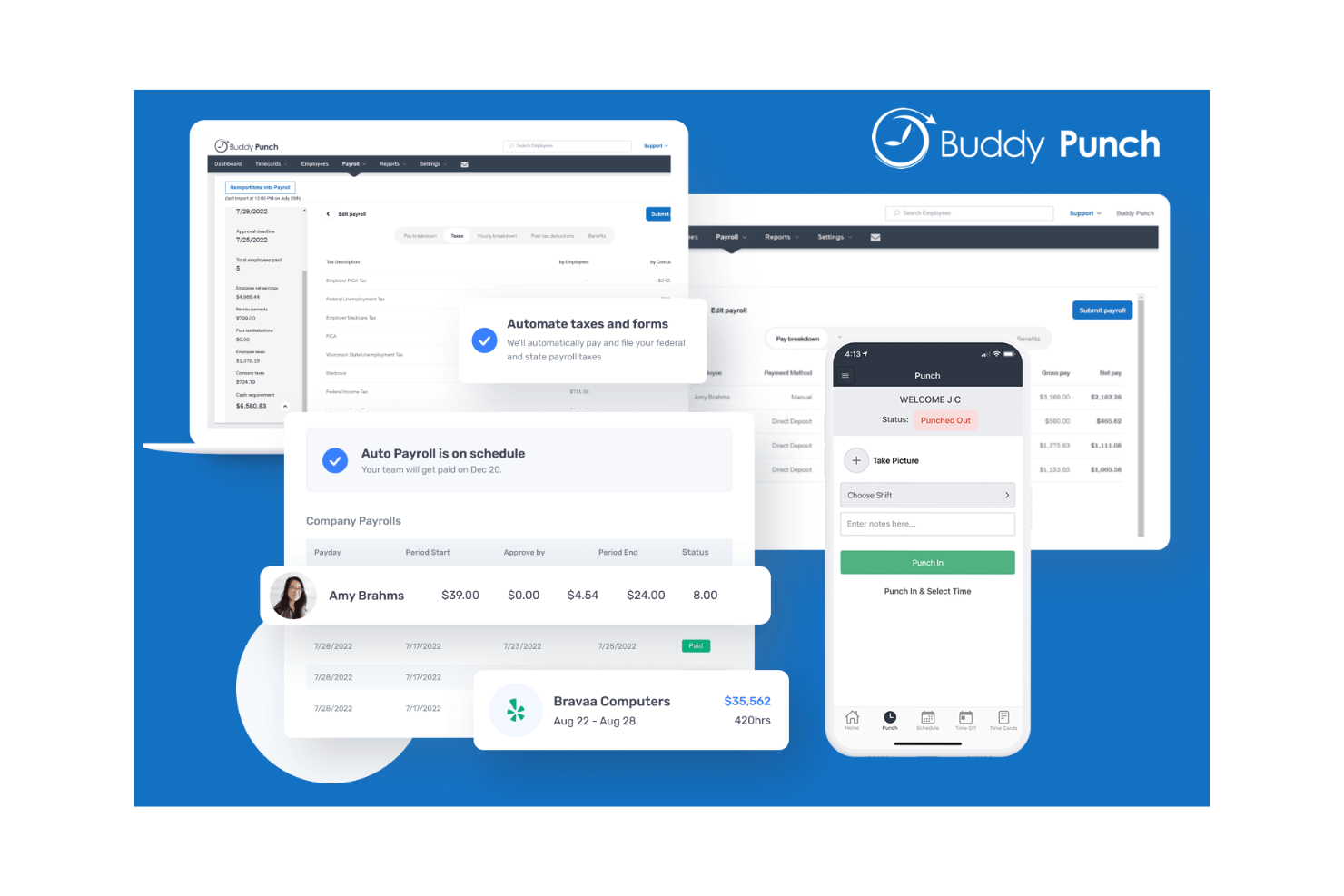

Buddy Punch is a cloud-based time tracking and payroll platform designed to help businesses automate workforce management, streamline payroll processing, and improve employee accountability. It combines advanced attendance tracking, automated payroll, and customizable reporting in one easy-to-use system, making it ideal for small to midsize businesses as well as larger organizations seeking efficiency and flexibility.

Why I picked Buddy Punch:

Buddy Punch stands out for its seamless integration between time tracking and payroll, eliminating manual data entry and reducing errors. Its automated payroll engine calculates wages, overtime, deductions, and taxes in real time, while also handling filings and payments automatically—saving hours of administrative work for HR teams.

The platform’s employee self-service portal enhances the employee experience by providing 24/7 access to pay stubs, time-off balances, and schedules. This eliminates the need for HR to handle repetitive information requests and supports a completely paperless payroll process.

Buddy Punch’s reporting capabilities are also a strong advantage. Businesses can generate customizable reports on work hours, overtime, job codes, and pay summaries, offering real-time insights for both HR and finance teams. For companies with remote or hybrid workforces, the platform’s GPS tracking and device flexibility ensure accurate timekeeping from any location.

Its intuitive interface and mobile apps for iOS and Android make it easy for employees to clock in and out, request time off, and view schedules, whether they’re in the office or in the field.

Buddy Punch Standout Features & Integrations:

Features include automated payroll processing, advanced time and attendance tracking, and GPS location verification to ensure accurate and compliant time logging. The platform also offers customizable pay rules, automated overtime calculations, time-off management, and employee self-service tools that help reduce administrative workload.

Buddy Punch provides robust reporting tools for payroll summaries, project tracking, and labor cost analysis, giving HR and finance teams real-time visibility into workforce data. Its automation features—such as auto-punch reminders and scheduling templates—help improve compliance and reduce timecard errors.

Integrations include ADP, Gusto, Paychex, Paylocity, PayPlus, SurePayroll, QuickBooks, and Workday, as well as Zapier for connecting with hundreds of additional HR, accounting, and productivity tools. The mobile app for Android and iOS extends full platform functionality to field and remote employees.

Pros and cons

Pros:

- Mobile app with GPS tracking supports remote and hybrid teams

- Streamlined tax filing and payment automation

- Robust reporting and analytics for payroll and attendance data

Cons:

- Reporting customization can take time for new users to master

- Limited HR management tools beyond payroll and time tracking

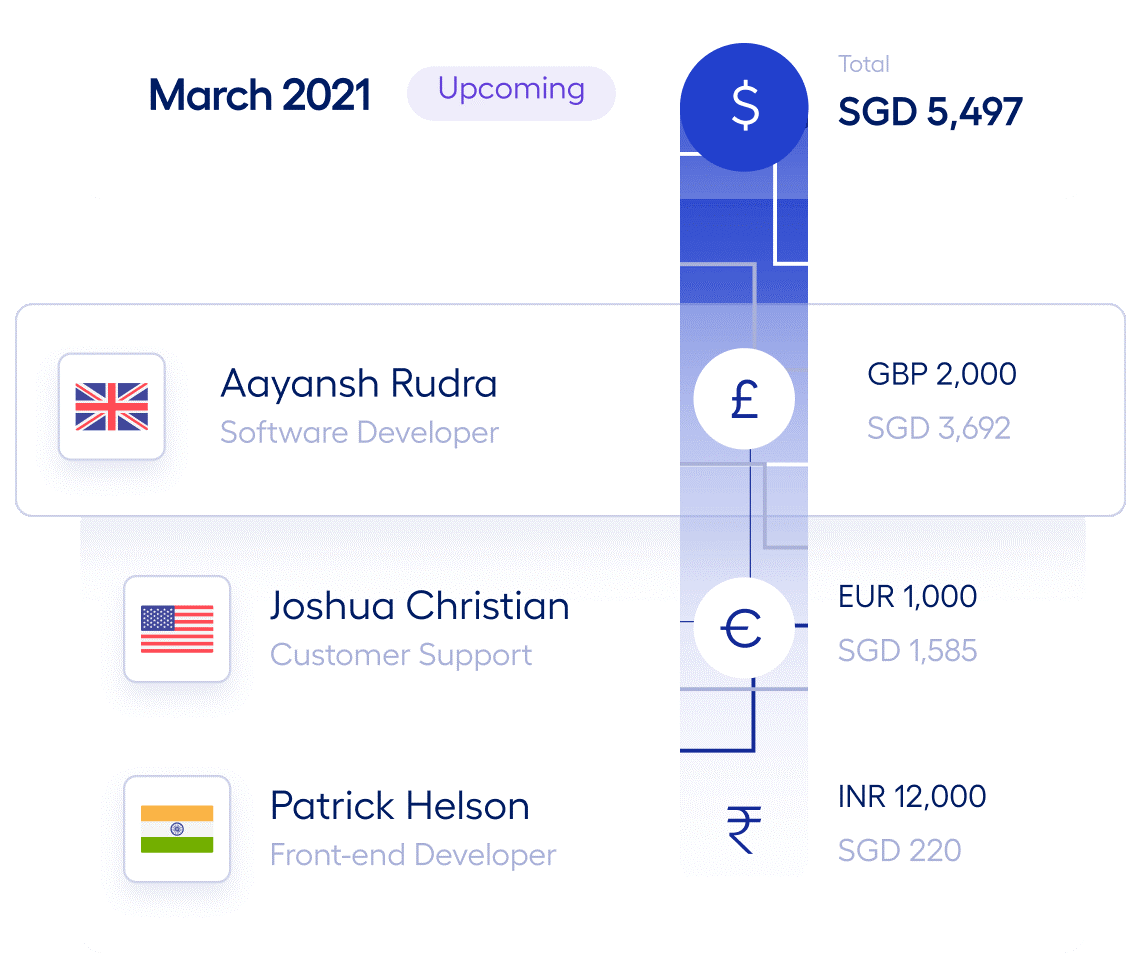

Multiplier is a global employment and payroll management platform designed to help businesses hire, manage, and pay international teams compliantly. It combines global payroll, benefits, compliance, PEO, and Employer of Record (EOR) services into one unified system, making it easier for companies to expand globally without needing to establish local entities or navigate complex international regulations.

Why I picked Multiplier:

Multiplier stands out for its ability to simplify international employment through automation and legal expertise. Its platform enables businesses to hire and pay employees or contractors in 150+ countries and 120+ currencies, while ensuring compliance with local tax, labor, and benefits regulations. This makes it an ideal solution for companies scaling across borders or managing distributed workforces.

The platform’s EOR and PEO models offer flexibility depending on your global structure. If your business already has an international entity, Multiplier can serve as your PEO—handling payroll, benefits, and compliance under your entity. If you don’t, Multiplier can act as your EOR, becoming the legal employer of your global workforce so you can onboard employees quickly and legally without setting up a local presence.

Multiplier also provides AI-assisted contract generation, localized benefits management, and automated payroll processing, ensuring employees are paid accurately and on time—no matter their country or currency. Its built-in legal and compliance oversight, powered by over 100 in-house experts, eliminates the guesswork and risk associated with managing global teams.

The platform’s centralized dashboard gives HR and finance leaders real-time visibility into payroll, contracts, and compliance documentation across all regions, providing both transparency and peace of mind.

Multiplier Standout Features & Integrations:

Features include global payroll automation, multi-currency payments, EOR and PEO services, and localized contract management that adapts to regional labor laws. The system also provides tax compliance automation, benefits administration, and visa and immigration support for international hires.

Its AI-powered contract generation simplifies onboarding, while in-platform analytics help organizations monitor payroll spending, benefits allocation, and workforce distribution. The platform also offers automated compliance monitoring, ensuring businesses stay aligned with local employment regulations.

Integrations include popular HR, accounting, and productivity tools such as BambooHR, QuickBooks, Xero, Workday, and Deel, as well as API connectivity for custom integrations with your existing HR or ERP systems.

Pros and cons

Pros:

- Centralized dashboard for full visibility into global workforce data

- Built-in benefits administration and tax filing support

- Supports payroll and compliance in 150+ countries and 120+ currencies

Cons:

- Limited customization options for complex payroll structures

- Limited integrations compared to some larger HRIS systems

Other Payroll Companies

Here are a few more worthwhile options that didn’t make the best payroll companies list:

- Oyster HR

For coverage across 180+ countries

- QuickBooks Payroll

For automatic tax calculations

- Papaya Global

For AI-backed compliance verification

- Wisemonk

For Indian payroll compliance

- ADP Workforce Now

For compliance support

- TopSource

For hiring without a local entity

- ADP GlobalView Payroll

For multinational organizations of any size

- Ceridian Dayforce

Payroll company for granting employees access to earned wages on-demand

- Gusto

HR software for full-service payroll outsourcing

- Employment Hero

Payroll software for Canadian organizations, including additional features for benefits, corporate insurance and asset tracking

- Namely

Online payroll service with a useful payroll wizard to streamline the payroll process

- Omnipresent

Global payroll solution for incorporating 13th and 14th month payments where legally required

- Immedis

For end-to-end payroll cycle automations for inputs, information validation and payments

- Payoneer

Global payroll solution designed to facilitate cross-border payments, intercompany payments and collections

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Recruiting Software

- Applicant Tracking Systems

- Workforce Management Software

- Learning Management Systems

- Business Management Software

Selection Criteria for Payroll Companies

When selecting the best payroll companies to include in this list, I considered common business needs and pain points that these providers address. This included things like streamlining complex payroll processes and reducing compliance risks.

I also used the following framework to keep my evaluation structured and fair:

Core Services (25% of total score): To be considered for inclusion in this list, each provider had to offer these basic services:

- Payroll processing and wage calculation for hourly and salaried workers

- Direct deposit and payment distribution in to employee bank accounts

- Employee self-service portal with digital pay statements (pay stubs)

- Tax filing and compliance management, including automatic withholding for government bodies (e.g., the IRS or CRA, etc.)

Additional Standout Services (25% of total score): To help further narrow down the competition, I also looked for unique or especially valuable services, such as:

- Global payroll processing in multiple currencies

- Multi-country compliance monitoring

- Contractor payments and classification support

- Integrated time tracking or scheduling tools

- Benefits administration and deductions handling

- Real-time analytics and payroll reporting

- Modern services, like same-day pay access for employees (also known as pay-on-demand or earned wage access)

- Additional support, such as global HR or EOR services

Industry Experience (10% of total score): To get a sense of the industry experience of each provider, I considered the following:

- Years in business and market presence

- Number and type of clients served

- Expertise in regional labor laws

- Specialization in specific business sizes

- Recognition or certifications in the payroll industry

Onboarding (10% of total score): To evaluate the onboarding experience for each provider, I considered the following:

- Availability of guided setup or account manager

- Clarity and speed of implementation process

- Access to onboarding resources or tutorials

- Ease of data migration and integrations

- Customer support during initial setup

Customer Support (10% of total score): To assess the level of customer support each provider offers, I considered the following:

- Availability of live chat or phone support

- Quality of support documentation or help center

- Responsiveness to urgent payroll issues

- Dedicated account manager availability

- Access to ongoing training or support resources

Using this assessment framework helped me identify the payroll providers that go beyond basic requirements to offer additional value through advanced services, deep industry experience, smooth customer onboarding, effective support, and overall value for price.

What is a Payroll Company?

A payroll company is a third-party service that handles employee pay processing, tax filings, and compliance on behalf of businesses.

It’s used by HR teams and business owners to save time, reduce manual errors, stay compliant with tax laws, and ensure employees get paid accurately and on time.

Frequently Asked Questions about Payroll Companies

Still curious about payroll companies and what they have to offer? Take a look through these answers to popular FAQs to get you grounded.

What are the best payroll options for small business owners?

Small business owners need payroll providers that are affordable, easy to use, and scalable as you grow. Look for solutions with flexible pricing, top-notch support, and all-in-one capabilities for payroll, taxes, and compliance. Comparing features, integrations, and customer service will help you choose the right fit for your company.

To save you time, take a look at my list of the best small business payroll options instead. Or, if you’re running a startup or operating on a very tight budget, I recommend browsing my list of the best free payroll software too.

How can payroll companies help with local and international payroll compliance?

Payroll companies help you stay compliant by handling automated tax calculations, filings, and updates for changing regulations. Many providers have compliance experts who keep up with local and international labor laws—including statutory deductions and reporting—so you’re less likely to face errors or penalties. International payroll specialists can help if your team works across borders.

What integrations are the most important to have with payroll software?

The most important payroll software integrations are with your HRIS, accounting software (like QuickBooks or Xero), and benefits administration tools. These integrations help your team keep data accurate, reduce manual work, and ensure payroll, tax, and benefits data flow smoothly.

Look for payroll providers that support native or API integrations with the key tools in your HR and finance stack to streamline your processes.

Can payroll providers integrate with my HRIS, benefits, or accounting tools?

Yes, most payroll software supports direct or API integrations with leading HRIS, benefits platforms, and accounting software. Confirm with your provider which integrations are included, since this can accelerate onboarding and reduce manual data entry for your HR and finance team.

How do payroll services support changing workforce needs, like contractors and remote employees?

Payroll services are designed to handle a mix of employee types, including contractors, part-timers, and full-timers. Many solutions let you automate payments for remote employees, manage compliance across state or country lines, and offer self-service access for workers to view pay slips and update personal details.

What should I consider when switching to a new payroll company?

Before switching payroll providers, plan for data migration, check compatibility with your current systems, and review service contracts. Ask about onboarding support and ensure the new platform can manage your compliance and integration needs. A parallel test run helps catch issues early.

How quickly can I implement a new payroll provider?

Most payroll providers can get you up and running in 1–2 weeks for simple needs, or 4–6 weeks if you have a large team or complex requirements. Prepare your payroll data and documentation in advance to speed up the process.

Other Payroll Resources

With so many different payroll providers out there, we couldn’t possibly fit them all into one article! If you’re still interested in considering other options, I recommend reviewing these other payroll solutions too:

- Automated Payroll Software

- Online Payroll Software

- HR Software for Payroll

- Payroll Services for Small Businesses

If you’re looking for payroll software specifically for internationally-based staff, you’ll want to check out these other types of payroll and HR services as well:

- Best Global Payroll Service Providers

- Best PEO Companies (Professional Employer Organizations)

Stay Connected

If you found this article useful, I recommend subscribing to our People Managing People newsletter as well. You'll learn about the latest trends in HR leadership, tricks and tips to help you process payroll more efficiently, and how-to guides for any HR topic you can think of. Plus, it's delivered to your inbox for free each week.