20 Best Payroll Software Shortlist

Here's my pick of the 20 best software from the 30 tools reviewed.

The best payroll software helps HR professionals pay employees and contractors accurately, stay compliant with changing tax laws, and automate tedious payroll tasks so you can focus on people—not paperwork.

If you’re stuck with clunky systems, juggling manual calculations, or worried about errors and late filings, the right platform can eliminate those headaches. Modern solutions handle wage calculations, direct deposits, multi-state or international payroll, benefits deductions, and detailed reporting—all in one place.

As someone with 9 years of hands-on experience managing payroll operations and 3+ years of testing and researching payroll and HR tools, I’ve put together this guide to help you cut through the noise, compare your top options, and confidently choose a system that saves time, reduces risk, and makes payday effortless. Let's jump in to help you find the right fit!

You Can Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Payroll Software: Comparison Chart

This comparison chart summarizes pricing, trial, and demo details for my top payroll software selections to help you find the best software for your budget and business needs.

| Tool | Best For | Trial Info | Price | ||

|---|---|---|---|---|---|

| 1 | Best for global payroll with tons of integrations | Free demo available | From $8/user/month (billed annually) | Website | |

| 2 | Best for compliant payroll in 150+ countries | Free trial + demo available | From $29/month | Website | |

| 3 | Best for supporting employee engagement | Free demo available | Pricing upon request | Website | |

| 4 | Best for small businesses | 90-day free trial | Pricing upon request | Website | |

| 5 | Best for global payroll compliance | Free demo available | Pricing upon request | Website | |

| 6 | Best for automating payroll tasks | 30-day free trial | Pricing upon request | Website | |

| 7 | Best for HR, payroll, and integrations in one | Free demo available | Pricing upon request | Website | |

| 8 | Best for real-time payroll data access | Free demo available | Pricing upon request | Website | |

| 9 | Best for global payroll management | Not available | From $199/employee/month | Website | |

| 10 | Best for managing hourly teams | Free plan available | From $20/location/month | Website | |

| 11 | Best for global teams in 170+ countries | Free demo available | From $25 - $199/user/month | Website | |

| 12 | Best for niche industries | 30-day free trial | From $40/month + $6/user/month | Website | |

| 13 | Best for accurate payroll processing | Free demo available | Pricing upon request | Website | |

| 14 | Best for integrated compensation benchmarking | Free demo available | Pricing upon request | Website | |

| 15 | Best for expert guidance | Free demo available | From $99/month | Website | |

| 16 | Best for syncing with the QuickBooks ecosystem | 30-day free trial | From $19/user/month (billed monthly) | Website | |

| 17 | Best for flexible payroll systems | Free demo available | Pricing upon request | Website | |

| 18 | Best international and local payroll consolidation | Free trial available | From $29/user/month | Website | |

| 19 | Best for hands-off tax filing | Free demo available | From $6/user/month (billed annually) + $49 base fee per month | Website | |

| 20 | Best for employee‑driven error prevention | Free demo available | Pricing upon request | Website |

-

Native Teams

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.9 -

Rippling

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.8 -

Paylocity

Visit WebsiteThis is an aggregated rating for this tool including ratings from Crozdesk users and ratings from other sites.4.5

Best Payroll Software Reviews

Here you’ll find my detailed overviews of the 20 best payroll solutions I’ve featured. Each overview has information about the platform’s best use case, standout features, and integrations. Plus, there are additional options included below if you’d like even more choices to consider.

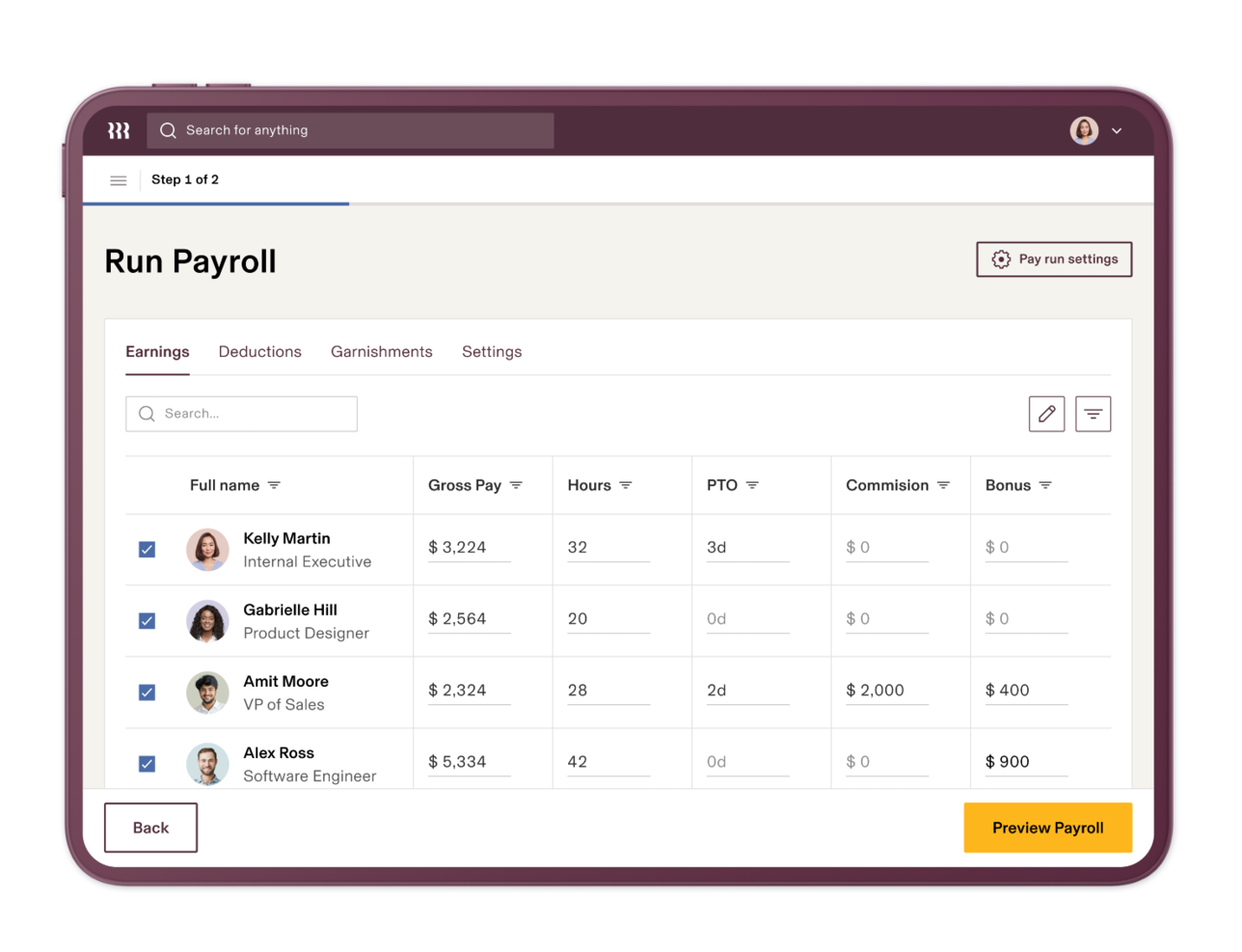

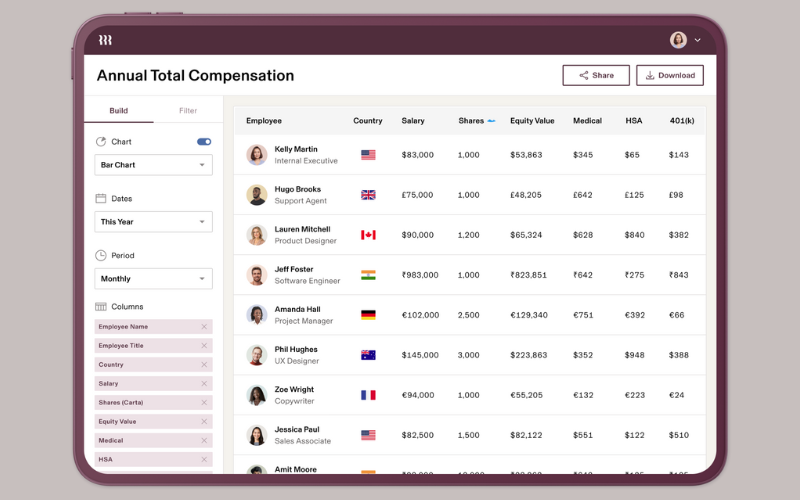

Rippling’s modern payroll system is part of their all-in one HR, payroll, and IT platform. It provides the robust functionality of legacy systems with the ease of newer systems to deliver the best of both worlds.

Why I picked Rippling: Rippling allows users to onboard new hires quickly and automatically, run payroll with a click, and pay employees or contractors, anywhere. Their system is built on centralized employee data, so businesses can automate all of the admin work that’s normally required to run payroll and update employee information.

Rippling Features and Integrations:

Features include domestic and global payroll, an organization chart, expense management, talent management, local tax filing, country-specific compliance, and international benefits programs. Companies can also manage their employees’ offer letters, I-9s, health insurance, and time off.

One feature I found particularly useful is the ability to compare your current pay run with previous runs side-by-side to quickly spot any changes. This visual comparison tool makes it easier to spot potential errors and verify that all expected payroll changes have been entered.

Integrations are available with Google Workspace, Typeform, Databricks, BrightHire, Atlassian, Google Workspace, Slack, Checkr, Zoom, GitHub, Asana, 1Password, Zendesk, Dropbox, Sage Intacct, Netsuite, Microsoft 365, QuickBooks, DocuSign, Upwork, LinkedIn, and dozens more.

Pros and cons

Pros:

- Customizable reporting

- Efficient onboarding and offboarding

- Smooth employee self-service

Cons:

- Limited customer support options

- Complex initial setup

New Product Updates from Rippling

Rippling Now Integrates with Points North

Rippling's new integration with Points North automates certified payroll reporting, ensuring compliance with Davis-Bacon and prevailing-wage laws by synchronizing data in real time and reducing manual errors. More details at Rippling Blog.

Deel is a global payroll platform available in over 150 countries and all 50 U.S. states, ensuring compliance with local regulations. With Deel, you can hire and pay anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll.

For business leaders like Cara Barnes, Founder at Good Carma Consulting, this peace of mind is invaluable: “Deel was a way to guarantee that we were properly classifying [employees] correctly and also making sure we are paying the right taxes and dues to the government. Otherwise, it could be really costly afterward.”

Why I picked Deel: I chose this software because it provides end-to-end global workforce management, including contract adjustments, expense reimbursements, and off-cycle payroll adjustments. You can schedule payments in advance and run off-cycle payroll whenever needed.

It's also worth noting that the company has local country experts working in-house to run global payroll and ensure all regional contributions are accounted for. Their team provides 24/7 online support, and dedicated account managers are available for specific requests.

Deel Standout Features and Integrations:

Standout features I noticed were the software's 10+ payment options, ranging from bank transfers to cryptocurrency pay-ins. What makes this stand out from other options is that employees and contractors can self-manage their pay and personal data, and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals.

Integrations include Ashby, BambooHR, Expensify, Greenhouse, Hibob, NetSuite, Okta, OneLogin, QuickBooks, Xero, Workday, and Workable. The software’s open API can support additional custom software integrations.

Pros and cons

Pros:

- Knowledgeable support staff

- Detailed dashboards

- Add-ons available to localized benefits and global payroll

Cons:

- Limited invoice customization

- Contract templates could be simplified

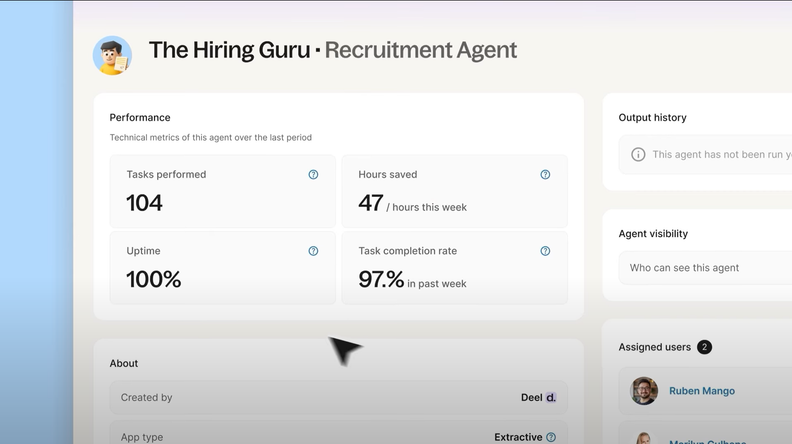

New Product Updates from Deel

Introducing Deel AI Workforce

Deel has launched the AI Workforce, a set of specialized agents designed to handle repetitive HR, payroll, and compliance tasks with speed and accuracy. These AI agents don’t just assist—they execute tasks from start to finish. For more information, visit Deel's official site.

UKG is an HR, payroll, & workforce management platform that offers solutions that cater to businesses of all sizes. They focus on enhancing workforce management and employee engagement, making it a valuable tool for organizations looking to optimize their payroll processes.

Why I picked UKG: the platform offers advanced payroll solutions like UKG Pro and UKG Ready, which integrate payroll with workforce management to reduce errors and boost efficiency. Its culture-focused approach supports employee engagement, while global payroll capabilities ensure compliance with local laws, making multi-country payroll management easier and more reliable.

UKG Features and Integrations:

Features include automated updates to ensure compliance with labor laws and tax regulations, mobile access for employees to manage their payroll data, and AI-driven insights that help improve workplace culture and employee engagement.

These features collectively contribute to a smoother payroll experience for both you and your team, enhancing overall satisfaction and efficiency.

Integrations include Flexspring, The Cloud Connectors, Kombo, Nagarro, Eljun LLC, Workato, Joynd, and Aquera 360.

Pros and cons

Pros:

- Strong compliance support for multi-region operations

- AI-powered insights for engagement and planning

- Wide range of HR, payroll, and workforce tools

Cons:

- No pricing mentioned

- Implementation may be complex for new teams

RUN by ADP is a comprehensive payroll and HR software solution designed to enhance payroll processing and human resource management for small businesses.

Why I picked RUN by ADP: I like its comprehensive suite of features tailored to meet the needs of small businesses. One of the most significant advantages is its ability to automate payroll processes, including tax calculations and filings. This feature not only saves time but also reduces the risk of errors, ensuring compliance with federal and state regulations.

The software also automatically calculates benefits and retirement deductions, and it customizes the experience based on the specific needs of the business and its employees.

RUN by ADP Standout Features and Integrations:

Standout features include AI-powered error detection that learns your payroll and proofs your data for you, flagging potential errors before they happen. It also offers direct deposit, multi-jurisdiction payroll, job costing, and a range of HR functions, like background checks, new employee onboarding, and forms and documents.

Integrations include Quickbooks, Wave, Xero, ClockShark, Points North, TruSaic, Compy, Wex, Synerion, JazzHR, 7Shifts, Snappy Gifts, Absorb LMS, SmartRecruiters, and hundreds more.

Pros and cons

Pros:

- Good integrations

- Employee self-service portal

- Good mobile app

Cons:

- Most HR functions are only available on higher-tier plans

- Setup can be complex

TopSource Worldwide is a global Employer of Record (EOR) provider offering payroll, compliance, and HR support to help businesses manage international hiring without establishing local entities. Its payroll solution covers processing payments in local currencies, managing statutory benefits, and ensuring compliance with employment laws.

Why I Picked TopSource Worldwide: I picked TopSource Worldwide because it’s a strong choice for businesses managing global payroll across multiple countries. It handles complex processes like paying employees in local currencies and managing contributions for taxes and benefits. This helps keep your business compliant while reducing manual effort.

Additionally, TopSource Worldwide offers strategic HR advisory and transition support from EOR to full-time employment, making it a flexible choice for businesses planning long-term growth in new markets.

TopSource Worldwide Standout Features and Integrations:

Standout features include its infrastructure for global operations, which supports compliance, payroll, and HR needs in over 180 countries. The platform also provides HR support, data security, and services like compliant employment contracts, onboarding, and advisory for international workforce management.

Integrations include Salesforce, NetSuite, SAP, Portico HR, and connections for CRM, ERP, API, EDI, and financial systems.

Pros and cons

Pros:

- Legal employer of record in each location

- Includes global payroll and tax management

- Salary estimator tool helps plan ahead

Cons:

- No public list of software integrations

- Pricing not publicly listed

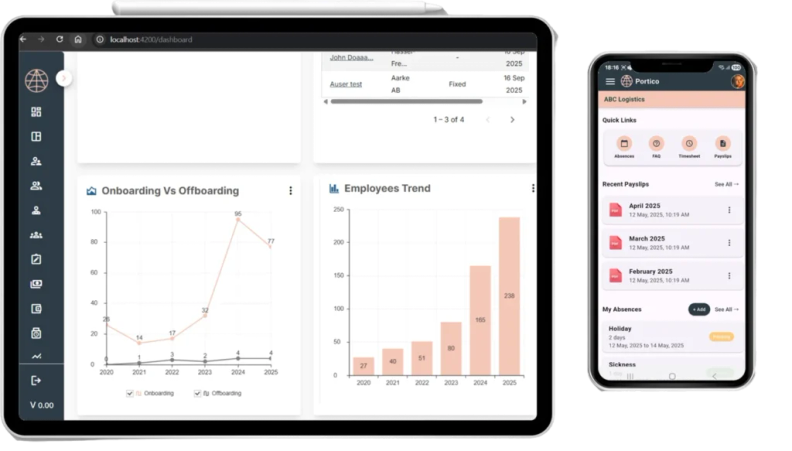

New Product Updates from TopSource

TopSource's Launch of the Portico Mobile App

TopSource's Portico mobile app offers a mobile-first EOR experience with real-time dashboards and secure login. For more information, visit TopSource's official site.

Paycor is a human capital management solution with payroll, workforce management, and employee experience features. The payroll product can handle payroll, expense management, time and attendance, and more.

Why I picked Paycor: Paycor offers automation features to run payroll automatically, as scheduled for a specific day and time. Multiple payment options are available through the software, including direct deposit, paycards, or on-demand pay.

It also provides in-depth compliance feedback to help you respect the employment laws in your state. Because of its robust functionality, I think it's best suited to large and enterprise businesses.

Paycor Standout Features and Integrations:

Standout features include its pay-on-demand feature, which allows employees to access their earned wages before their next official payday — a very modern functionality that not all payroll providers offer.

It's also convenient that expense management, scheduling and time tracking, and employee experience monitoring are all also available in the platform.

Integrations include several other tools for wage and salary verification, expense management, employee wellness, certified payroll, and FMLA. Key software systems to note include Certify, ESR, Payfactors, and WageWorks.

Pros and cons

Pros:

- All-in-one solution well suited to enterprise businesses

- Live and on-demand product training and industry webinars

- Mobile app allows for payroll management on the go

Cons:

- Time cards are a bit simplistic

- UX can be a little clunky at times

Paylocity is an all-in-one payroll and human resources platform built to help businesses manage their workforce efficiently.

Why I picked Paylocity: When it comes to payroll, Paylocity helps you run payroll accurately and on time with automated tax calculations and filings. You can manage deductions and garnishments, ensure compliance with wage and hour regulations, and track payments for direct deposits or paychecks.

The system also provides detailed payroll reports that let you analyze labor costs and payroll data in real time. This way, you can keep track of everything from overtime to tax liabilities, without needing manual calculations or separate tools.

I also like that it's tightly integrated with its HR features, allowing you to manage processes outside of payroll, such as talent management, shift management, learning, and time tracking.

Paylocity Standout Features and Integrations:

Standout features include expense management, tax services that cover all 50 US states, on-demand payments, managed garnishment services, and global payroll abilities covering 100+ countries.

In addition to Paylocity's payroll features, their software also includes time and labor management tools that let you track employee attendance and manage shift schedules. Its talent management tools allow you to set up performance reviews and manage employee development.

In addition, the benefits administration feature helps your team handle employee health plans, retirement options, and other benefit packages.

Integrations include over 400 third-party tools across recruitment, productivity, communication, and benefits management, like ClearStar, Microsoft Dynamics 365, 7shifts, AirMason, APA Benefits, Azure, Atlassian, Asana, Box, ClearCompany, Dropbox, Freshdesk, Google Workspace, Greenhouse, HubSpot, Slack, Salesforce, Trakstar, and Zoho People.

Pros and cons

Pros:

- Includes tax compliance services

- On demand payment options

- Includes performance management features

Cons:

- Setup can be time consuming

- Lacks support for independent contractor payments

HiBob is a human resources (HR) platform with integrated payroll software for businesses in the US and UK. Its Payroll Hub centralizes payroll tasks, making it easier to manage compensation, compliance, and employee data in one place.

Why I Picked HiBob: I picked HiBob because its Payroll Hub gives you real-time access to payroll data, reducing the risk of errors and helping you stay compliant. You can also run payroll on different cycles, such as weekly or monthly, depending on your business needs. HiBob’s compensation tools add further value by supporting salary reviews, bonuses, and equity management in one system, which helps ensure pay transparency and consistency across your organization.

HiBob Standout Features and Integrations

Standout features include its sandbox environment, where you can test payroll and HR processes without impacting live data, as well as built-in tools for time and attendance tracking to support accurate payroll runs. HiBob also offers learning management and performance review features, making it a broader HRIS platform.

Integrations include ADP, Deel, Google applications, Slack, Greenhouse, LinkedIn Learning, Microsoft Teams, Jira, Oyster, Paylocity, Zapier, and Xero.

Pros and cons

Pros:

- Built-in compensation tools

- Flexible payroll cycle options

- Real-time payroll data hub

Cons:

- Implementation fee required

- Limited to US and UK payroll

Remote People is a payroll software solution that helps businesses hire and manage remote talent globally. By offering a range of services, including global payroll management and compliance solutions, it enables companies to handle HR tasks across various countries.

Why I Picked Remote People: I picked Remote People as a top payroll software for its robust global payroll management, ensuring accurate, on-time payments across countries while handling local compliance through its employer of record services. It also streamlines contractor management for easy onboarding and payments, meets legal and tax obligations, and offers employee benefits management to help attract and retain top talent—making it a comprehensive solution for managing a diverse workforce.

Remote People Features and Integrations:

Features include a database of over 300,000 vetted candidates, providing you with access to a wide pool of talent for your specific needs. The platform also offers executive recruitment services, allowing you to find experienced leaders to drive your company forward. Additionally, Remote People provides HR tools like salary and onboarding cost calculators to help you manage your budget and expenses effectively.

Integrations are not currently listed by Remote People.

Pros and cons

Pros:

- Dedicated client support contact

- Provides global payroll, contractor, and relocation support

- Includes Employer of Record and PEO services

Cons:

- Some services available only in certain regions

- No publicly listed integrations

Homebase is a payroll and team management platform tailored to the needs of small businesses, especially those with hourly employees.

Why I picked Homebase: I like that Homebase offers built-in payroll capabilities on top of strong scheduling and time tracking features. It's particularly helpful for managing hourly teams—automating shift swaps, time-off requests, and compliance tracking. That means less time juggling schedules and more time focusing on the business.

The platform also helps you stay compliant with labor laws and reduce payroll errors by syncing time clock data with payroll processing.

Homebase Standout Features and Integrations:

Standout features include automated scheduling, real-time time clocks with schedule alerts, built-in messaging for shift reminders, and PTO tracking. The software also supports employee onboarding, departmental permissions, and labor cost optimization.

Integrations include QuickBooks, Gusto, Square, Clover, Shopify, Xero, ADP, Zapier, Lightspeed, and Revel Systems.

Pros and cons

Pros:

- Automated payroll and tax processes

- Offers direct deposit into bank accounts or printable checks

- Time tracking for accurate payroll

Cons:

- Payroll functions are only available as an add-on

- No details on customization for specific business needs

RemoFirst is a payroll software that provides users with a secure, efficient, and easy-to-use platform for managing payroll processes in 170+ countries. Users can input employee information, calculate taxes, and generate pay stubs. The software offers many features, including employee self-service, direct deposit, tax compliance, and reporting.

For global companies, this reliability is key. As Wendy Makinson, HR Manager at Joloda Hydraroll, shares: “RemoFirst has proven to be an affordable software that allows us to easily onboard members remotely and make payments globally. We can also feel reassured that all the correct documentation has been completed, with none of the errors that may occur from us trying to organize virtually, without local knowledge.”

Why I picked RemoFirst: Using RemoFirst, you can manage payroll and invoicing for businesses with employees abroad. The software automatically generates accurate paychecks and invoices in the local currency and tracks employee vacation days, sick leave, and expense reimbursements.

RemoFirst sends invoices every month, ensuring your employees are paid on time. Users can access a dedicated account manager and RemoFirst's knowledge base to troubleshoot any issues.

RemoFirst also lets businesses manage employee benefits programs with ease. Users can track employee eligibility, enroll employees in benefits plans, and even change existing plans. It also allows businesses to generate employee enrollment and participation reports. Dashboards summarize team distribution and spending with visual graphs and charts.

RemoFirst Standout Features and Integrations:

Features include a cost calculation tool that helps businesses budget costs effectively by considering various factors, including the number of employees, the type of benefits provided, and the frequency of payments.

Employees can also view their equity and bonus information in real time, and the system automatically calculates vesting schedules and payout dates.

Other features include tools for managing employee shares and dilution, plus tools to issue specialized reports on equity and bonus activity. Its reporting feature allows users to generate detailed reports on their payroll data which can be generated for a specific period.

Integrations include ADP.

Pros and cons

Pros:

- Dedicated account managers

- Customizable dashboards

- Multi-currency abilities within a single payroll run

Cons:

- Lacks extensive integrations

- No mobile app available

OnPay’s payroll platform helps organizations with payroll processing, managing HR functions, and integrating employee benefits, all in one place. Their software includes a full suite of payroll services and compliance settings for the US, covering all 50 states.

Why I picked OnPay: I picked this company because special payroll services are offered at no additional cost for niche industries like restaurants, farms and agriculture, churches and clergy, and nonprofits.

They provide great customer service in addition to the payroll platform, which is helpful when you have specific business needs. Platform specialists are available to help you set up your payroll process and automate your taxes, even if you don’t have any previous experience with this kind of software.

OnPay Standout Features and Integrations:

Standout features include their team of licensed in-house insurance brokers. I like that they can help you set up health, dental and vision plans with top providers such as Humana, Cigna, Blue Cross / Blue Shield, and UnitedHealthcare. You can also set up a 401k integration that supports employer matching and profit sharing arrangements.

Integrations include Deputy, Magnify, Mineral, PosterElite, QuickBooks, When I Work, Xero, Guideline, and Vestwell.

Pros and cons

Pros:

- QSEHRA payments can be made

- Clean, intuitive user interface

- A team of specialists come with the cost

Cons:

- Employee files can be a bit complex

- Integrations can be a bit tricky to set up

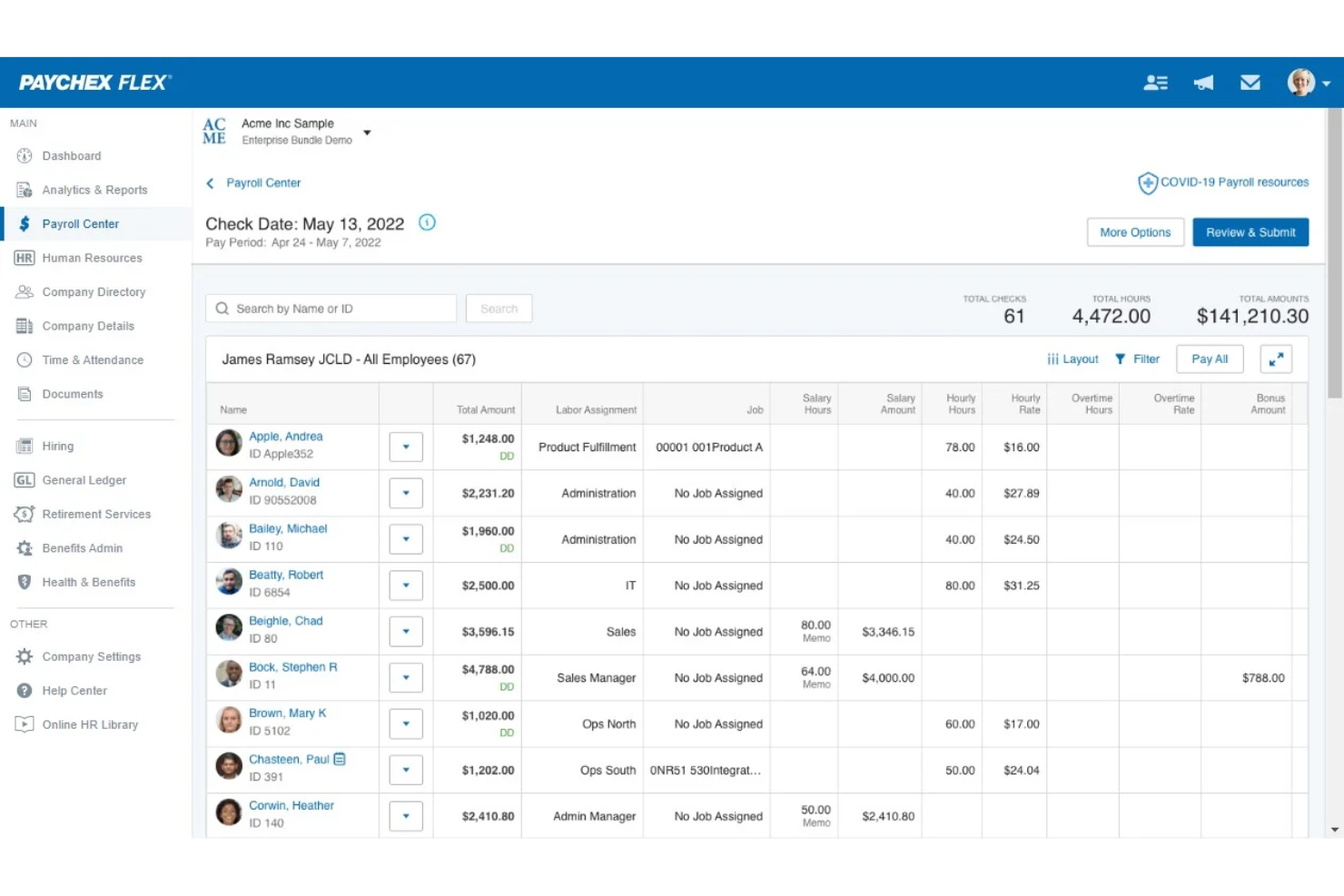

Paychex Flex is a cloud-based payroll and human resources management software designed to help businesses of all sizes manage their payroll processes, employee benefits, and other HR-related tasks.

Why I picked Paychex Flex: It's a comprehensive solution that aims to simplify and streamline the entire payroll process, making it easier for businesses to stay compliant with tax regulations and ensure their employees are paid accurately and on time.

Using Paychex Flex, you can track your team’s daily hours, manage time sheets, approve PTO, and oversee benefits in one place. You can also schedule your payrolls and approve them before payday with ease, or schedule multiple runs in the same pay period, and oversee your work on the mobile app.

The solution also gives you access to extra HR features as add-ons for additional fees.

Paychex Flex Standout Features and Integrations

Features include payroll processing, payroll tax filing, a garnishment payment service, paycheck preview and approval, new-hire reporting, and a mobile app.

Another useful feature is the self-service portal where employees can access digital copies of their pay stubs, see their contributions, and manage their retirement accounts, making it easy for them to access their data.

Integrations include Ashby, BambooHR, Clover, Deputy, HIREtech, iCIMS, Indeed, Oracle Netsuite, QuickBooks Payroll, and others.

Pros and cons

Pros:

- 24/7 specialized service for US clients

- Knowledgeable representatives

- Helps you save time with payroll filters and saved views

Cons:

- Adding pay categories could be easier

- Automatically creates multiple subfolders, making it difficult to find the right files at times

Trinet is a global payroll and HR software and service provider. It can help your organization manage various HR operations including payroll and employee benefits administration, performance and learning management, and risk mitigation.

Why I picked Trinet: I picked this platform because its payroll capabilities can handle complex regulations in several countries, making it suitable for global organizations or businesses operating in multiple locations. It can also manage worker's compensation claims, retirement plans, and employee benefits packages. Time tracking is included, which connects exact employee hours with their pay.

Trinet Standout Features and Integrations:

Standout features are definitely the software's compensation benchmarking capabilities, which stood out to me in my testing. The data is verified by Salary.com and covers 15,000 different job titles and 225 industries, helping you craft a better, more competitive compensation structure.

Integrations include QuickBooks, Oracle NetSuite, Sage Intacct, BambooHR, Lattice, Greenhouse Software, Carta, and Xero.

Pros and cons

Pros:

- Global payroll management for multinational businesses

- Centralizes all of your HR processes in one platform

- Company provides HR consulting as well as software

Cons:

- Robust system, comes with a learning curve

- Full functionality may not be needed

Bambee's cloud-based HR software is specifically tailored for small and medium-sized businesses. Their software covers a wide range of functions, including onboarding, compliance, and employee termination. They also offer a guided payroll service, which is available as an add-on.

Why I picked Bambee: I included Bambee's combined payroll software and expert services because of its ease of use and affordability. Their services cover a comprehensive set of payroll functions, including 2-day direct deposit, tax filings, and year-end reporting.

In addition, Bambee also offers personalized support from HR experts, as well as a dedicated HR manager for every client, making it easier for businesses to navigate complex payroll regulations.

Bambee Standout Features & Integrations:

Features include 2-day direct deposit, integrated compliance monitoring, and automatic federal, state, and local taxes. They also provide businesses with guidance on payroll-related compliance issues, such as minimum wage requirements and overtime rules too.

Their employee self-service portal also allows employees to view their pay stubs, manage their personal information, and request time off, all without having to contact HR, saving businesses time and resources.

Integration details are currently not available.

Pros and cons

Pros:

- Personalized support

- Great mobile experience

- A guided payroll service is also available

Cons:

- For US organizations only

- Customer support is only available Monday to Friday

QuickBooks Payroll is a payroll platform that connects directly with your accounting, time tracking, and team management tools. It’s designed for small to midsize businesses that want to simplify how they pay employees, file taxes, and manage benefits.

Why I picked QuickBooks Payroll: What makes QuickBooks Payroll stand out is how closely it integrates with accounting and time tracking so payroll always reflects what’s actually happening in your business. Time data from QuickBooks Time syncs directly into payroll so you’re not chasing down hours or dealing with spreadsheets. It also connects to your chart of accounts, so payroll expenses are automatically logged and reconciled with no extra data entry.

QuickBooks also handles tax compliance. It calculates, files, and pays your payroll taxes automatically, and includes an accuracy guarantee. If there’s ever a penalty due to a mistake on their end, QuickBooks will cover it up to $25,000. That kind of protection is especially useful if you’re a smaller business without a dedicated payroll expert on staff.

QuickBooks Payroll Features and Integrations:

Features include same-day direct deposit, which gives you more flexibility with cash flow since you can fund payroll and pay employees on the same day. The QuickBooks Workforce app gives employees direct access to pay stubs, W-2s, and time tracking without having to contact payroll admins.

You also get built-in tools for HR compliance, such as onboarding checklists, I-9 automation, and the ability to request e-signatures directly within the platform.

Integrations include Ramp, Method CRM, Fundbox, QuickBooks Time, Expensify, Float, Dext, BILL, and Uncat.

Pros and cons

Pros:

- Same‑ or next‑day direct deposit options speed up payments to employees

- Automatic tax calculation, filing, and payment for state/federal taxes simplifies compliance

- Seamless integration with QuickBooks accounting

Cons:

- Reports/customization for niche use‑cases can be confusing or less flexible than desired

- More expensive than many competing tools especially once you add needed feature

GoCo is an all-in-one HR platform designed to simplify payroll and HR tasks for small and mid-sized businesses. It offers tools for payroll processing, benefits administration, time tracking, and compliance management.

Why I picked GoCo: GoCo offers flexible payroll solutions, featuring integration capabilities with existing payroll systems as well as its own embedded system, Execupay. This flexibility supports businesses in selecting the most suitable payroll management option, whether it's their own or GoCo's.

GoCo Standout Features and Integrations:

Features include automated new-hire setup, benefits deductions, paycheck calculations, time tracking, and PTO management, which collectively enhance accuracy and minimize administrative tasks.

Other standout features include tax calculation and filing services that help you stay compliant with tax regulations, reducing the risk of penalties. GoCo also provides unified HR and payroll support, offering a single point of contact for assistance. It even offers the ability for users to create and automate custom HR workflows.

Integrations include QuickBooks Online, ADP Workforce Now, Paychex, JazzHR, Greenhouse, Workable, Slack, Zoom, Google Workspace, Microsoft Teams, Checkr, and Verified First.

Pros and cons

Pros:

- Strong onboarding and benefits administration

- Automates various HR processes

- Flexible payroll integration options

Cons:

- Limited customization options

- May not be ideal for large enterprises

Remote empowers companies of all sizes to pay and manage full-time and contract workers around the world. Remote makes it possible for users to take care of international payroll, benefits, taxes, stock options, and compliance in over 50 countries.

Why I picked Remote: Their payroll software makes it easy to onboard and pay your contractors and employees in one modern, secure, cloud-based platform, freeing you and your team up to focus on more strategic work.

Through Remote’s platform, you’ll have access to your most important employment documents, data, and HR processes, while Remote takes care of your localized payroll, benefits, compliance, IP protection, and taxes wherever your team works.

Their platform is managed by a network of HR and legal experts who stay on top of the nuances, changes, and complexities of local regulations to ensure full compliance with all relevant legislation at all times, giving their clients peace of mind.

Remote Standout Features and Integrations:

Features include full-service global payroll, expertly-managed compliance tracking, and a centralized platform to manage all your employee and payroll data efficiently.

Remote also partners with powerful HR systems to connect people, payroll and HR data. Through Remote’s global employee API and native partner integrations, Remote empowers partners to leverage its global infrastructure in their offerings and help more customers scale their global teams faster.

Integrations are available with 25+ software applications including Workday, BambooHR, Greenhouse, Gusto, Hibob, Personio, Slack, Xero, and other systems. Users can also connect Remote with over 5,000 external apps via the Zapier integration.

Pros and cons

Pros:

- Great for international compliance

- Superior IP protection

- Offers lots of HR features

Cons:

- Pricing can be difficult to understand

- Support can feel impersonal

Gusto is a payroll solution that brings automation and flexibility to how small businesses run payroll. It combines tax filing, employee payments, and compliance in one place that is designed to work without needing constant oversight.

Why I picked Gusto: Gusto does more than calculate payroll taxes. It also files them automatically with the right agencies every time payroll runs, and this is included without extra fees. Many payroll tools offer tax filing only as an add-on, but Gusto builds it into the core experience, which makes staying compliant a lot simpler. This is especially useful if your business operates across multiple states where tax rules vary.

Another reason I chose Gusto is the way it handles timing around paydays. Gusto gives you the option to delay cash movement with Instant Pay, meaning employees can get paid on time while you hold onto funds until the last moment. You can also set up AutoPilot for recurring runs, so payroll processes run without manual steps while still giving you a chance to review everything before it goes through.

Gusto Features and Integrations:

Features include built-in compliance guardrails that help you avoid issues with things like I-9 forms, W-2 filings, and new hire reporting. Gusto also syncs time tracking and paid time off directly into the payroll flow, so you don’t have to pull that data from other tools.

For contractor payments, Gusto supports international payouts and automatically prepares and files 1099 forms, which removes a lot of end-of-year administrative work for teams that work with freelance or contract talent.

Integrations include QuickBooks, FreshBooks, Xero, Sage Intacct, Hubstaff, Expensify, Breezy HR, Greenhouse, Shopify, Upserve, and Slack.

Pros and cons

Pros:

- Allows flexible payroll functions like bonus or off‑cycle runs and unlimited payrolls

- Handles payments for contractors (domestic and international)

- Automates payroll tax filings for federal and state agencies reliably

Cons:

- Occasional difficulties when changing payroll entries after partial processing

- Reporting and custom report options aren't the most flexible

Paycom is a payroll platform designed to unify how businesses manage employee pay within a single HR ecosystem. It eliminates the need for separate systems or data transfers by connecting payroll directly with the rest of the employee lifecycle.

Why I picked Paycom: I picked Paycom for its employee‑powered error detection. With Beti®, the system highlights potential payroll issues (like timesheet discrepancies, missing approvals, expense errors) and prompts employees to correct them before payroll runs. This shifts responsibility toward people who know their data most and reduces the chances of payroll corrections later.

Paycom also offers automation of payroll‑adjacent administrative tasks, especially around expenses, garnishments, tax payments, and general ledger mapping. The software automates expense approvals (based on configured rules), brings in approved expenses directly into payroll, handles payroll tax management automatically, and provides GL Concierge to generate reports mapped for your accounting system.

Paycom Features and Integrations:

Features include employee self-service, where employees update their own payroll-related info like direct deposit, benefits, and time‑off requests. There is also IWant, a command‑driven AI‑style search engine that lets users query payroll or HR data via simple commands so they can get accurate answers without navigating menus.

Integrations are not listed publicly by Paycom.

Pros and cons

Pros:

- Strong payroll compliance support

- Flexible pay delivery (daily pay, pay cards) helps with employee preferences

- Single system means time cards, benefits, payroll share same data

Cons:

- Occasional issues in regions outside the U.S.

- Some features are locked behind expensive add‑ons

Other Payroll Software

Here are a few more options that didn’t make the best online payroll software shortlist. If you need additional suggestions for software to help you process payroll, check these out:

- PrimePay

For early wage access through paycards

- UZIO

For integrated benefits

- Namely

For SMBs

- Insperity

For combined software and services

- Dayforce

For continuous pay calculation

- Wagepoint

For Canadian-based small businesses

- Knit People

For startups

- FinancePal

For payroll outsourcing

- Buddy Punch

For integrated employee time tracking

- Justworks

For salaried and hourly employees

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

- Learning Management Systems

Selection Criteria for Payroll Software

To find the best payroll software, I focused on tools that directly solve the common pain points HR professionals face, like time-consuming data entry, error-prone calculations, and complex compliance requirements.

My recommendations are based on in-depth research, recent market trends, and my firsthand experience managing payroll through a human capital management system over the years.

Here’s what I looked for when evaluating each payroll platform:

Core Payroll Software Functionalities (25% of total score): To be considered for inclusion in my list of the best payroll software, each solution had to offer the following functionalities first:

- Automated calculations for wages and taxes

- Payment processing including direct deposit for employee paychecks

- Compliance with federal, state, and local tax laws

- Tools to generate and distribute employee pay stubs and tax forms

- Digital pay stubs that are accessible to employees through a self-service portal

- Integration capabilities to sync data with time tracking and other HR systems to reduce manual data entry

Additional Standout Features (25% of total score): To help me uncover the best payroll software out of the numerous options available, I also took note of any unique features, including:

- Sophisticated features, such as pay-on-demand or earned-wage-access

- Advanced analytics and reporting capabilities

- Customizable payroll workflows

- Enhanced security features, such as multi-factor authentication

- Additional integrations with a broader range of HR and financial systems, including bookkeeping systems and benefits administration systems for health insurance

Usability (10% of total score): To evaluate the usability of each payroll system, I considered the following:

- An intuitive design and user-friendly interface that simplifies complex processes and requires minimal training to master

- Quick access to essential features without overwhelming users

- A user-friendly mobile experience or dedicated mobile apps for Android and iOS mobile devices

- Role-based access control that's straightforward to configure

Customer Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Quick setup processes and clear guidance for first-time users, including customizable templates

- Multimedia training materials such as videos or interactive tutorials

- Support systems like chatbots and webinars to guide new users through the initial learning curve

- Support for migrating historical employee data into the new platform

Good customer support is essential, especially when dealing with things like payroll and benefits. You need to know that if something goes wrong, you’ll have quick access to help.

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- The availability of multiple support channels, including email, phone, and chat

- The existence of a self-service knowledge base, FAQ repository, or other self-help resources to speed up troubleshooting

- The overall quality, responsiveness, and helpfulness of the support team during customer onboarding and post-purchase, as inferred from customer reviews

- The existence of dedicated account managers

- Whether the company offers full-service payroll services, or any additional HR support services

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- The availability of free trials or demos to test the software before purchasing

- Transparent pricing models that clearly explain which payroll features are included at each level, with no additional hidden costs for training or set-up

- Tiered pricing plans that cater to different business sizes, from small to medium-sized businesses (SMBs) up to large businesses and enterprise-level organizations

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Whether a product has consistently high user ratings across multiple review platforms, indicating a broad level of user satisfaction

- Specific praises, criticisms, or trends in customer feedback that indicate the software's strengths or areas for improvement

- Whether customer feedback specifically mentions issues with ease of use, customer support responsiveness, or lacking features

- Any testimonials that highlight how a platform solved a particular challenge or adapted to changing payroll needs

Using this assessment framework helped me identify the payroll software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

When selecting a system, it’s important to first map out what your core needs are. Think about things like payroll, compliance, and employee management—if these aren’t handled properly, it’ll cause a lot of headaches down the line.

How to Choose Payroll Software

Payroll software can eliminate manual data entry and help you pay employees or contractors with ease. To help you figure out which payroll software best fits your needs, keep the following points in mind:

- What payroll challenges are you trying to solve? Identifying your current payroll challenges will help you understand the specific payroll features and functionalities you want in your new payroll system.

- Common challenges may include: Timesheet data that isn't integrated, an inability to process payroll in multiple currencies, or too many manual steps within your payroll process.

- What outcomes are important and how will you measure success? Being clear on your desired outcomes upfront is crucial to avoid wasting valuable time. For example, you may want to provide more flexible payment options for your employees, such as on-demand pay.

- Who are your main users? Consider your different user groups — power users, administrators, managers, employees, etc. — and their unique needs, to ensure they're all met. You'll need to evaluate if it'll just be your HR professionals, select accounting staff, or your entire finance and HR departments that need access.

- What is your budget? Determining a realistic budget for your new payroll system up-front is crucial, so you don't waste time considering software that's too expensive.

- Do you require specific software integrations? Clarify whether your new payroll platform will replace any existing tools or need to integrate with them, such as accounting, time-tracking, HR, or PEO software. Can you replace multiple tools with one consolidated HR and payroll platform?

- Does the payroll software satisfy your technical requirements? Consider the software selection alongside your existing workflows and operating systems. Evaluate what's working well, and any problem areas that need to be addressed.

Remember, every business is different — don’t assume that a payroll system will work for your organization just because it's popular. Instead, focus on your specific challenges and the features your new system will need to address them.

Trends in Payroll Software for 2025

When it comes to people management, nothing matters more than ensuring payroll runs smoothly. That’s why keeping up with payroll software trends is essential, not just for efficiency, but also to stay compliant and meet evolving employee expectations.

The latest trends are reshaping how HR teams manage payroll, address legal complexities, and deliver a better employee experience.

Here are five key developments to watch:

- AI-powered automation: Modern payroll tools use artificial intelligence (AI) to automate repetitive tasks, catch anomalies, flag compliance issues, and minimize costly errors. These smart systems streamline workflows and handle increasingly complex payroll regulations with greater accuracy.

- Global payroll management capabilities: As companies expand internationally, tools like Deel and Papaya Global offer seamless multi-country payroll, currency conversion, and compliance management in one platform.

- Stronger data security: With rising cybersecurity threats, payroll systems are reinforcing protections with features like two-factor authentication, encryption, and biometric login options to safeguard sensitive data.

- Mobile access: With remote and hybrid work here to stay, mobile-optimized payroll software ensures that both employees and HR teams can access key payroll features anytime, anywhere.

- Financial wellness integrations: Many platforms now offer features that help employees track income, plan finances, and access real-time pay insights, supporting both retention and financial well-being.

These trends reflect a growing focus on automation, security, global scalability, and employee empowerment—all essential for modern payroll management.

What is Payroll Software?

Payroll software is a digital tool that automates employee wage calculations, tax deductions, and direct deposits.

It helps HR and finance teams pay employees accurately and on time while staying compliant with tax laws.

Used by businesses of all sizes, payroll software reduces manual work, prevents costly errors, and simplifies complex payroll processes, saving time and ensuring peace of mind.

Features of Payroll Software

Modern payroll software comes packed with features designed to simplify the complex and time-sensitive task of paying your team. Whether you’re managing salaried employees, hourly workers, or a mix of both, payroll software automates calculations, ensures compliance, and keeps your processes running smoothly.

Here's a summary of the core features in today’s modern payroll systems:

- Automated payroll processing: The software must be able to process your employee’s pay, including automatically calculating wages, deductions, and taxes. This eliminates manual errors and saves time, making the process more efficient.

- Direct deposit: Pretty much all payroll software allows employers to pay their staff directly into their bank accounts. This eliminates paper-based processes and provides a better experience for employees and payroll staff.

- Tax compliance forms: Compliance requirements require payroll software to prepare year-end tax forms for employees, such as W2's or T4's.

- Customizable payroll reports: The ability to customize your payroll reports to track payroll taxes, employee deductions, and other expenses can help with budgeting and financial forecasting.

- Data management: Payroll software typically includes an employee database to store key details such as salaries or hourly rates, position levels, emergency contacts, social insurance numbers, and other employment details.

- Unique payment options: This might be unlimited payroll runs or pay-on-demand options to make payments between designated pay days.

- Time-tracking: Especially for hourly workers, having timesheets and scheduling built into your payroll system can really streamline your processes.

- Compensation management: This includes being able to track different pay rates (salary, hourly, overtime, vacation pay, PTO, etc.). It can also mean tracking salary increases over time.

- Self-service employee portals: These portals allow employees to proactively access and update their own personal information, access pay statements, and submit time off requests or expense reports. This is an important feature since it simultaneously empowers employees and reduces demands on your HR staff.

- Analytics: Dashboards, graphs, and reports to analyze payroll data to gather insights about your staff. These analytics support your organization’s workforce planning efforts.

These features work together to create a more efficient payroll process, reduce administrative overhead, and give your team greater confidence that payroll is being handled correctly—every time.

Benefits of Payroll Software

Payroll software offers several benefits for organizations as a whole, and for those who use the software regularly to manage payroll processes. As you're evaluating the different options for payroll software, understanding these main benefits is key to making an informed decision.

Payroll software delivers major advantages for both HR teams and the wider organization. If you’re comparing options, here are the several benefits to help guide your decision:

- Saves time and reduces costs: By automating time-consuming tasks like tax calculations, direct deposits, and timesheet processing, payroll software dramatically cuts down on manual work. This efficiency translates into labor cost savings and fewer errors across pay runs.

- Boosts compliance and accuracy: With built-in tax updates and automatic regulatory changes, cloud-based payroll tools help reduce the risk of costly compliance mistakes. You stay ahead of changing laws—without needing to track every update yourself.

- Protects sensitive data: Modern systems use encryption, secure storage, and role-based permissions to keep employee data safe. This is a significant upgrade from spreadsheets or paper records, helping you meet data protection standards with ease.

- Provides integrated reporting and insights: Many payroll tools connect with broader HR or finance systems, allowing you to generate reports on payroll, budgets, headcount, and more. These insights support smarter workforce planning and financial forecasting.

- Empowers employees with self-service tools: With employee portals, staff can view pay stubs, update personal details, and download tax forms on their own—cutting down on admin requests and improving the employee experience.

Together, these features help payroll software streamline complex processes, boost compliance, and make life easier for both payroll administrators and employees.

Costs & Pricing for Payroll Software

As you explore the different payroll options on the market, it's important to understand the full range of plans and pricing structures that are available.

Payroll software varies in price depending on the type of payroll services and features that are included. Often, you’ll pay a monthly base fee and an additional fee for every active employee on your payroll register.

To give you a general sense of what you can expect to pay for different payroll software packages, I've compiled the most common plan levels into this table:

Plan Comparison Table for Payroll Software

| Plan Type | Average Monthly Fee | Average Price per Employee | Common Features |

| Free | $0 | $0 | Basic payroll processing for a limited number of employees, basic tax calculation, and limited reports. |

| Basic | $10 - $25 per month | $2 - 4 per employee, per month | Payroll processing for a limited number of employees, basic tax filing, standard reports, employee self-service portal |

| Professional | $25 - $40 per month | $4 - $6 per employee, per month | Multi-state or province payroll, additional reports, HR features, compliance report + all the features in Basic. |

| Advanced | $40 - $60 per month | $5 - $8 per employee, per month | Customizable reports, advanced HR tools, integrations, enhanced security + all the features in Professional. |

| Enterprise | Custom pricing | Custom pricing | Scalable for a large number of employees, dedicated support, advanced analytics, custom integrations + all features in Advanced. |

| Global Payroll | Usually priced per employee | $199 - $500 per employee, per month | Ability to pay employees in multiple currencies, international direct deposit, international compliance monitoring, dedicated support + required Basic features or higher. |

In addition to the prices above, some payroll vendors may also charge a one-time set-up fee for complex software implementations.

If you only have a small number of employees, you can likely get started with a free or basic plan initially. However, there are several reasons why you may want to opt for a more advanced plan, including:

- Growth in Employee Numbers: As your company expands, your payroll processing needs will also increase. Advanced plans can handle higher volumes of payroll transactions and offer better tools for managing a larger workforce.

- Need for Additional Features: You may find you need more advanced payroll software that offers features like automated tax filings, direct deposit, benefits management, compliance tracking, and detailed financial reporting, which aren't included in your current plan.

- Increased Complexity in Payroll Requirements: If your business has complex payroll requirements (e.g., new employees in multiple states or countries) you might need software with more sophisticated capabilities to handle varying tax laws, regulations, and multi-currency payments.

- Enhanced Customer Support: More comprehensive plans often come with better customer support, including dedicated support teams, quicker response times, and more personalized assistance, giving you additional peace of mind.

- Integration with Other Systems: If your current payroll software or plan doesn't integrate seamlessly with the other systems your business uses (such as human resources management systems, accounting software, or time tracking tools), then it's time to find a better fit.

Ultimately, it's important to secure a plan that offers the features you need to serve your current needs and solve your challenges without exceeding your budget.

New & Noteworthy Product Updates

Below, I've summarized the most recent release notes and product updates for my top payroll software recommendations. Discover what’s now possible through new service improvements, software features, and other company updates, and why it matters for payroll software.

2025 Q3: Payroll Software Updates

Rippling Update Notes

Rippling recently added several new payroll features to make global payroll simpler, clearer, and easier to control.

The update adds an “entities” tab to track payroll readiness and a report to view all transactions by company or entity. Country upgrades include clearer pay statements and vacation tracking in Canada, auto-calculated taxes in Canada and the UK, automatic statutory pay handling in the UK, and bank-file funding in New Zealand.

These changes cut manual work and improve oversight. Companies get a single view of payroll readiness, cleaner reporting, and fewer errors in compliance. Regional improvements automate complex tasks, reduce admin time, and make payroll funding and filing smoother. The result is faster, safer payroll across multiple countries.

Verdict: This update delivers real value by cutting payroll complexity and boosting compliance.

Deel Update Notes

Deel has introduced three new features in its Global Payroll platform aimed at helping HR and payroll teams manage routine tasks with less effort and without needing outside assistance.

The release includes three key tools. Off-cycle payments, such as bonuses or corrections, can now be processed directly from the dashboard. A bulk termination option allows HR teams to off-board multiple employees at once through a template that captures essential details. And the new entity transfer function makes it possible to shift an employee between legal entities while preserving their data and contracts, with payroll updates happening automatically.

Together, these enhancements save time and cut down on manual processes. Off-cycle payments move faster, bulk terminations minimize paperwork and mistakes, and entity transfers maintain accurate records during organizational changes. For users, this means payroll runs more smoothly with less risk of compliance issues.

Verdict: This is a practical and valuable update that solves real challenges for HR and payroll professionals.

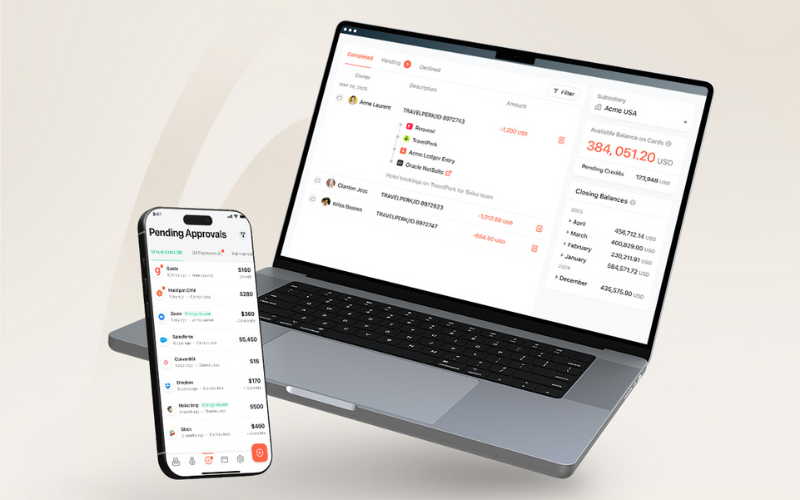

Paylocity Update Notes

Paylocity has launched Paylocity for Finance, expanding its human capital management platform into finance. The update brings integrated spend management, powered by Airbase, into the same system companies already use for payroll and HR.

The new solution adds five tools:

- automated accounts payable

- AI-driven expense reporting

- corporate cards with built-in controls

- guided procurement workflows, and

- headcount planning.

It connects directly with systems like NetSuite, QuickBooks, Microsoft Dynamics, and Sage Intacct to speed reconciliation and month-end close. A mobile version will also be available in fall 2025.

This release reduces the need for separate finance tools. It eliminates silos, automates routine work, and gives HR and finance teams shared visibility. For existing Paylocity users, it means running payroll and managing non-payroll spend in one place, with fewer manual processes and stronger control.

Verdict: This is a strong update that unifies HR, payroll, and finance in a way that reduces complexity and boosts efficiency.

Payroll Software Frequently Asked Questions

Do you have general questions about how payroll software works or how to choose the right system for you? Take a look through these answers to frequently asked questions to get yourself oriented.

What is same-day payroll?

Same-day payroll lets employees access their earned wages the same day you process them, rather than waiting until the traditional payday. This feature is especially popular with hourly workers or contractors who value immediate payment for completed work. To implement this, your payroll platform must partner with banks or third-party providers that support instant transfers and allow you to run off-cycle payrolls quickly.

Same day payroll helpful for attracting talent in competitive markets as it provides financial flexibility for staff. Before using same-day payroll, check if there are extra processing fees and ensure your timesheet approvals and data entry can happen on tight deadlines.

This type of payroll set up is also known as pay-on-demand, on-demand pay, or real-time pay. It rose to popularity during the COVID-19 pandemic as millions of workers suddenly needed access to their earnings in order to cover their basic household expenses.

What's the difference between cloud-based and on-premise payroll software?

Cloud-based payroll systems run online and don’t require you to install anything locally. This gives you and your team access from any device, supports automatic software updates, and offers vendor-managed data security. You pay a subscription, and there’s usually quicker setup.

On-premise software, installed on your own servers, lets you control updates and security yourself but can be costly and less flexible, since upgrades, backups, and support fall on your IT team. Most growing companies now choose cloud payroll because it scales easily, supports distributed teams, and minimizes downtime. However, on-premise payroll software may be a better fit for organizations with strict data control policies and large in-house IT teams (such as government agencies).

Tip: If your company runs on Macs, look for cloud-based payroll software compatible with macOS.

What data security features are included in payroll software?

Top-tier payroll solutions encrypt data both in transit and at rest, use multi-factor authentication (MFA), have granular role-based access control (RBAC) and permissions, and perform regular vulnerability scans. You’ll want audit logs to see who accessed or changed payroll details. Good vendors also comply with standards like GDPR, SOC 2, or ISO 27001.

For best results, review permissions on a regular schedule and require strong password policies. Ask your provider if they offer single sign-on (SSO) integration and how they handle security breaches or attempted logins from unknown IP addresses.

Payroll software houses a lot of personal identifying information (PII), including your employees’ names, addresses, contact information, social security or SIN numbers, and personal bank accounts so robust security features are essential.

What compliance monitoring features are built into payroll software?

Payroll software often includes automatic tax table updates, flagging of errors in wage or tax calculation, and alerts for approaching filing deadlines. Many platforms can identify missing employee data, track required documentation (like I-9s or W-4s), and help monitor overtime compliance. Some offer built-in checks for minimum wage, benefits eligibility, or automatically generate government reports (e.g., 941s, W-2s).

For HR professionals, these features reduce audit risks and make it easier to onboard employees or expand into new regions without missing compliance steps. They also work together to automate compliance requirements, saving you time and stress.

Can payroll software handle multiple currencies for global teams?

Yes, many payroll platforms now support multi-currency payroll, letting you pay employees and contractors in different countries in their local currency. The software should calculate currency conversions, track exchange rates, and handle differing local tax regulations automatically.

For example, you might pay a UK employee in GBP and a Canadian one in CAD, with the platform handling tax calculations and deadlines for each country. Be sure to check if the software covers all your target countries, and whether it can generate country-specific reports and filings.

Global payroll features are essential for businesses wanting to expand globally as they help companies ensure their payroll operations are compliant and efficient across various jurisdictions.

How can I ensure a smooth transition to new payroll software?

To transition smoothly, follow this process:

- Start with a clear timeline and map out your current payroll processes.

- Gather accurate employee and tax data and check for discrepancies before migration.

- Choose a payroll provider with strong onboarding and migration support, and request staff training workshops.

- Run parallel payrolls for at least a month to catch any issues without affecting pay.

- Assign an internal project lead and communicate with all stakeholders about the go-live date and changes to expect.

- Keep your legacy system active as a backup during your first cycles.

What are common payroll software implementation challenges?

Challenges include data migration errors, overlooked or misconfigured integrations, and resistance from staff used to old processes. It’s common for permissions to be set incorrectly, resulting in unauthorized access or missed payroll runs.

To avoid these issues, double-check imported data, run test payrolls, and invest in staff training. Get stakeholder buy-in early and create clear documentation on the new processes. Keep IT and HR involved throughout, and set up vendor support for go-live day and the first few payroll cycles.

How often should I update or audit payroll system permissions?

Review your payroll software permissions quarterly and immediately after staff changes, promotions, or departures. Removing old user accounts right away helps prevent accidental or malicious access.

For stricter oversight, enable alerts for suspicious activity, such as payroll edits outside normal hours. Include audits as part of routine compliance checks and when preparing for third-party audits. Restrict admin-level access to only those who absolutely need it—typically, just key HR or finance personnel.

What reporting capabilities should I expect from payroll software?

Modern payroll systems offer standard reports like pay registers, deductions, benefits tracking, and tax liability summaries. Look for custom reporting tools that let you filter by department, location, or pay type.

Robust payroll software should also provide dashboards for overtime, turnover, and labor cost analysis, helping you spot patterns and budgets more accurately.

The best solutions allow you to schedule regular exports to Excel, PDF, or even integrate reports with your BI tools—making payroll insights easy to share with leadership.

What integrations are the most important for payroll software?

Key integrations for payroll software include your HRIS (for employee data sync), time and attendance tracking (to automate wage calculations), accounting software (for simplified reconciliation), and benefits management platforms. If your workflow involves expense reimbursement, shift scheduling, or compliance management, make sure those systems connect as well.

Good integrations eliminate double entry, reduce manual data errors, and improve audit trails. Here are several detailed examples, speaking from my own experience:

- HR Management Systems (HRIS/HRMS/HCM): If your payroll software is separate from your HR system, you’ll want to sync employee data like salary changes automatically so updates flow directly from HR to payroll without duplication.

- Time Tracking Tools: Seamless integration with timesheets is essential. Without it, you’ll spend hours manually reconciling hours worked before each payroll run—trust me, I’ve been there!

- Benefits Administration Software: Connect benefit deductions to payroll to reflect changes in real-time and avoid manual cross-checking. (I’ve also experienced a world without this integration, and wow, it was painful.)

- Expense Reporting Software: If your team files frequent reimbursements, this integration streamlines adding them to payroll, saving time and avoiding errors.

These integrations help eliminate repetitive tasks and reduce the risk of payroll errors caused by disconnected systems.

How do payroll systems support remote or hybrid teams?

Payroll platforms support remote or hybrid teams by offering cloud access for approvals, data entry, and reporting from any location. Employees can enter hours or update details via mobile apps or online portals, speeding up payroll cycles.

The software can account for varying tax jurisdictions based on employee addresses and sometimes automate location-based compliance. Integration with attendance apps helps accurately track in-office versus remote work, and some platforms offer geofencing or IP monitoring to further validate entries by remote staff.

What are PEO payroll services?

PEO payroll services are offered by Professional Employer Organizations (PEOs) that manage payroll processing, tax filings, and compliance for businesses by acting as a co-employer.

They handle employee wages, deductions, and benefits, reducing the administrative burden on businesses. This allows companies to focus on core activities while ensuring payroll accuracy and compliance with labor laws.

Additional Payroll Software Reviews

Want to check out our other reviews related to payroll software? Here are a few more:

- Automated Payroll Software

- Payroll Software for CAD Businesses

- Payroll Services for Small Businesses

- Free Payroll Software

- Payroll Software for Contractors

- Payroll Software for Construction

Modernize Your Payroll Process

There are plenty of payroll software options available, and each one is a bit different from the next. That's why understanding the core functionality of these platforms equips you to pick the right one for your business needs.

Invest in advanced payroll software that satisfies all your business needs, including compensation and salary benchmarking features.

Stay in Touch

Before you go, stay in touch by subscribing to our People Managing People newsletter. We cover everything from how to master your payroll challenges, to how to develop modern compensation packages to retain your top talent. Plus, it's delivered to your inbox for free each week.