Payroll tax and income tax are both types of taxes imposed by authorities, but they differ in several key aspects.

Ensuring you understand the difference between the two is crucial when the time comes to process payroll. Failure to calculate either correctly will result in unhappy employees and unhappy tax authorities!

Here I’ll take you through what each tax is, what the key differences are, and how each is calculated.

What Is The Difference Between Payroll Tax And Income Tax?

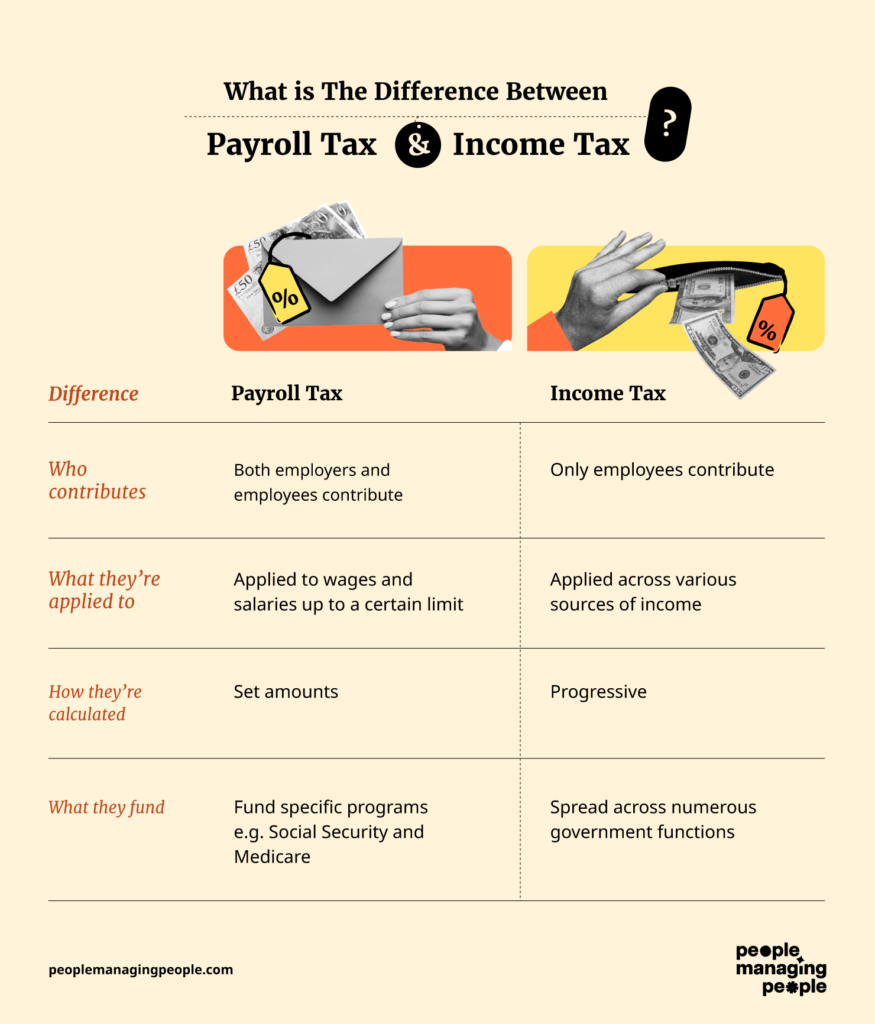

The main differences between payroll and income tax are who contributes, what they’re applied to, how they’re calculated, and what they fund. For example, payroll taxes are contributed to by both the organization and the employee, while income taxes are levied on employees only.

Payroll taxes are also calculated as a fixed percentage of gross salary whereas income tax is progressive and incorporates multiple income sources.

Whereas payroll taxes are allocated to specific programs, income taxes are put towards a multitude of government programs.

I’ll now delve a bit deeper into each tax type.

What Are Payroll Taxes?

In the U.S., payroll taxes are levied on both employees and employers to fund specific federal and state programs:

- FICA taxes (Social Security and Medicare taxes)

- Federal Unemployment Tax Act (FUTA)

- State Unemployment Tax Act (SUTA).

These are applied to employee’s wages up to a certain limit.

As of 2024, the Social Security tax applies to wages up to $168,000, while the Medicare tax has no income cap.

What are the payroll tax rates?

The Social Security tax rate is 6.2% for both employees and employers (12.4% total).

The Medicare tax rate is 1.45% for employees and employers each (2.9% total). Additional Medicare taxes may apply to higher-income individuals.

The FUTA tax rate is 6% on the first $7,000 of wages paid to each employee in a calendar year (maximum $420). However, employers may receive a credit of up to 5.4% for paying state unemployment taxes, resulting in a net FUTA tax rate of 0.6%.

SUTA tax rates and wage bases vary by state and are subject to state-specific regulations.

What do payroll taxes fund?

In the U.S., Social Security and Medicare taxes fund specific government programs. Social Security taxes primarily support retirement, disability, and survivorship benefits, while Medicare taxes fund the Medicare health insurance program for seniors and certain disabled individuals.

How to calculate payroll taxes example

Payroll taxes are relatively straightforward to calculate. All you have to do is calculate how much is owed as a percentage of the employee’s gross salary.

For example, if an employee earns $60,000 a year and is paid monthly at $5,000, then the monthly contributions would be as follows:

- Social security (12.4%): $620 split 50/50 between employee and employer

- Medicare (2.9%): $145 split 50/50 between employee and employer

- FUTA (6%): $300 paid by employer

- SUTA (2.8%): $140 paid by the employer.

Total to paid by employee: $310 + $72.50 = $382.5 0

Total paid by the employer: $310 + $72.50 + $300 + $140 = $822.50

What Are Income Taxes?

Income taxes are taxes levied by governments on the income earned by individuals, businesses, and other entities within their jurisdiction. These taxes are typically based on various sources of income, including wages, salaries, interest, dividends, capital gains, rental income, and business profits.

The tax rates are calculated by organizations based on income levels and filing status. Individuals are responsible for filing income tax returns annually and paying any taxes owed directly to the government.

What are the income tax rates?

U.S. income tax rates are progressive, meaning they increase with income. As of 2024, there are seven tax brackets ranging from 10% to 37%, with tax rates applied to different income ranges.

The tax code also includes deductions, credits, and exemptions that can affect the amount of tax owed.

What do income taxes fund?

Income tax revenue in the U.S. contributes to funding various government functions, including national defense, healthcare programs, education, infrastructure, and social welfare programs.

How to calculate income tax

Calculating income taxes is slightly more complex involving several steps. Here's a general overview of how to calculate federal income tax:

1. Obtain Form W-4 from the employee

Require each employee to fill out Form W-4, Employee's Withholding Certificate, upon hiring or whenever their tax situation changes. This form provides information about the employee's filing status, allowances, and additional withholding preferences.

2. Determine filing status and allowances

Review the information provided by the employee on Form W-4 to determine their filing status and the number of allowances claimed. The more allowances claimed, the less federal income tax will be withheld from the employee's paycheck.

3. Use IRS Publication 15 (Circular E)

Refer to IRS Publication 15 (Circular E), Employer's Tax Guide, provided by the Internal Revenue Service (IRS).

This publication contains the federal income tax withholding tables and instructions for calculating withholding amounts based on employee wages, filing status, pay frequency, and withholding allowances.

4. Consult IRS withholding tables

Use the appropriate withholding tables from IRS Publication 15 to calculate the federal income tax withholding amount based on the employee's filing status, pay frequency (e.g., weekly, biweekly, monthly), and wages.

For example, continuing the above example of an employee with a $60,000 a year salary paid monthly, then the calculation would look like this:

- 10% of the first $11,600 = $1,600

- 12% of $11,601 - $47,150 = $4,266

- 22% of $47,150 - $60,000 = $2,827

- Total yearly = $8,693

- Total monthly = $724.42

5. Apply percentage method if applicable

If an employee's wages exceed the highest wage bracket in the withholding tables, use the percentage method to calculate withholding. This involves applying a flat percentage to the excess amount over the highest bracket.

6. Account for additional withholding requests

Consider any additional federal income tax withholding requested by the employee on Form W-4. Employees can specify an additional dollar amount to be withheld from each paycheck if they anticipate owing more taxes or want to ensure sufficient withholding.

7. Calculate withholding amount

Calculate the federal income tax withholding amount for each pay period based on the information gathered from Form W-4 and IRS withholding tables. Deduct this amount from the employee's gross wages before issuing the paycheck.

8. Remit withheld taxes to IRS

Withhold the calculated federal income tax amount from each employee's paycheck and remit these taxes to the IRS on a regular basis according to the deposit schedule determined by the size of your payroll and tax liability.

9. Keep records

Maintain accurate records of federal income tax withholdings for each employee, including pay stubs and payroll reports, to support tax reporting and compliance.

Best Practices For Handling Payroll And Income Taxes

With so many components, managing payroll taxes can feel daunting. Here's how to keep things streamlined:

- Maintain up-to-date employee records: Maintain accurate records of employee compensation and keep records of tax withholdings, including federal income tax, Social Security tax, Medicare tax, and any state or local taxes. All employees must fill out their Form W-4 for paying income tax.

- Staying updated with regulations: Tax laws evolve. It's your responsibility to stay updated with the latest changes and ensure your processes align. In the U.S., The IRS website is a natural starting point.

- Make use of payroll software: Modern payroll software can automate calculations and help you remain compliant. It's an investment that often pays off in saved time and reduced errors. To help, here’s our pick of the best payroll software.

- Regular audits: Frequently reviewing your processes can help catch and rectify mistakes early. Regular checks ensure everything runs smoothly.

Some organizations choose to outsource certain functions such as payroll to professional services such as payroll companies or professional employer organizations that help ensure accuracy and compliance.

Payroll Knowledge Is Useful

Whether you choose to run payroll yourself or not, a working knowledge of how payroll works and the different payroll taxes and regulations is always helpful.

Hopefully this guide has helped you to you the difference between payroll and income tax. For further recourses, check out our articles on payroll deductions and certified payroll.

You can also subscribe to the People Managing People Newsletter, a weekly feed of our latest articles, podcasts, resources, and inspiration.

FAQs

Is payroll tax flat or progressive?

Payroll taxes can be considered regressive in some respects, but it depends on the specific context and how you analyze them.

In many countries, including the United States, payroll taxes are often considered regressive because they are levied at a flat rate up to a certain income threshold. This means that everyone pays the same percentage of their income up to that threshold, regardless of how much they earn. However, once an individual’s income exceeds the threshold, they may no longer pay payroll taxes on additional income, effectively making the tax rate lower for higher earners.

For example, in the United States, Social Security taxes (which are part of payroll taxes) are levied at a flat rate up to a certain income limit, after which no additional Social Security taxes are collected. This creates a situation where lower-income individuals may end up paying a higher percentage of their income in Social Security taxes compared to higher-income individuals.

So, while payroll taxes are typically flat up to a certain income threshold, they can be considered regressive because they disproportionately affect lower-income earners. However, it’s essential to note that this characterization may vary depending on the specific design of the tax system and the definitions used.

Is payroll tax income tax?

Payroll tax and income tax are two distinct types of taxes.

Payroll tax is a tax that employers withhold from their employees’ wages or salaries. It is based on a percentage of the employee’s income and is used to fund programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are typically paid by both the employer and the employee.

Income tax, on the other hand, is a tax levied on an individual’s or entity’s income. It applies to various sources of income, such as wages, salaries, interest, dividends, and capital gains. Income tax rates can be progressive, meaning they increase as income rises, or flat, meaning they remain the same regardless of income level.

While both payroll tax and income tax are based on income, they are administered differently and serve different purposes within the tax system.

What taxes are considered payroll tax?

Payroll taxes typically include taxes withheld from an employee’s wages or salary by an employer. These taxes are often used to fund social programs such as Social Security, Medicare, and unemployment insurance. Common types of taxes considered as payroll taxes include:

Social Security tax (FICA): This tax funds the Social Security program, which provides retirement, disability, and survivor benefits to eligible individuals.

Medicare tax: This tax funds the Medicare program, which provides health insurance for people aged 65 and older, as well as certain younger individuals with disabilities.

Federal Income Tax withholding: Employers may also withhold federal income tax from employees’ paychecks based on the employee’s W-4 form, which indicates the amount of tax to withhold.

State Income Tax withholding: Some states require employers to withhold state income tax from employees’ paychecks, depending on the state’s tax laws.

Local Income Tax withholding: In certain areas, local governments may impose income taxes, which employers are required to withhold from employees’ paychecks.

These are the primary types of taxes considered as payroll taxes in many jurisdictions. The specific taxes withheld may vary depending on the laws and regulations of the country, state, or locality in which the individual works.

Is payroll tax the same as withholding?

No, payroll tax and withholding are not the same, although withholding is a component of payroll taxes.

Payroll tax refers to the taxes that employers are required to withhold from their employees’ wages or salaries and remit to the appropriate government agencies. These taxes typically include Social Security tax, Medicare tax, federal income tax, and sometimes state and local income taxes.

Withholding, on the other hand, specifically refers to the process by which employers withhold a portion of their employees’ earnings to cover various taxes, including federal and state income taxes, as well as payroll taxes like Social Security and Medicare taxes. Withholding ensures that employees’ tax obligations are met throughout the year, rather than having to pay a large lump sum at tax time.

In summary, while withholding is a method used to collect payroll taxes, payroll tax encompasses a broader range of taxes withheld from employees’ wages or salaries.