As a benefits professional, I see the impact benefits can have on people’s lives and how they're powerful drivers of employee retention and recruitment.

Keep reading to learn what employee benefits are, why they’re important, the different types of employee benefits, and how to develop your benefits package.

What Are Employee Benefits?

Employee benefits are forms of non-salary/non-wage compensation an employer offers employees in addition to their regular financial compensation.

Benefits are stipulated in the employment contract and may be renegotiated and updated, making them a powerful employee retention tool.

Why Are Employee Benefits Important?

According to the Bureau of Labor Statistics (BLS), employee benefits for private industry workers averaged $12.77 per hour worked in December 2023. This works out to 29.6% of total compensation ($43.11 per hour).

Benefits packages are a significant cost to organizations, so why offer them?

Employee benefits are important for:

- Attracting and retaining talent: Competitive benefits packages make an organization more attractive to potential employees. They also help retain existing employees, reducing turnover and the associated costs of hiring and training new staff.

- Compliance: As we’ll discuss in more detail below, some employee benefits are required by federal or state law.

- Health and wellness support: Benefits such as health insurance, mental health services, and wellness programs can help support employees' overall health and well-being. This can lead to reduced absenteeism and increased productivity.

- Diversity and inclusion: Tailoring benefits to meet the diverse needs of a varied workforce can foster a more inclusive and equitable workplace, which is increasingly important in a global market.

Now we've covered why employee benefits are important, let’s take a closer look at the main types of employee benefits with some examples of what these look like in practice.

Types Of Employee Benefits

Broadly speaking, there are seven primary types of employee benefits:

- Benefits that are required by federal/national or state law

- Medical insurance

- Life insurance

- Retirement plans

- Disability insurance

- Paid time off

- Fringe benefits.

Type 1: Employee Benefits Required by Federal Law (in the U.S.)

The following types of employee benefits are standardized across industries and states. This means that organizations must offer them to their employees to remain compliant with U.S. labor laws.

Keep in mind that labor laws may vary slightly by state. While this list serves as a field guide to the various types of federally-enforced employee benefits programs, we advise you to consult a labor lawyer when constructing your employee benefits packages.

Social Security and Medicare contributions

Social Security and Medicare contributions are long-term employee benefits to which both employees and employers contribute.

- The U.S. Social Security Administration’s Old-Age, Survivors, and Disability Insurance (OASDI) program limits the percentage of an employee’s earnings that are subject to taxation for a given year.

- The OASDI tax withholding rate is 6.2% for both employees and employers, of taxable max of $160,200 (in 2023), while the self-employed pay 12.4 percent. The max will increase to 168,600 in 2024

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employees whose wages exceed $200,000 are subject to an additional 0.9% Medicare Tax. Employers also pay a 1.45% tax on their employee's wages. They do not pay the additional tax.

Health insurance

Under the Affordable Care Act (ACA), applicable large employers (ALE) are required to provide affordable minimum essential health insurance to full-time employees and their dependents.

To meet the definition of an ALE you must have 50 or more full-time employees (including full-time-equivalent employees) during the prior calendar year. ACA defines full-time employees as anyone having worked an average of 30 hours a week or 130 hours a month.

Time off and leave entitlements

Mandatory time off and leave of absence programs are regulated by federal, state, and local laws and provide employees with job-protected time away from work.

- Federal laws:

- The Family Medical Leave Act (FMLA), provides eligible or covered employers with up to 12 weeks of unpaid job-protected leave for qualifying family and medical reasons as well as reasons related to Military service.

- State/local laws:

- In addition to federal laws, some states and municipalities also have their own leave and time off mandates employers must comply with.

While leave and time off entitlements vary by location some common mandated leave and time off types include.

- Jury Duty Leave

- Military Leave

- Voting Leave

- Victims Leave

- Caregiver Leave

- Paid Sick Time Off

- Personal Paid Time Off

Disability insurance

Disability insurance provides income protection for employees who are unable to work due to a non-work-related illness, injury, or pregnancy.

While disability insurance is not a federal requirement, it is legally required in select states and U.S. territories:

- California

- Hawaii

- New Jersey

- New York

- Puerto Rico

- Rhode Island.

Because disability insurance is not required in all states, most employers offer a company policy to ensure coverage for all employees.

Workers' compensation insurance

Workers' compensation insurance (also known as “workers’ comp”) is a mandatory benefit that provides employees with income protection and medical cover in the event of illness or injury resulting from their work.

Unemployment compensation contributions

Similar to Workers’ Comp insurance, unemployment insurance seeks to provide employees with a safety net.

Employers contribute to an unemployment trust fund in accordance with a combination of federal and state laws, regardless of whether the employee is part-time or full-time.

Employees who become involuntarily unemployed may be eligible for partial income replacement for a limited period.

Type 2: Medical insurance

It’s industry standard for most organizations to provide medical insurance, however there’s no real standard here.

While employers with more than 50 full-time employees must offer health insurance coverage, dental and vision insurance plans are not legally required.

As a standard, health insurance plans typically only offer basic vision and dental services for children under the age of 18 years as mandated by the Affordable Care Act.

To offset gaps in coverage, it is best practice for employers to offer dental and vision insurance as a supplement to the health insurance offering.

Below, we’ll briefly describe each type of insurance and what they typically cover. Keep in mind that the specifics will vary from insurance provider to provider.

Health insurance

Health insurance plans cover general healthcare costs, such as:

- Hospital accommodation

- Emergency ambulance fees

- Annual physicals

- Doctor’s fees

- Pregnancy and maternity care

- Antibiotics for minor infections like ear infections and strep throat

- Setting broken bones

- Prescriptions

- Laboratory services.

Coverage for each type of care can vary significantly by the insurance provider, network, and healthcare provider/institution. As such, it’s important to provide employees with detailed information about their options so they can make an informed decision.

Vision insurance

Vision insurance covers medical benefits related to eyesight, including

- Annual eye tests

- Contributions toward prescription spectacles or contact lenses

- Medically-necessary (non-elective) eye surgery.

Dental insurance

Dental insurance covers dental care costs, such as:

- Preventative care (routine exams, cleanings)

- Tooth extractions

- Restorative care (fillings, root canals, crowns, etc).

- Gum disease treatment

- Orthodontic care (braces, retainers, jaw surgery, etc.)

- Cosmetic dentistry (tooth whitening, implants, etc.).

The extent to which specific dental procedures are covered will vary from plan to plan.

Health savings account and health reimbursement account

Healthcare is expensive and offering a health savings account (HSA) and/or a health reimbursement account (HRA) to your employees can better prepare them to pay for out-of-pocket health expenses when needed.

HSAs allow employees to put pre-tax funds aside to cover qualified health expenses such as medical, dental, vision, and prescription care costs. What’s great about this benefit is the triple tax advantage.

- Contributions go into the HSA tax-free

- Employees can invest that money and enjoy tax-free growth potential

- Withdrawals for qualified health expenses don’t incur taxes

Flexible spending accounts

Similar to an HSA, flexible spending accounts (FSA) allow employees to set tax-free money aside to cover qualified expenses.

There are three types of FSAs, Dependent Care FSA, Health FSA, and Limited Purpose FSA.

- Health FSA allows employees to put pre-tax funds aside to cover medical, dental, and vision expenses.

- Offered because HSA eligibility is tied to employees enrolling in your company's High deductible health plan so there are employees who won’t be able to participate.

- Limited Purpose FSA allows employees to put pre-tax funds aside to cover dental and vision expenses only. This plan is only available to employees enrolled in your company’s High Deductible Health Plan and HSA benefits.

- Dependent Care FSA allows you to put pre-tax funds aside to cover dependent care expenses for children 13 and under (i.e. daycare, summer camp, nannies) as well as adult care for a spouse or a dependent who is incapable of self-care (covers services such as elder care and in-home aids).

Type 3: Life insurance

Another common employee benefit type is life insurance. There are a few options here depending on who you want to offer this benefit to:

- Group term life insurance: This is the most common type of life insurance offered by employers. It provides coverage for a set period (the term) and typically offers a death benefit to the employee's beneficiaries if the employee dies during that term. The premiums are often lower compared to individual policies, and sometimes the employer may cover the full cost.

- Whole life insurance: Less common in employee benefit packages, whole life insurance covers the employee for their entire life, not just a set term. Premiums are usually higher than term life insurance, but the policy builds cash value over time, which the employee can borrow against.

- Universal life insurance: This is a more flexible form of life insurance that combines elements of term life and whole life insurance. It provides a death benefit and also accumulates cash value, but offers more flexibility in terms of premium payments and the death benefit amount.

- Voluntary/supplemental life insurance: Employers may offer employees the option to purchase additional life insurance through a group plan. This is often at a lower cost than if the employee bought it individually. The employee pays the premium, but benefits from the group rate.

- Accidental death and dismemberment (AD&D) insurance: This is often offered alongside life insurance policies. It provides benefits if the employee dies or is seriously injured in an accident.

- Executive or key person life insurance: This is a life insurance policy that a company purchases on the life of a key executive or employee. The company is the beneficiary and pays the premiums. This is used to protect the company against the financial loss that would result from the death of a key individual.

- Portable life insurance policies: Some employers offer life insurance policies that employees can keep even after leaving the company. This is a desirable option for employees, as it provides them with continuous coverage regardless of their employment status.

Type 4: Retirement plans

Many organizations offer contributions toward employees’ retirement as an employee benefit.

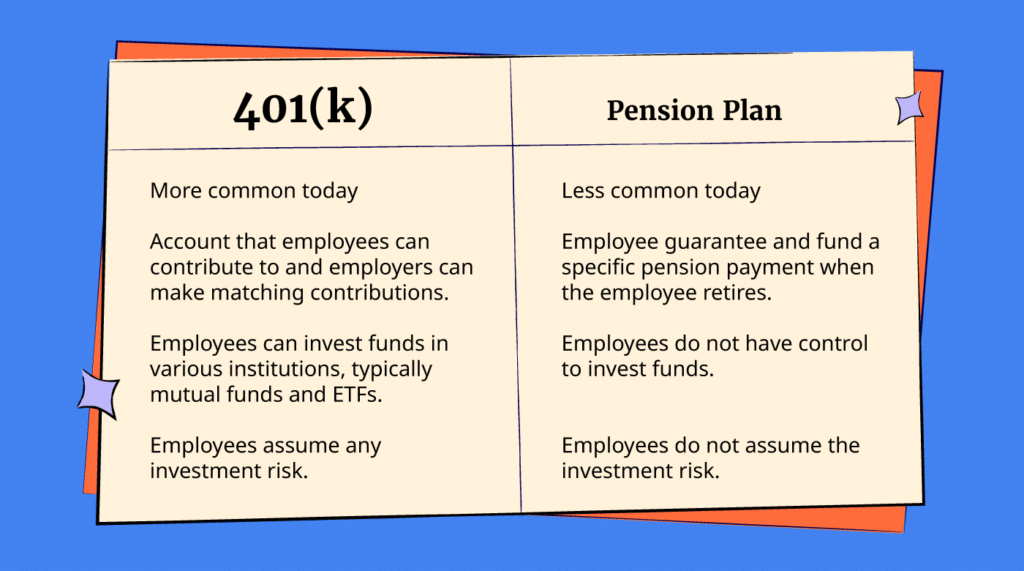

There are two main mechanisms for this, namely pension plans and 401(k) programs. While some companies still offer pension plans, 401(k) plans are by far the more popular retirement planning option today.

Quick facts:

- A 401(k) fund is a tax-advantaged retirement savings plan with automatic deductions from the employee’s paycheck.

- A 401(k) match means that the employer matches the employee’s contributions either partially or fully.

- 401(k) funds are generally less expensive than other retirement plans

- Employees have more control over fund contributions with a 401(k) than with a pension

- Employers are not required to contribute to their employees’ 401(k) plans

- Pension plans often have rules about which employees are eligible based on tenure.

Whichever option you decide to go with, most job seekers expect contributions to their retirement savings as an employee benefit.

Type 5: Disability insurance

As mentioned earlier, disability insurance isn’t required federally but it is in 5 U.S. states.

However, it’s common for employers to offer either short or long-term disability insurance.

Short-term disability insurance (STD)

- Coverage: STD typically covers a portion of the employee's salary if they are temporarily unable to work due to illness, injury, or pregnancy.

- Duration: The coverage usually lasts for a short period, ranging from a few weeks to several months, though the exact duration varies by policy.

- Waiting period: There's often a short waiting period (like a week) after the employee becomes disabled and before benefits start.

- Benefit amount: Benefits usually range from 50% to 70% of the employee's regular income.

- Purpose: It's designed to help employees manage their expenses during short-term absences from work due to health-related issues.

Long-term disability insurance (LTD)

- Coverage: LTD provides income protection for employees who are unable to work for a longer period due to a serious illness or injury.

- Duration: This coverage typically kicks in after the short-term disability insurance expires and can last for several years or until the employee reaches retirement age, depending on the policy.

- Waiting period: The waiting period for LTD benefits is usually longer than for STD, often several months.

- Benefit amount: Like STD, LTD benefits generally range from 50% to 70% of the employee's regular income, though this can vary.

- Purpose: LTD is crucial for providing financial stability to employees who face long-term health challenges preventing them from working.

Type 6: Paid time off

Whether it’s offering more paid vacation time or paid sick leave days, paid time off (PTO) is one of the most widely occurring types of employee benefits.

Some of the types of paid time off include:

- National holidays and religious observances

- Vacation days

- Sick leave

- Mental health or personal leave days

- Volunteering or service days.

Some organizations are doing away with the distinction between sick leave and other types of time off altogether, and unlimited PTO is becoming increasingly commonplace.

While paid time off is not federally mandated, employers in some states are required to provide paid sick time off and are also liable to pay out the monetary value of accrued/unclaimed PTO in when an employee quits or retires.

Type 7: Fringe benefits

Fringe benefits are less mainstream employee benefits that help companies differentiate themselves from other employers.

Supplemental Income Protection

While this varies from company to company, voluntary supplemental income protection plans have become popular when attracting and retaining your talent.

Not only is this low cost and easy to administer from an employer perspective but it can be life-saving for employees during the most difficult times.

There are a variety of income protection plans but some of the most popular offerings are:

- Hospital Indemnity. Hospital Insurance helps covered employees and their families cope with the financial impacts of a hospitalization. Employees can receive benefits when they’re admitted to the hospital for a covered accident, illness, or childbirth.

- Critical Illness. If your employee is diagnosed with an illness that is covered by this Critical Illness insurance, they can receive a lump sum benefit payment. They can use the money however they want (i.e. to pay for bills, out-of-pocket medical bills, etc).

- Accident Insurance. Accident Insurance can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It covers accidents that occur on and off the job. And it includes a range of incidents, from common injuries to more serious events.

Work flexibility

In part thanks to the pandemic, remote and hybrid work have become mainstream, and employees and jobseekers increasingly expect flexibility in terms of either where or when they work—or both.

A 2021 EY survey of more than 16,000 employees from 16 countries, and various industries and roles, found that 54% of workers would consider changing jobs if they weren’t afforded flexibility in terms of location and/or hours worked.

Which type of flexibility is more important? A 2021 FutureForum survey found that 76% of employees want location flexibility, while 93% want flexible working hours.

Home office setup

If you do offer employees the option to work remotely, you might consider creating a benefits package that helps employees get their home office set up.

For instance, you might allocate each employee a budget for an ergonomic chair, desktop monitor, video conferencing equipment, and other home office essentials.

Employee stock options

Offering employee stock options (ESOs) that give employees the right to purchase the company’s stock at a set price has become a popular employee benefit in recent years.

Stock options and other profit share schemes can be an effective way to get employees to invest in the company—mentally as well as in the literal sense—seeing as they create a direct link between the employee’s performance and the company’s success.

This type of benefit also encourages employees to stay with the company longer.

Tuition Reimbursement

Offering tuition reimbursement, assistance with student loan repayment, or subsidizing or sponsoring further education is an increasingly popular fringe employee benefit.

It makes sense that this type of benefit would appeal to jobseekers when you consider the fact that more than 46 million people in the U.S. carry student loan debt amounting to some $1.75 trillion and 81% of surveyed individuals report delaying key life milestones as a result of student debt.

Education and professional development opportunities

Investing in your employees’ development not only fosters loyalty but also empowers employees to unlock additional value in their role and career with your organization.

Some ways of doing this include budgeting for learning stipends and/or dedicated time allocated for personal and professional development.

You can also offer employees access to online courses, workshops, and other forms of training, or even offer subsidies for higher learning.

Financial literacy programs

Employer-driven financial literacy programs are a great way to combine employee education opportunities with initiatives to empower employees by lessening their financial stress.

From budgeting skills to navigating taxes to learning the fundamentals of investing, most people want to make the most of their finances and could benefit from dedicated training programs.

Employee wellness programs

As employees increasingly strive for better work-life balance, many organizations are implementing employee wellness initiatives that encourage employees to make healthy choices.

Examples include

- On-site gyms

- Healthy snacks or catered food options

- In-office yoga and/or meditation sessions

- Subsidized or free gym memberships

- Free consultations with personal trainers, nutritionists, mental health professionals, etc.

- Company-sponsored massages and other stress-relieving activities

- Health challenges that reward employees for healthy choices

- Volunteer days.

Of course, encouraging healthy habits, both physical and mental, means healthier employees who take fewer sick days.

Mental wellness benefits

If the pandemic taught us anything, it’s that there is a much greater need for mental health support in the workplace than anyone had previously realized.

In response, a growing number of organizations are offering mental wellness benefits such as company-sponsored therapy sessions, as well as subscriptions to meditation and therapy apps such as Headspace and Betterhelp.

Relocation and Housing benefits

Some companies—especially those located in “talent deserts”—offer relocation allowances and assistance or even housing benefits. These can be an effective means of enticing new recruits to join the company.

Childcare solutions

Childcare can be a significant expense for parents in the workforce, prompting some employers to offer childcare solutions such as subsidies or on-site daycares as a fringe benefit.

Some 50 million American workers (about a third of the U.S. workforce) have a child under the age of 14 in their household.

Helping parents offset the high costs associated with childcare can encourage parents to return to, or remain at, work and reduce absenteeism.

Some companies are even offering assistance with fertility treatments, adoption procedures, and abortion assistance.

Benefits Of Employee Benefits

Besides legal compliance, what are some potential benefits of offering benefits to employees?

- Attracts talent. Offering a competitive benefits package is essential for attracting top talent as many consider benefits a critical part of their total compensation.

- Boosts employee retention. Benefits contribute to job satisfaction and loyalty, encouraging employees to stay longer with their employer.

- Enhances productivity. Health and wellness-focused benefits can lead to a healthier workforce that is typically more productive due to fewer sick days and better overall performance.

- Provides tax advantages. Certain benefits may offer tax advantages for both employers and employees, such as deductions for retirement plan contributions and pre-tax health benefits.

Potential Drawbacks Of Employee Benefits

While employee plans are largely advantageous to organizations and workers, there are some potential drawbacks to be aware of.

Risk of dependency

Employees may become overly dependent on employer-provided benefits such as health insurance or retirement savings plans. This dependency can make it difficult for employees to change jobs or retire which can lead to employees staying longer than they really should.

Perceived inequality

Offering different levels of benefits to different groups of employees (e.g., full-time vs. part-time) can lead to perceived or real inequities within the workplace, affecting morale and teamwork.

Potential for abuse

Certain benefits, like sick leave or flexible working arrangements, might be susceptible to abuse by a small number of employees. This abuse can lead to additional costs and potentially create resentment among other employees.

Employee Benefits Best Practices

Developing your benefits package is no mean undertaking. As with most projects employee-related, it’s good practice to delve into the data and get their input as much as you can.

Follow these best practices to develop a competitive benefits package that’s right for your organization.

Use employee feedback to cater benefits to your workforce

Using employee feedback to tailor benefits to the workforce is a strategic approach that can significantly enhance job satisfaction and retention.

- Benefit utilization data: Analyze data on the usage of current benefits. Low utilization of certain benefits might indicate they are not valued or well-understood by employees.

- Surveys and questionnaires: Conduct surveys or questionnaires to gather insights on employee satisfaction with the current benefits package and suggestions for improvements.

- Benchmarking: Compare your benefits package with industry standards and competitors. Employee feedback can be used to identify areas where your organization falls short or could differentiate itself.

Make benefits inclusive

Making employee benefits inclusive involves designing and offering a benefits package that caters to the diverse needs of all employees.

- Diverse employee input: Actively seek input from employees of various ages, genders, ethnicities, and other backgrounds to understand different needs and preferences.

- Cultural competence in benefits administration: Ensure that those administering benefits are trained in cultural competence to effectively support all employees.

Make personalization easy

Personalizing employee benefits can greatly enhance their value and appeal to a diverse workforce. Here are ways employers can make benefits personalization easy and effective:

- Flexible benefits plans: Implement a flexible benefits plan that allows employees to choose from a variety of options. This can include a 'cafeteria plan' where employees allocate a set amount of benefit dollars to the options they prefer.

- User-friendly technology platforms: Utilize technology platforms that allow employees to easily view, select, and change their benefits. Ensure these platforms are intuitive, accessible, and provide clear information about each option.

Communicate about benefits regularly

Regular communication about employee benefits is crucial for ensuring that employees are aware of and understand the benefits available to them.

- Welcome kits for new employees: Provide comprehensive benefits information in welcome kits for new hires. This should include detailed descriptions of all benefits, how to enroll, and who to contact for questions.

- Regular email updates: Send periodic emails updating employees on any changes or additions to the benefits package, reminders about enrollment periods, and tips on how to make the most of their benefits.

- Intranet or employee portal: Maintain an up-to-date section on the company intranet or employee portal where all benefits information is readily available, including FAQs, contact information for benefits providers, and instructional videos.

Measure and monitor benefits usage

Employers can measure and monitor the usage of employee benefits effectively through various methods.

- Data analysis and reporting: Utilize your benefits/compensation management software to track enrollment numbers and usage rates of different benefits. Regularly reviewing this data can provide insights into which benefits are most and least popular.

- Utilization reports from vendors: Request regular utilization reports from benefits providers. These reports often include detailed statistics on how employees are using the benefits, such as claims data for health insurance or participation rates in retirement plans.

- Cost analysis: Monitor the costs associated with each benefit. Comparing the costs to the utilization and perceived value can help determine the return on investment (ROI) of each benefit.

Setting Up Your Employee Benefits Package

Setting up an employee benefits package is a balancing act between the needs and preferences of employees with the organization's budget and goals.

Before getting into the nitty-gritty of benefits planning, it pays to develop a pay philosophy that outlines your organization's approach to rewarding employees for work and how work should be done.

Here's a step-by-step guide to establishing an effective employee benefits package:

1. Assess needs and preferences

Like with all business X employee projects, a good place to start is with the wants and needs of both.

- Analyze benefit utilization data: Asses enrollment numbers and usage rates of different benefits and request regular utilization reports from benefits providers.

- Conduct surveys: Gather feedback from current and potential employees to understand what benefits are most valued.

- Analyze workforce demographics: Consider the needs of your workforce, including age, lifestyle, and family status, to tailor your benefits package.

- Benchmark against industry standards: Research the industry and benchmark your benefits package with industry standards and competitors.

- Assess other HR metrics such as turnover, engagement, and absenteeism.

2. Define objectives

Determine what you want to achieve with your benefits package, such as attracting talent, improving retention, or enhancing employee well-being and productivity.

3. Budget planning

Establish a budget for your benefits package. Consider the total costs, including employer and employee contributions, and how these expenses will fit into your overall payroll budget. We’ve seen that the average is 29.6% of total compensation, but market research will come in handy here.

4. Research and select benefits

- Core benefits: Start with core benefits such as health insurance, retirement savings plans, and paid time off.

- Additional benefits: Consider adding other benefits based on employee feedback and your objectives, like dental and vision insurance, life insurance, flexible working hours, wellness programs, and professional development opportunities.

- Legal requirements: Ensure that your benefits package complies with all local, state, and federal laws.

5. Choose providers

Obtain quotes from several providers for each benefit. Consider factors like cost, coverage options, provider networks, and customer service.

It also pays to evaluate the administrative requirements and support each provider offers.

6. Design the enrollment process

Decide on the enrollment period and how employees will choose their benefits. Consider using a benefits administration platform or software to simplify the process.

7. Communicate with employees

Make a plan to communicate the details of the benefits package to all employees.

This will include information on what benefits are available, how they can enroll, and any costs associated with each option.

It’s also recommended to offer sessions and materials to help employees understand and make the most of their benefits.

8. Implement the benefits package

Work with your chosen providers to implement the benefits. Ensure all administrative processes are in place for enrollment, changes, and claims.

9. Monitor and evaluate

Regularly review the benefits package to assess its effectiveness and employee satisfaction and keep an eye out for any changes in laws and regulations that could affect your benefits.

10. Adjust as Needed

Be prepared to make adjustments to the benefits package based on feedback, changes in your workforce, and financial considerations.

Benefits Administration Technologies

Benefits management is a key HR responsibility and, for many, a full-time job. It involves a wide range of tasks including selecting appropriate benefits, negotiating with providers, ensuring compliance with laws and regulations, and open enrollment and claims processing.

Benefits administration software can significantly reduce the amount of administrative effort required to ensure benefit applications and employee data are handled in accordance with applicable laws and regulations.

Key features include:

- Built-in enrollment services

- Employee self-service portal

- Benefits broker buy-in

- Reporting and analytics

- Employee education and engagement.

For more, check out our pick of the best benefits administration software.

Further Resources

While pretty comprehensive, I wasn’t able to cover everything regarding employee benefits in this article.

Some further resources to help you develop and manage employee benefits effectively:

Join The People Managing People Community

For more employee benefits insights, join our supportive community of HR and business leaders sharing knowledge and best practices to help you grow in your career and make greater impact in your org.

FAQs

What are the four major types of employee benefits?

- Health insurance: This is one of the most important and valued benefits. Health insurance can cover a range of medical expenses for employees and often their families, including doctor visits, hospital stays, surgeries, prescriptions, and sometimes dental and vision care.

- Retirement plans: Retirement benefits, such as 401(k) plans in the United States, pension plans, and other savings programs, help employees save and plan for their retirement. Employers may offer contributions or matching funds to employee accounts as part of these plans.

- Paid time off (PTO): This category includes vacation days, sick leave, personal days, and holidays. Paid time off allows employees to rest, recover, or attend to personal matters without losing income.

- Life and disability insurance: These benefits provide financial protection to employees and their families in case of an unforeseen event. Life insurance policies pay a beneficiary in the event of the employee’s death, while disability insurance offers income protection if an employee is unable to work due to a disability.

When do employee select their benefits?

Employees can select or make changes to their benefits at or as a result of:

- Onboarding

- Annual open enrollment

- Qualifying life events such as marriage, death, loss of coverage, childbirth or adoption

- Offboarding