Mergers and Acquisitions (M&As) form part of many organization’s journeys and HR has a significant role in their success or failure.

Here, I’ll explore HR’s role in M&As and outline some key strategies and best practices that can help ensure a smooth and successful transition.

HR’s Role In Mergers And Acquisitions

To simplify, HR’s role in a merger or acquisition is to ensure that employees experience a “soft” and smooth transition post the M/A.

As discussed in my previous article on HR career paths, there are specialized HR M&A professionals. Their duties include:

- Due diligence process: Conducting due diligence on the human resources aspects of potential acquisition targets, including reviewing employee benefit plans, compensation, and performance management practices.

- Workforce planning: Developing workforce plans that address the impact of the transaction on the workforce, including identifying redundancies, retention strategies, key employees, and talent development plans.

- Compliance: Ensuring compliance with HR-related laws and regulations, including those related to benefits, compensation, and labor relations.

- Employee communication: Communicating with employees about the transaction, including its impact on their jobs and benefits, and answering questions and concerns.

- Change management: Managing the change process, including addressing resistance to change, communicating the benefits of the transaction, and developing a culture of integration.

- Cultural integration: Identify and align the cultures of the two organizations.

- Post-merger HR integration: Oversee the integration of HR systems, policies, and practices after the transaction has been completed, including ensuring a smooth transition for employees.

Whether it’s M&A HR or HR working on the M&A, they should both be heavily involved from start to finish and work closely with other senior leaders.

Mergers And Acquisitions Steps And Best Practices

A successful merger or acquisition is not guaranteed. Depending on which research you believe, anywhere between 50-90% of M&As fail to deliver the expected value.

Trying to ensure that the employees experience a smooth transition with minimal disruption to their day-to-day routine is no easy feat.

However, with careful planning and the right talent management initiatives in place, you will be able to ensure a successful M&A integration.

1. HR due diligence

First up, it’s HR’s job that any local compliance and legislation around M&A activities for employee terms and conditions are adhered to.

In some territories, you’re obligated to maintain the current terms and conditions of incoming employees.

The HR team should be aware and have access to all aspects of the incoming employee's terms, conditions, and policies.

Depending on the local laws in your state/country, you may need to ring-fence those terms and conditions and/or offer similar or higher-value benefits.

This could result in two different sets of policies and procedures for employees, which is a nightmare to administer (trust me I have lived through multiple).

The best advice I can give on this is to have a matrix outlining the different entitlements making it clear what the entitlement is and for whom.

Having all sets of entitlements in one place will make it easier to distinguish between the groups and deal with queries long after the M&A has been completed.

2. Thorough workforce planning

In any organization, like a jigsaw, all the pieces must together to work in harmony toward the bigger picture.

This is where workforce planning comes into effect.

You need to gather information on both workforces and review how they will fit into the new organizational structure.

As Alex Link mentions in his article on workforce planning, this process involves analyzing your current workforce and taking stock of their skills and capabilities.

You then develop strategies to ensure you “Have the right people in the right roles at the right time” to achieve the organization’s objectives.

On day 1 of the merger or acquisition, the priority is to ensure that everyone can continue working (access to emails, personal details on the system, etc).

However, long before this, during the pre-merger stage, the M&A team and relevant stakeholders should be involved in ensuring that the different roles will work in harmony post-merger.

To do this, the leadership and HR teams should carry out an analysis of both workforces.

At a high level, the process should look like:

- Analysis—reviewing the current workforce

- Forecasting—projecting the future needs of the organization

- Characterization—identifying potential gaps between the now and aims

- Concept—designing the strategy and structure to achieve goals

- Execution—carrying out strategy and accomplishing goals.

When carrying out this exercise, I’ve seen organizations use their grading structure as the foundation for categorizing the roles.

The incoming workforce is aligned to the grading structure and the business then forecasts for what will be needed.

It is important to be transparent about the logic used for the grading process. You should also allow employees to raise any issues and address them before the integration.

There will be some legacy processes and procedures that will still need to be administered until such time that it is no longer required. These should be noted during the workforce planning process.

For example, if post day 1 the incoming finance team will still be required to report based on the previous process or system, what will happen once this is no longer required?

These are the types of considerations that differentiate M&A workforce planning from regular workforce planning and will contribute to the overall complexity of the process.

Post the completion of the workforce planning stage, it should then be outlined to the employees how their roles with be affected going forward.

It’s important that employees are given the time to review their roles and teams going forward and that they also know the process for raising any questions they may have.

Workforce planning is a difficult process during normal times, and this is more pronounced for workforce planning during an M&A.

However, when done well, it will help reduce attrition, ensure that processes and procedures run efficiently, and ensure the organization achieves its overall goals.

3. Create a change management plan

Only one thing is certain about mergers and acquisitions and it’s that they’ll bring substantial change for some people.

As such, getting the change management element right is crucial to the success of the overall integration/transition.

When change is first introduced, employees' initial response is shock or denial. Then, once the reality has set it, anger or fear.

After the employees let go of what is being lost (absorbed or previous iteration of the company) the changes start to become accepted.

Once the change has been accepted fully then employees will start to feel committed and will embrace it.

As you can see from above, there are many emotions and stages that employees go through and they will go through this at their own pace.

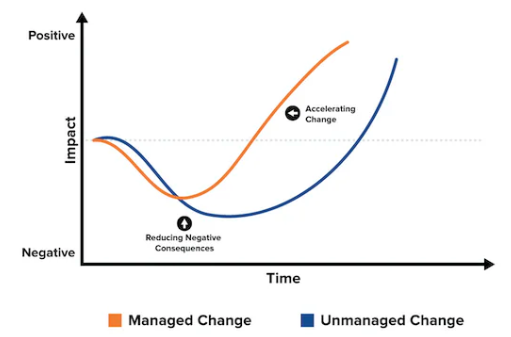

Figure 1 shows the impact of “managed” vs “unmanaged” change in organizations.

While change will be accepted by people over time, the differences lie in how they accept it and how committed they are in the longer term.

If unmanaged, the long-term effects could be negative employee engagement, low morale, demotivated staff, and higher levels of attrition.

I’ve been involved in multiple M&As and I can vouch for the importance of a proper change management process.

Some things to watch out for:

- Ensure that all stakeholders are onboard and aware of the change plan. This includes the timelines and the message that will be shared with the employees and by whom.

- Provide time and space for employees to digest the information. After being informed allow them to either stay and work or go home.

- There will always be “dissenters” no matter the plan. It’s best to deal with them individually and address any issues they may have.

- Avoid the “kicking the can down the road” approach. All issues should be transparently and completely dealt with during “pre-M&A”. Not doing this will lead to the employee believing that their issue will be addressed to their satisfaction when it might not even be possible according to the organization’s policies and procedures. Post M&A.

- Accept that not everyone will be happy with the M&A and that you may have increased attrition for a time after.

- Ensure leadership is also dealing with questions around the M&A. This should not just be left to HR, leadership needs to be front and center when dealing with questions and issues regarding the M&A. Having a united front will help to move the transition along smoothly.

For further change management tips, Bree Garcia’s excellent article covering HR change management is well worth a read.

4. Be transparent and communicate regularly

Communication is key to the success of an M&A.

As we’ve covered, employees going through an M&A can experience a level of stress and anxiety. The best way to support them is to open clear and transparent communication channels between the leadership team and the M&A team.

As with most things, timing is crucial.

You want to avoid employees finding out via other channels (media, rumor, etc.) as this will cause additional stress and anxiety.

It’s therefore important that people are given the key information as and when it’s taking place.

When communicating the M&A, it’s important to stress the reason and how it’s going to benefit not only the two companies involved but also the employees themselves.

This should be outlined to all employees by organizational leaders (whether separately or together will depend on the M&A).

Afterward, employees should be informed of who the M&A team is and who they can contact for questions.

Individual business leaders should also then speak with their departments/teams to cascade the message to their teams and facilitate any specific questions that employees have.

Formal structures aren't the only way to get the message to the employees. It’s helpful to also recruit “change agents” from the employee population who are in roles of influence or importance so that they can speak with the employees with a level of authority.

The change agents should be instructed on how to communicate the “change story” and where to escalate matters should they arise.

Employees knowing that at any time they can approach someone from these teams to ask questions can help.

5. Cultural integration

Graphic for this section I think

Culture is unique to each organization and the merger or absorption of one culture into another can be a challenging feat.

Below are some tips to ensure that the best parts of both cultures are integrated and that one culture is not overpowering the other.

Culture survey

In a recent interview, Caoimhe Keogan, Chief People Officer at Aveva, outlined how she utilized a culture survey to aid in their acquisition of another company.

The survey was completed by all employees and asked questions about how they get things done, how they see the organization, etc.

The survey highlighted that both companies share similar values but there was a difference in what they valued the most.

Company 1 had relationships as a priority within the company whereas Company 2 had results as a priority.

As a result, the leadership team went on to agree on the set of values and cultural styles that they wanted to implement in the organization.

This shows that rather than forcing together the cultures of two organizations and “hoping” it works out, organizations should take the deliberate approach to reviewing and analyzing the culture of their organizations and how best to integrate them.

Integration process

Once you’ve identified the elements of each culture, it’s important to follow up by creating/developing synergies between both companies.

While the system, process, and procedure integrations will be taken care of by the respective teams, the HR and leadership teams will need to prioritize the integration of the cultures.

This can be achieved by identifying how certain elements of each culture can help the “new” company grow and develop and then setting out the expected set of behaviors and traits that will further support and strengthen the “new” company.

Cultural artifacts (mission, vision, values, etc) can help to reinforce this further and encourage the new set of behaviors and traits.

Once this is agreed upon, the leadership should then set the plan to integrate these new traits and behaviors.

This can be done with different action plans, activities, and KPIs.

Business leaders should be accountable for driving this change, not just HR, and it should be a mix of “Hard” initiatives (KPIs, incentives, etc) and “Soft” initiatives (communications, celebrations).

The integration of cultures relies on lots of “seemingly” little interventions/actions that go a long way to supporting the overall success of the M&A.

Avoiding the underdog mindset

Time and again I’ve witnessed the negative effects of the “underdog” mindset held by employees during acquisitions in particular.

It can result in people feeling demotivated, disengaged, devalued and even rejecting the idea of the acquisition.

This is especially evident in acquisitions as one company is absorbing another.

This can result in the employees from the acquired company having the “underdog” mindset which can stem from the notion that the acquired company and its processes, people, and functions are less valuable because they were absorbed.

It’s vital that all employees (especially acquired employees) don't see this as business as usual.

The merger or acquisition should be sold as a new beginning that everyone is empowered to contribute and grow within.

HR Should Be First In And Last Out

When it comes to mergers and acquisitions, HR should be the first person in the room and the last to leave. If HR is not involved early in the M&A process this can result in missed opportunities.

There is no one-size-fits-all approach and there will always be one or two hiccups along the way. This should be accepted and success will be based on your reaction and flexibility to address these issues as they come up.

Recognizing and cultivating the “Human” element of the M&A deal is an essential aspect that can be easily missed in the negotiations and discussions around IP, processes, HR software, and systems.

Having gone through several M&As during my time in HR, I’ve seen how the little things (communication, messaging, change management, etc) can facilitate or hinder the M&A transition.

HR and leadership should be tied at the hip during the whole process with HR ensuring the employee voice is heard.

Join The People Managing People Community

For further advice on handling the delicate process of M&As, join our supportive community of HR and business leaders sharing knowledge and best practices to help you progress in your career and make greater impact in your organization.