10 Best Payroll Software & Services for Accountants Shortlist

Here's my pick of the 10 best software from the 17 tools reviewed.

Get free help from our HR software advisors to find your match.

There are several payroll software for accountants available, so identifying which tool stands out the most can be daunting. You're looking for a solution that streamlines your payroll processes, but you need to find the tool that matches your needs. I've got you covered! I'm here to guide you through the maze with my extensive background in HR software and workplace management tools, to present you with the best payroll software solutions.

Why Trust Our HR Software Reviews

We’ve been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different HR management use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

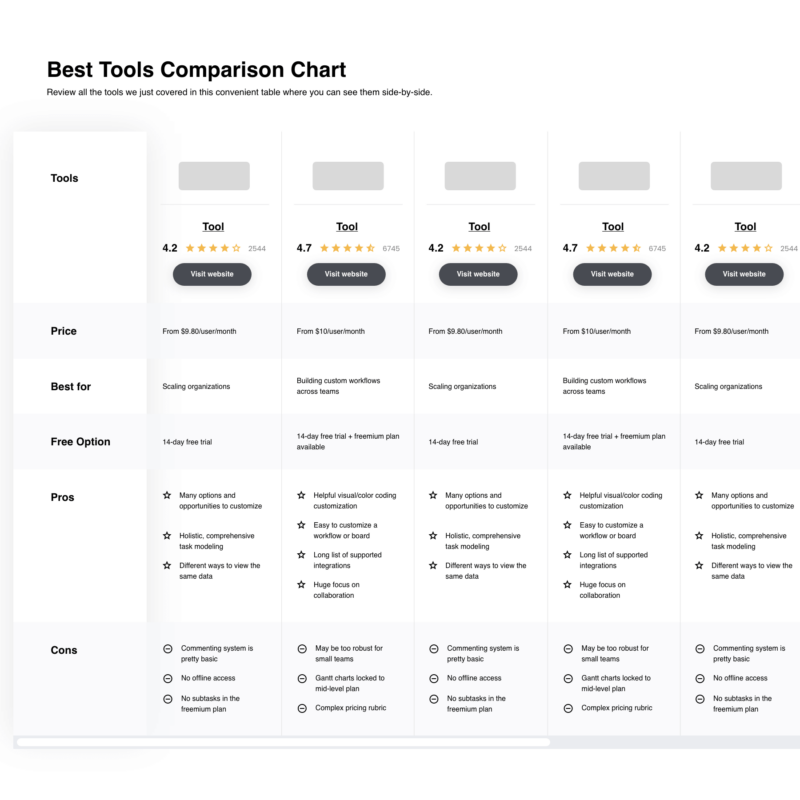

Best Payroll Software for Accountants: Comparison Table

This comparison chart summarizes pricing details for my top payroll software selections for accountants to help you find the best software for your budget and business needs.

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing | Website |

| Rippling | From $8/user/month | Website |

| FreshBooks | From $17 per month | Website |

| Gusto | From $40/month plus $6/staff member | Website |

| Namely | Pricing upon request | Website |

| Sage for Accountants | From $90/user/month (billed monthly) | Website |

| Patriot Payroll | From $4/employee/month + $17/month base fee | Website |

| ADP | Pricing upon request | Website |

| QuickBooks Payroll Elite | From $125/user/month (+ $10/employee/month) | Website |

| Paycom | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Payroll Software for Accountants

As you work through your own unique software selection process, keep the following points in mind:

- Compliance Management: Ensuring that the payroll software adheres to the latest tax laws and regulations is crucial. Accountants must deal with constantly changing tax codes and labor laws. A payroll system that automatically updates to comply with these changes can save accountants from the painstaking task of manually keeping track of legal requirements, thus reducing the risk of non-compliance penalties.

- Integration Capabilities: The ability to integrate with existing accounting systems and other HR software is a significant consideration. Accountants often work with a suite of financial tools and need payroll software that can seamlessly share data with these systems. This integration can help minimize errors and save time on data entry, which is especially useful during financial reporting and audits.

- Scalability: As businesses grow, their payroll needs become more complex. The chosen payroll software should be able to scale with the business. For accountants servicing clients of varying sizes or businesses planning to expand, software that can handle an increasing number of employees without a drop in performance is essential.

- User Experience: The software should be user-friendly and require minimal training. Accountants can face a steep learning curve with complex software, which can lead to errors and inefficiencies. A payroll system with an intuitive interface and clear guidance can help accountants process payroll more efficiently and accurately.

- Customization and Reporting: The ability to customize reports and payroll processes is vital for accountants who need to cater to specific client needs or industry standards. Payroll software that allows for the creation of custom reports can help accountants provide tailored insights to clients, which is particularly useful for strategic decision-making and financial planning.

Reviews of the Best Payroll Software for Accountants

Check out my comprehensive reviews to explore the strengths and weaknesses of leading payroll software for accountants. I’ll detail the features, benefits, and ideal scenarios for each platform to guide you in making an informed decision.

Deel is a comprehensive HR platform designed to help businesses manage their global teams with ease, offering solutions for compliance, payments, and payroll.

Why I picked Deel: I selected Deel because it provides accountants with a comprehensive solution that caters to the complexities of managing global teams. Its ability to automate payroll and ensure compliance with local laws across over 150 countries makes it an excellent choice for those who require a reliable system with integrated HR features all in one place.

Standout features & integrations:

Features include comprehensive payroll services like the ability to pay teams on time with one click, handle taxes, and offer benefits and payslips. Deel also supports global hiring with in-house visa support and the creation of compliant contracts, making it easier for companies to hire and manage employees and contractors across different countries.

Integrations include BambooHR, Hibob, Workday, Workable, Expensify, Quickbooks, Xero, Netsuite, Greenhouse, Ashby, OneLogin, Okta, and more.

Pros and cons

Pros:

- All-in-one HR capabilities

- Facilitates local benefits and payroll across different countries

- Ensures compliance with local labor laws

Cons:

- May take time to learn how to maximize the platform's features

- Potential migration delays

Rippling streamlines HR and IT systems into a single, cohesive platform. It is best for IT and HR integration, offering a unified solution that simplifies complex processes across both domains.

Why I picked Rippling: I selected Rippling for its standout capability to merge IT management and HR functionalities, which is a differentiator in the payroll software market. It has a comprehensive approach that allows accountants to manage employee data, payroll, and IT resources in one place, ensuring consistency and accuracy across systems.

Standout features & integrations:

Features include automatic tax calculation and compliance management. It also allows businesses to automatically set up and manage employee devices and apps as soon as they onboard, which ensures a secure and efficient start for new hires. Furthermore, Rippling offers detailed employee self-service portals that empower employees to manage their details, payroll information, and benefits, enhancing transparency and engagement.

Integrations include leading platforms like QuickBooks, Xero, Trello, Slack, Asana, and Salesforce.

Pros and cons

Pros:

- Comprehensive employee self-service features

- Enhanced data security with IT integration

- Unified management of IT and HR systems

Cons:

- Limited information on specific integrations without direct inquiry

- May be complex for smaller businesses that do not require IT integration

FreshBooks offers payroll software that integrates with its well-known accounting and invoicing tools, making it a great choice for small businesses and freelance accountants. It simplifies payroll processing while providing robust features for managing invoices and financial reports.

Why I picked FreshBooks: I chose FreshBooks because it excels in simplifying invoicing and financial management for small business owners, which often goes hand-in-hand with payroll tasks. It stands out from other payroll software because of its integration with the broader FreshBooks ecosystem, enhancing payroll and overall financial management. It also has a user-friendly interface and integrated invoicing functions.

Standout features & integrations:

Features include automatic tax calculations and filings to ensure compliance with federal and state regulations. The platform offers direct deposit and detailed pay stubs, helping businesses maintain transparency with their employees. Additionally, its robust reporting tools enable business owners to monitor payroll expenses and budget effectively.

Integrations include Gusto, Stripe, Shopify,Fundbox, Bench, Hubstaff, G Suite, Zoom, and among others.

Pros and cons

Pros:

- Effective handling of tax calculations and filings

- User-friendly for non-specialists

- Direct integration with FreshBooks accounting and invoicing

Cons:

- Annual commitment required

- Primarily beneficial for users already familiar with the FreshBooks ecosystem

Gusto simplifies payroll, benefits, and HR for accountants within a modern, automated platform. It’s recognized for delivering a contemporary payroll experience through its innovative features and user-friendly design.

Why I picked Gusto: I selected Gusto for its fresh approach to payroll management, which is well-suited to the evolving landscape of accounting services. Its emphasis on automation and ease of use makes it a standout choice. It adeptly integrates payroll processing with benefits and HR management, all within a platform that is both accessible and efficient for accountants.

Standout features & integrations:

Features include automated tax processing, seamless direct deposits, integrated time tracking, comprehensive compliance support, and actionable insights through reporting. Additionally, it offers robust tools for new hire onboarding, talent management, and benefits administration, which are essential for a holistic payroll and HR solution.

Integrations include QuickBooks, Xero, FreshBooks, TSheets, When I Work, Clover, Expensify, Receipt Bank, Trainual, and Homebase.

Pros and cons

Pros:

- Comprehensive suite of HR and benefits tools

- Intuitive user interface

- Automated tax filing and payroll processing

Cons:

- Advanced features are limited to higher-priced plans

- Transitioning from another system may be cumbersome

- Higher cost relative to basic payroll-only services

Namely is a comprehensive HR and payroll software specifically designed for mid-sized companies. It focuses on simplifying complex HR processes while providing tools for payroll, benefits, and compliance within one integrated platform.

Why I picked Namely: I chose Namely for this list because it stands out as a modern HR solution tailored for the finance industry, offering a secure platform with unlimited user roles and permissions. Its ability to reduce risk and provide actionable business insights makes it a top choice for mid-sized companies. Its comprehensive set of tools supports the entire employee lifecycle, from onboarding to performance management, all within a single, integrated platform.

Standout features & integrations:

Features include a user-friendly interface that centralizes employee data, payroll, benefits, and compliance information, making it easy to manage from a single platform. The software offers performance management tools, helping businesses engage and develop their workforce. Additionally, Namely’s mobile app allows employees and managers to access essential HR functions on the go, enhancing flexibility and productivity.

Integrations include major payroll providers, time-tracking applications, and benefits management platforms, including Bonusly, Culture Amp, Equifax, Greenhouse, Lattice, Lever, LinkedIn Talent Hub, NetSuite, Slack, Small Improvements, Workable, Worktango, and 15Five. Zapier can also be connected to configure additional integrations.

Pros and cons

Pros:

- Mobile access enhances flexibility and productivity

- User-friendly interface suitable for mid-sized companies

- Integrates HR, payroll, and benefits into a single platform

Cons:

- May require extensive training to fully understand all features

- Lack of transparent pricing information

- Can be cost-prohibitive for smaller businesses

Sage for Accountants is designed to support accounting professionals with payroll management capabilities and enhanced collaborative features. It enables efficient handling of payroll processes while offering comprehensive tools to facilitate teamwork among accounting teams.

Why I picked Sage for Accountants: I chose Sage for Accountants because it emphasizes collaborative features that differentiate it from other payroll software tailored to accountants. Its ability to integrate client and accountant workflows into a single platform makes it a standout choice. I believe it’s best for accountant collaboration due to its strong focus on interactive tools and shared access, enhancing transparency and efficiency in client communications.

Standout features & integrations:

Features include real-time data access, allowing both accountants and clients to view and manage payroll information simultaneously. The software offers advanced reporting capabilities that enable detailed financial analysis and better strategic planning. Additionally, the cloud-based nature ensures that the data is always up-to-date and accessible from anywhere, which is crucial for dynamic business environments.

Integrations include Microsoft Excel, Salesforce, Scoro, Xero, QuickBooks, Trello, Slack, HubSpot, Zapier, and Mailchimp.

Pros and cons

Pros:

- Cloud-based, enhancing accessibility and data security

- Advanced reporting capabilities

- Real-time collaboration features

Cons:

- May require initial training to maximize use

- High dependency on internet connectivity

- Might be overwhelming for solo practitioners

Patriot Payroll is a payroll processing software designed to be both affordable and simple to use. It stands out as the best option for those seeking a straightforward and cost-effective solution for payroll management.

Why I picked Patriot Payroll: I chose Patriot Payroll for this list because of its clear focus on providing a user-friendly experience at a competitive price point. In comparing it to other payroll software, Patriot Payroll's commitment to simplicity without sacrificing essential features is what makes it different. It offers a robust set of features that cater to the needs of small to medium-sized businesses without overwhelming users with complexity or hidden costs.

Standout features & integrations:

Features include an easy three-step payroll process, free setup, and unlimited payrolls. Users can make on-the-fly pay rate changes and have access to a free employee portal. The software also provides free direct deposit, the ability to track reported tips, and customizable hours, money types, and deductions.

Integrations include QuickBooks Desktop, QuickBooks Online, Patriot's Accounting software, and other tools for time and attendance, HR, and 401(k) management.

Pros and cons

Pros:

- Efficient tax calculation and payment functionalities

- User-friendly interface suitable for beginners

- Cost-effective pricing structure

Cons:

- Integration details are vague

- Limited advanced features for larger businesses

ADP offers robust payroll software tailored for accountants, providing comprehensive tools to manage client payroll and HR needs. It is a pivotal solution in consolidating payroll processes and compliance management into one streamlined package.

Why I picked ADP: I chose ADP because of its reputation for reliability and comprehensive service offerings that stand out among payroll solutions for accountants. What makes ADP different is its holistic approach to payroll and human resources, providing an all-in-one solution that handles everything from tax filings to employee benefits. It simplifies payroll tasks and supports broader HR functions, which are crucial for businesses looking to grow and manage their workforce.

Standout features & integrations:

Features include automatic tax calculations ensuring compliance with local, state, and federal tax laws, which is essential for accountants managing multiple clients. The platform also features customizable payroll reports, which help in making informed business decisions. Additionally, the integration of time and attendance tracking helps ensure accurate payroll processing, which reduces errors and saves time.

Integrations include QuickBooks, Xero, Wave, FinancialForce, Kashoo, Sage 50, Microsoft Dynamics, TSheets, ClockShark, and When I Work.

Pros and cons

Pros:

- Customizable reports aid in detailed financial analysis

- Automatic tax compliance reduces risk of errors

- Comprehensive HR and payroll solutions in one platform

Cons:

- May include features not necessary for smaller clients

- Can be complex to set up initially

- Pricing transparency could be improved

QuickBooks Payroll Elite is a comprehensive payroll solution designed for accountants looking to streamline payroll and integrate it with overall financial management. It offers tools for automated payroll processing, tax compliance, and employee management, all within a familiar QuickBooks environment.

Why I picked QuickBooks Payroll Elite: I chose QuickBooks Payroll Elite because it offers an exceptionally integrated experience with the broader QuickBooks accounting suite, which many accountants already use. This software stands out from other payroll services by providing deep integration capabilities that simplify the transition between payroll tasks and other accounting functions. It enhances productivity by allowing accountants to manage payroll within the same platform they use for other accounting tasks.

Standout features & integrations:

Features include tax calculations and filings, reducing the risk of errors and ensuring compliance. The service includes a time tracking feature, which integrates directly with payroll to streamline the payment process based on actual hours worked. It also offers same-day direct deposit, which is a significant benefit for businesses that need flexible payroll solutions.

Integrations include QuickBooks Online, QuickBooks Time, and Intuit Tax Online, Tsheets, Receipt Bank, Bill.com, Shopify, Square, and more.

Pros and cons

Pros:

- Same-day direct deposit available

- Automated tax calculations and filings

- Deep integration with QuickBooks accounting software

Cons:

- Annual billing may be a barrier for some small businesses

- Primarily beneficial for users already familiar with the QuickBooks ecosystem

- High starting price point

Paycom provides an all-in-one payroll solution that incorporates HR, talent acquisition, and time management within a single software system. This integration allows accountants and HR professionals to handle all employee management processes from one platform.

Why I picked Paycom: I chose Paycom for its ability to streamline multiple HR functions into a single software system, reducing the need for multiple tools and interfaces. This integrated approach not only simplifies the user experience but also enhances data accuracy and accessibility across departments. The platform eliminates redundancies and improves workflow consistency in managing employee data.

Standout features & integrations:

Features include an employee self-service portal that enables workers to manage their own HR tasks, such as time off entries and benefits management. It offers direct payroll processing, which is integrated with all other HR functionalities, ensuring accuracy and consistency across data. Additionally, Paycom's software facilitates compliance with automatic updates to meet changing tax codes and regulations.

Integrations include various business tools, enhancing its capabilities in areas such as employee scheduling, performance management, and benefits administration.

Pros and cons

Pros:

- Ensures compliance with up-to-date system adjustments

- Employee self-service feature reduces HR administrative tasks

- Unified platform simplifies management of HR tasks

Cons:

- Limited information on integration with external software

- Lack of transparency in pricing

Other Payroll Software for Accountants to Consider

Below is a list of additional payroll software for accountants that didn’t make it into my top 10 list, but are still worth checking out:

- Paychex Flex

Best for scalable payroll solutions

- Paycor

Best for HR data analytics

- OnPay

Best for flexible payroll services

- BrightPay

Best for UK-based businesses

- Accounting CS Payroll

Best for integrated accounting solutions

- Justworks

Best for benefits and HR tools

- SurePayroll

Best for automated tax filing

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other related tools that we've tested and evaluated:

- HR Software

- Payroll Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

Selection Criteria for Payroll Software for Accountants

Selecting payroll software for accountants involves a careful analysis of functionality and the ability to meet specific use cases that are crucial for accounting professionals. The criteria for choosing such software are directly related to the buyer's needs, addressing common pain points, and ensuring the software is tailored for the tasks it is intended to perform. I have personally tried and researched these tools, and my criteria for evaluation are based on features that are essential for payroll management in an accounting context.

Core Payroll Software for Accountants Functionalities (25% of total score): To be considered for inclusion in this list, each solution had to fulfill these common use cases first:

- Payroll processing and direct deposit capabilities

- Accurate tax calculation and filing of payroll tax forms

- Integration with popular accounting systems and bookkeeping platforms

- Compliance management with labor laws and regulations

- Reporting and analytics for payroll data

Additional Standout Features (25% of total score): To help me uncover the winners from the stack, I also kept a keen eye out for unique features, including the following:

- Innovative automation features that reduce manual entry

- Advanced security measures like multi-factor authentication

- Customizable payroll workflows tailored to various business sizes

- Integration with emerging technologies such as AI for predictive analytics

- Exceptional scalability options for growing businesses

Usability (10% of total score): To evaluate the usability of each system, I considered the following:

- Intuitive navigation and user interface design

- Clear and concise dashboard displays for at-a-glance information

- Streamlined processes that minimize the number of steps to complete tasks

- Mobile compatibility for on-the-go account management

- Visual clarity in reporting features for better data interpretation

Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Comprehensive training materials such as videos and documentation

- Availability of customizable templates for quick setup

- Interactive product tours to familiarize new users with features

- Support channels like chatbots and webinars for real-time assistance

- A clear roadmap for data migration and tool implementation

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- Availability of 24/7 support through various channels

- Responsiveness and resolution times of the support team

- Access to a knowledgeable and specialized support staff

- Proactive monitoring and alerts for issues

- Community forums or knowledge bases for peer-to-peer assistance

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- Transparent pricing models without hidden fees

- Comparative analysis of feature sets against price points

- Flexibility in pricing plans to suit different business sizes

- Cost-effectiveness of the software over the long term

- Free trials or demos to evaluate the software before purchase

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Consistency in positive feedback across multiple review platforms

- Testimonials that highlight the software's reliability and efficiency

- Critiques that provide constructive feedback for potential improvements

- Trends in customer satisfaction over time

- Real-world examples of how the software has benefited other accounting firms

Through this comprehensive and specific set of criteria, I ensure that the payroll software selected for accountants meets the standard requirements and provides additional value, ease of use, and expert support that accountants need to manage payroll effectively.

Trends in Payroll Software for Accountants in 2024

Here are some trends I’ve noticed in payroll software for accountants technology, plus what they might mean for the future of the online payroll industry. To uncover these trends, I sourced countless product updates, press releases, and release logs to tease out the most important insights:

- Increased Integration with Remote Work Tools: In 2024, payroll software has evolved significantly to accommodate the surge in remote work. Seamless integration with remote work management tools such as time-tracking and project management software has become commonplace. This integration ensures accurate payroll processing in real-time and minimizes discrepancies due to remote work setups. The direct connection between productivity tools and payroll systems simplifies the complexity of managing a geographically dispersed workforce, ensuring that payroll departments are always up to date with employees' working hours and activities.

- Enhanced Data Security and Compliance Features: As cyber threats have become more sophisticated, there has been a significant emphasis on enhancing the security features within payroll software. Advanced encryption protocols, two-factor authentication, and frequent security audits have become standard. Compliance updates are now more dynamic, with many platforms offering real-time updates to keep pace with changing tax laws and regulations globally. This functionality is vital for in-house accountants who manage payroll across different regions and need to ensure compliance with local laws to avoid hefty penalties.

- Adoption of AI for Predictive Analytics: Artificial intelligence (AI) has penetrated the payroll software sector, with many platforms now offering predictive analytics capabilities. These features allow accountants to forecast payroll costs and analyze trends based on historical data. AI-driven tools can also suggest optimizations for payroll management, such as the best times to hire or adjustments in wages based on economic forecasts. This novel application of AI in payroll software helps firms plan better financial strategies and maintain budget control.

- Employee Self-Service Portals: The demand for robust employee self-service portals has grown, reflecting the need for transparency and empowerment among staff. Modern payroll software now often includes portals where employees can view their pay stubs, track benefits, and manage their tax withholdings. This shift not only reduces the workload for payroll departments by delegating tasks to the employees themselves but also enhances satisfaction by giving employees more control over their payroll information.

These trends suggest a clear direction towards more integrated, secure, and intelligent payroll systems that cater to the needs of businesses and their remote or hybrid workforces. For accountants, staying abreast of these trends is crucial not only for selecting the right tools for their practice but also for offering informed advice to their clients on optimizing payroll operations.

What is Payroll Software for Accountants?

Payroll software for accountants is a specialized tool designed to manage and streamline the process of paying employees within a company. It automates the payroll process, reducing the potential for human error and saving time for managing employee compensation. It is essential for maintaining compliance with tax laws and labor regulations.

The software's key components such as tax calculation engines, databases for employee information, time and attendance tracking systems, and payment processing features, work in unison to deliver a comprehensive payroll management experience. The software typically offers reporting capabilities to assist financial analysis and compliance with governmental requirements.

Features of Payroll Software for Accountants

When selecting payroll software for accountants, it's essential to consider the features that will streamline payroll processes, ensure compliance, and provide robust reporting capabilities. Accountants require tools that not only simplify the calculation of wages and taxes but also offer integration with other financial systems. Here are the top features to look for in payroll software that can help accountants manage payroll effectively.

- Automated Tax Calculations: This feature ensures accurate withholding and payment of local, state, and federal taxes. It is crucial because it helps accountants avoid costly penalties associated with tax errors.

- Direct Deposit: By offering direct deposit, payroll software eliminates the need for manual check writing. This feature is important as it saves time and reduces the risk of errors in payment distribution.

- Integration with Accounting Software: Seamless integration allows for real-time data transfer between payroll and accounting systems. This feature is important for maintaining accurate financial records and streamlining the reconciliation process.

- Compliance Management: Payroll software should help accountants stay compliant with labor laws and tax regulations. This feature is important because it reduces the risk of legal issues and fines.

- Time and Attendance Tracking: Accurate tracking of employee hours is essential for correct payroll processing. This feature is important as it ensures employees are paid for the exact time they work.

- Customizable Payroll Reports: The ability to generate tailored reports is vital for analyzing payroll expenses and trends. This feature is important for strategic financial planning and decision-making.

- Employee Self-Service Portal: An employee portal allows staff to view payslips and manage personal information. This feature is important as it empowers employees and reduces the administrative burden on accountants.

- Multi-State Payroll: For businesses with employees in different states, this feature simplifies the management of varying tax rates and regulations. This feature is important for maintaining compliance with local taxes across state lines.

- Payroll Alerts and Reminders: Alerts help accountants stay on top of critical deadlines and changes in payroll. This feature is important for ensuring timely and accurate payroll processing.

- Data Security: Strong security measures are essential to protect sensitive payroll information. This feature is important because it safeguards against data breaches and maintains employee trust.

The features listed above are not just beneficial; they are integral to the successful management of payroll responsibilities. By choosing software that encompasses these capabilities, you can provide exceptional service and support to the businesses you serve.

Benefits of Payroll Software for Accountants

Payroll software for accountants offers advantages that streamline the complex and time-consuming task of managing employee compensation. These tools simplify the payroll process and ensure accuracy and compliance with tax laws and regulations. Here are five primary benefits that payroll software can provide to both users and organizations.

- Enhanced Accuracy: Payroll software automates calculations and data entry, which diminishes the chances of mistakes that can occur with manual processing.

- Time Savings: By automating routine tasks, accountants can focus on more strategic financial activities, thus optimizing their time and contributing to the overall efficiency of the organization.

- Tax Compliance: Payroll software is regularly updated to comply with the latest tax regulations, helping businesses avoid costly penalties associated with non-compliance.

- Data Security: With advanced security measures in place, payroll software ensures that confidential employee data is safeguarded against unauthorized access or breaches.

- Integrated Systems: Many payroll software solutions can integrate with other HR systems, providing a cohesive platform for managing all HR-related tasks, which enhances data consistency and reduces duplication of effort.

Advanced payroll software can help accountants and in-house finance teams significantly improve their payroll management. Leveraging these tools can provide a competitive edge, boost efficiency and accuracy, and support compliance and data security, all of which are critical components of successful business operations.

Costs & Pricing of Payroll Software for Accountants

Pricing for payroll software for accountants varies depending on the features, scalability, and level of support required. Providers typically offer several pricing tiers to cater to different sizes of businesses and their specific needs, from small firms to large enterprises. Understanding the available plan options will help you select the most appropriate software solution to streamline payroll processing efficiently while adhering to compliance standards.

Plan Comparison Table for Payroll Software

| Plan Type | Average Price | Common Features |

| Free Option | $0 per user/month | Basic payroll processing, tax calculations, limited reports, and customer support |

| Entry-Level | $20 - $40 per user/month | Payroll processing, tax filing, direct deposit, basic reporting, and customer support |

| Mid-Range | $40 - $80 per user/month | Enhanced payroll features, integrations with accounting software, advanced reporting, customer support |

| High-End | $80+ per user/month | Full-service payroll, HR management, compliance assistance, dedicated support, analytics |

| Custom/Enterprise | Quote-based pricing | Customizable features, enterprise-level support, global payroll capabilities, strategic integrations |

When considering a payroll software plan, it's essential to assess the specific needs of your accounting practice and the level of support and features you require. The right balance between cost and functionality will ensure that you can provide efficient and compliant payroll services to your clients.

Payroll Software for Accountants FAQs

Here are some answers to frequently asked questions you may have about payroll software for accountants:

What features should accountants look for in payroll software?

When selecting payroll software, accountants should prioritize features that streamline and automate payroll processes. Essential features include tax calculation and filing, direct deposit capabilities, garnishments, compliance management, and integration with existing time-tracking and accounting systems. Additionally, the software should offer detailed reporting and analytics to aid in financial planning and decision-making.

How does payroll software improve accuracy and compliance?

Payroll software improves accuracy by automating calculations for wages, taxes, and deductions, reducing the likelihood of human error. It ensures compliance by staying up-to-date with tax laws and regulations, automatically applying these updates to payroll calculations. This helps accountants avoid penalties associated with non-compliance.

Can payroll software handle multiple pay rates and schedules?

Yes, most modern payroll software can accommodate various pay rates and schedules. It can manage hourly, salary, contract, and freelance pay structures, as well as different pay frequencies such as weekly, bi-weekly, or monthly. This flexibility is crucial for businesses with diverse employment arrangements.

Is it possible to integrate payroll software with other HR systems?

Integration capabilities are a common feature of payroll software, allowing accountants to connect the system with other HR and accounting platforms. This integration streamlines data management and ensures consistency across all systems, facilitating a more efficient workflow.

What kind of support can accountants expect with payroll software?

Accountants can expect a range of support options depending on the software provider. This typically includes online resources, such as help centers and community forums, as well as direct support through email, chat, or phone. Some providers may also offer dedicated account managers or onboarding assistance.

How secure is payroll software in protecting sensitive data?

Payroll software is designed with robust security measures to protect sensitive data, including employee information and financial records. Security features often include data encryption, multi-factor authentication, regular backups, and compliance with data protection regulations.

Are there payroll software options suitable for small businesses or freelancers?

There are payroll software options tailored to the needs of small businesses and freelancers, which offer simplified features and pricing structures appropriate for smaller operations. These solutions still provide essential payroll functions while being cost-effective and user-friendly.

If your business uses Mac computers primarily, you’ll want to check out my list of the best payroll software for Mac too.

What is the cost range for payroll software, and are there any hidden fees?

The cost of payroll software varies widely based on features, the number of employees, and the level of support required. Prices can range from a few dollars per employee per month to several hundred dollars per month for advanced features. It’s important to inquire about any additional fees for setup, year-end reporting, or additional services to ensure transparency.

What’s Next?

Choosing payroll software for accountants involves consideration of your business’s specific needs and budget constraints. If the options seem overwhelming and you’re unsure which features will best serve your operations, consider reaching out to the vendors for a detailed demonstration. This provides clarity on how a particular software can address your payroll challenges effectively.

To remain up to date on all the latest in people management, subscribe to our newsletter for leaders and managers. You'll receive insights and offerings tailored to leaders and HR professionals straight to your inbox.