10 Best Payroll Software Shortlist

Here's my pick of the 10 best software from the 30 tools reviewed.

Get free help from our HR software advisors to find your match.

With so many different payroll solutions available, figuring out which is right for you is tough. You know you want to automate employee payments and reduce errors, but need to figure out which tool is best. In this post, I make things simple by leveraging my experience with both large and small teams using dozens of different payroll tools to bring you this shortlist of the best payroll software overall.

Why Trust Our Software Reviews

We've been testing and reviewing HR software since 2019. As HR professionals ourselves, we know how critical and difficult it is to make the right decision when selecting software.

We invest in deep research to help our audience make better software purchasing decisions. We've tested more than 2,000 tools for different HR use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent, and take a look at our software review methodology.

Best Payroll Software: Pricing Comparison Chart

This comparison chart summarizes basic details for my top payroll software selections. View pricing details and the availability of free trials or demos side-by-side to help you find the best software for your budget and business needs.

| Tools | Price | |

|---|---|---|

| Deel | Flat rate user pricing, with free HR tool for businesses | Website |

| Papaya Global | EOR from $650/employee/month or $2/contractor/month; Global payroll from $3 to $12/employee/month | Website |

| Rippling | From $8/month/user | Website |

| Remofirst | From $199/employee/month for EOR and $25/mo for contractors | Website |

| Paycor | From $5/employee/month + $99/month base fee | Website |

| Paychex Flex | From $39/month + $5/employee/month | Website |

| Bambee | From $99/month | Website |

| Trinet | Pricing upon request | Website |

| ADP Workforce Now | From $160/month for up to 49 employees | Website |

| ADP TotalSource | Pricing upon request | Website |

Compare Software Specs Side by Side

Use our comparison chart to review and evaluate software specs side-by-side.

Compare SoftwareHow to Choose Payroll Software

With so many different payroll software solutions available, it can be challenging to figure out which option would be the best fit for your needs.

As you're shortlisting, trialing, and selecting payroll software consider:

- What problem are you trying to solve - Start by identifying the challenges you're trying to overcome. This will help you clarify the key features and functionalities the payroll software needs to provide.

- Who will need to use it - To evaluate cost and requirements, consider who will use the software and how many licenses you'll need. You'll need to evaluate if it'll just be your HR professionals, select accounting staff, or entire departments that will require access. Once that's clear, it's also useful to rank the needs of your different users to identify your key priorities for your payroll power users to ensure they're met.

- What other tools it needs to work with - Clarify what tools you're replacing, what tools are staying, and the tools you'll need to integrate with, such as accounting, time-tracking, or HR software. You'll need to decide if the tools will need to integrate together, or alternatively, if you can replace multiple tools with one consolidated payroll software.

- What outcomes are important - Review the capabilities you want to gain or improve, and how you will measure success. For example, you may want to provide more flexible payment options for your employees, such as on-demand pay. You could compare payroll software features until you’re blue in the face but if you aren’t thinking about the outcomes you want to achieve, you'll waste a lot of valuable time.

- How it would work within your organization - Consider the software selection alongside your existing workflows and systems. Evaluate what's working well, and any problem areas that need to be addressed.

Remember every business is different — don’t assume that a payroll system will work for your organization just because it's popular.

Best Payroll Software Reviews

Here you’ll find my detailed overviews of the 10 best payroll solutions I’ve featured. Each overview has information about the platform’s best use case, standout features, and integrations. Plus, there are 20 additional options included below if you’d like even more choices to consider.

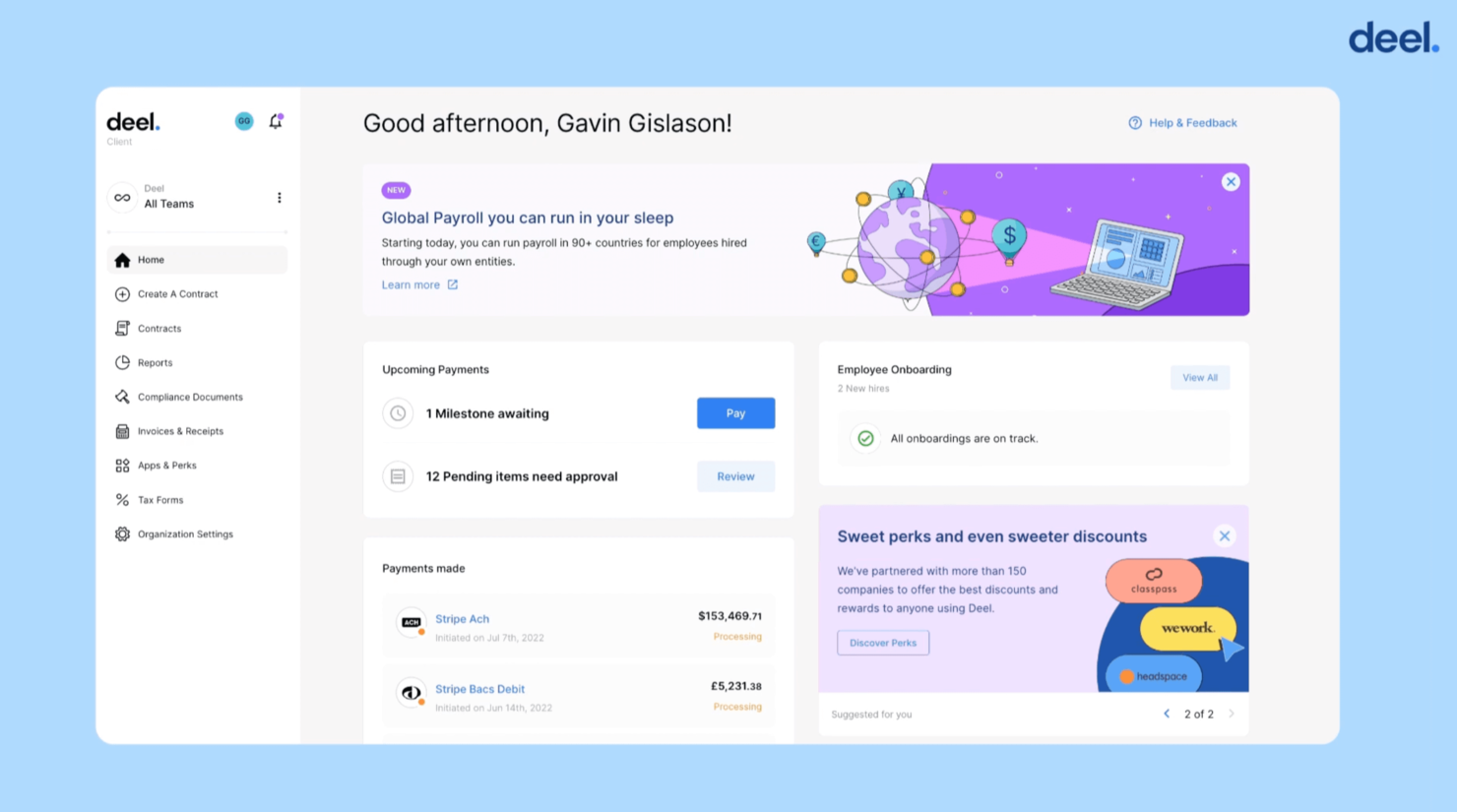

Deel is a global payroll platform that's available in over 150 countries. With Deel, you can hire and pay anyone as a contractor or employee without worrying about local laws, complicated tax systems, or international payroll.

Why I picked Deel: I chose this software because it provides end-to-end global workforce management, including contract adjustments, expense reimbursements, and off-cycle payroll adjustments. You can schedule payments in advance and run off-cycle payroll whenever needed. It's also worth noting that the company has local country experts working in-house to run global payroll and ensure all regional contributions are accounted for. Their team provides 24/7 online support, and dedicated account managers are available for specific requests.

Deel Standout Features and Integrations:

Standout features I noticed were the software's 10+ payment options, ranging from bank transfers to cryptocurrency pay-ins. What makes this stand out from other options is that employees and contractors can self-manage their pay and personal data, and use providers like Wise, PayPal, Payoneer, and Revolut for easy international withdrawals.

Integrations include Ashby, BambooHR, Expensify, Greenhouse, Hibob, NetSuite, Okta, OneLogin, QuickBooks, Xero, Workday, and Workable. The software’s open API can support additional custom software integrations.

Pros and cons

Pros:

- Add-ons available to localized benefits and global payroll

- Detailed dashboards

- Knowledgeable support staff

Cons:

- Contract templates could be simplified

- Limited invoice customization

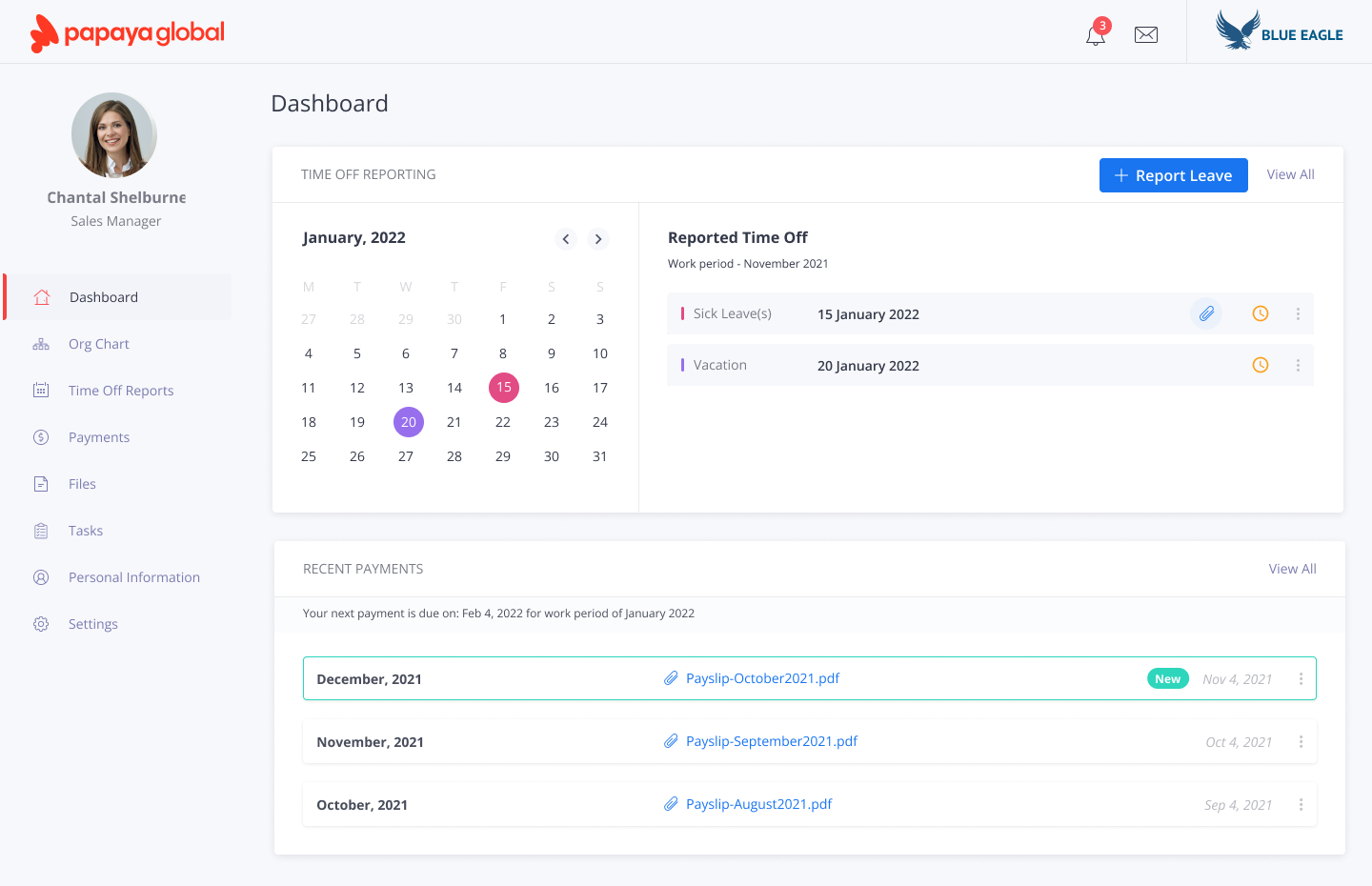

Papaya Global is an online payroll solution that helps companies remove barriers to global hiring. Their software provides end-to-end global workforce management with everything from onboarding to cross-border payments in over 160 countries.

Why I picked Papaya Global: This software covers all employee options (payroll, EoR, contractors) and can be used to send payments securely to remote and global personnel. I chose it because of its various payroll packages, which make it a flexible option for various business sizes and needs. The reporting and analytics tools offer detailed payroll and business intelligence, and give you a real-time view of your funds. Payment delivery is also guaranteed within 72 hours by the company.

Papaya Global Standout Features and Integrations:

Standout features include that its bank rails were built in partnership with JP Morgan and Citibank, which makes me confident in their reliability and compliance standards. Payroll anomalies and issues can be detected with the software’s artificial intelligence capabilities, which automatically notifies admins so they can address the problem swiftly.

Integrations include most financial tools, and HR software like BambooHR, Expensify, NetSuite, SAP SuccessFactors, and Workday. An API is also available to support additional custom integrations.

Pros and cons

Pros:

- Strong automation features

- Extensive knowledge base

- Payments can be made in virtually any currency

Cons:

- Employee profiles could be more detailed

- No mobile app is currently available

Rippling

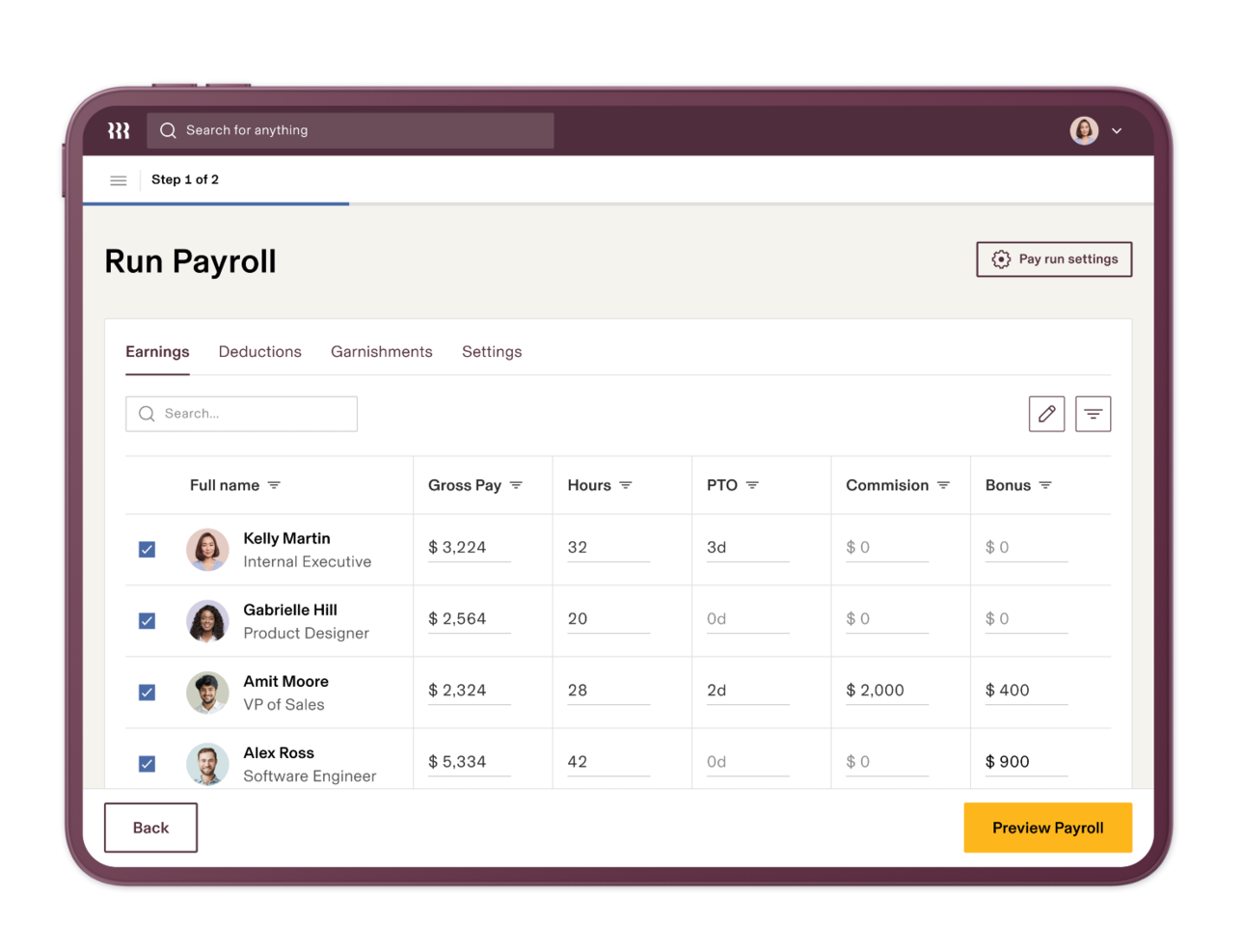

Best for USA and Canada-based payroll with tons of integrations

Rippling’s modern payroll system provides the robust functionality of legacy systems with the ease of newer systems to deliver the best of both worlds.

Why I picked Rippling: Rippling allows users to onboard new hires quickly and automatically, run payroll with a click, and pay employees or contractors, anywhere. Their system is built on centralized employee data, so businesses can automate all of the admin work that’s normally required to run payroll and update employee information.

Rippling Features and Integrations:

Features include domestic and international payrolls, an organization chart, expense management, talent management, local tax filing, country-specific compliance, and international benefits programs. Companies can also manage their employees’ offer letters, I-9s, health insurance, and time off.

Integrations are available with Google Workspace, Typeform, Databricks, BrightHire, Atlassian, Google Workspace, Slack, Checkr, Zoom, GitHub, Asana, 1Password, Zendesk, Dropbox, Sage Intacct, Netsuite, Microsoft 365, QuickBooks, DocuSign, Upwork, LinkedIn, and dozens more.

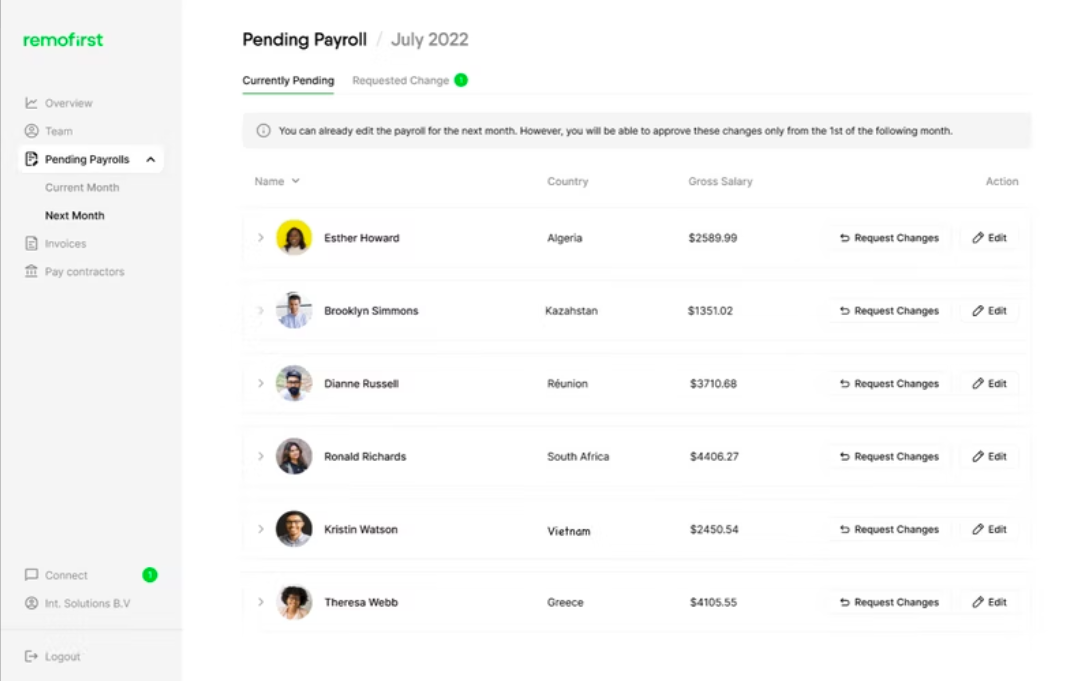

Best international payroll software for global teams in 170+ countries

Remofirst is a payroll software that provides users with a secure, efficient, and easy-to-use platform for managing payroll processes in 170+ countries. Users can input employee information, calculate taxes, and generate pay stubs. The software offers many features, including employee self-service, direct deposit, tax compliance, and reporting.

The software provides tools for managing employee shares and dilution, as well as for issuing specialized reports on equity and bonus activity. Its reporting feature allows users to generate detailed reports on their payroll data which can be generated for a specific period. The cost calculation feature helps businesses budget costs effectively by considering various factors, including the number of employees, the type of benefits provided, and the frequency of payments. Employees can also view their equity and bonus information in real time, and the system automatically calculates vesting schedules and payout dates.

Remofirst lets businesses manage employee benefits programs with ease. Users can track employee eligibility, enroll employees in benefits plans, and even change existing plans. It also allows businesses to generate employee enrollment and participation reports. Dashboards summarize team distribution and spending with visual graphs and charts.

Remofirst can also manage payroll and invoicing for businesses with employees abroad. The software automatically generates accurate paychecks and invoices in the local currency and tracks employee vacation days, sick leave, and expense reimbursements. Remofirst sends invoices every month, ensuring your employees are paid on time. Users can access a dedicated account manager and Remofirst's knowledge base to troubleshoot any issues.

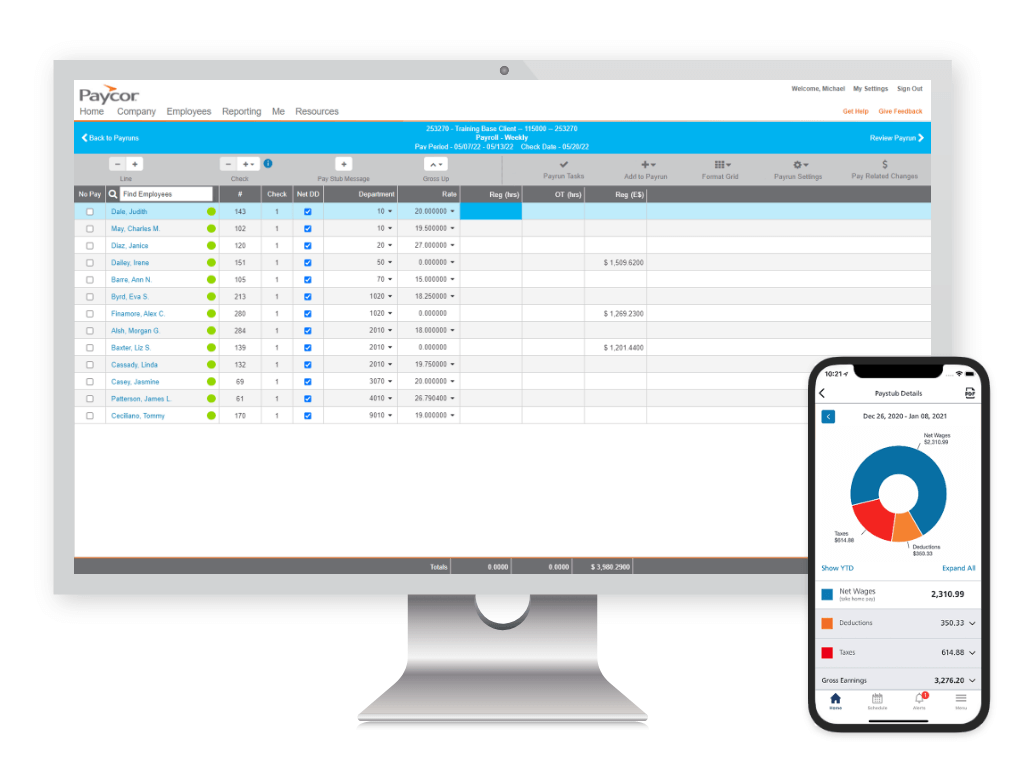

Paycor is a human capital management solution with payroll, workforce management, and employee experience features. The payroll product can handle payroll, expense management, time and attendance, and more.

Why I picked Paycor: Once I set up payment options for employees, I was able to use the automation features to run my payroll automatically, as scheduled for a specific day and time. Multiple payment options are available through the software, including direct deposit, paycards, or on-demand pay. It also provides in-depth compliance feedback to help you respect the employment laws in your state. Because of its robust functionality, I think it's best suited to large and enterprise businesses.

Paycor Standout Features and Integrations:

Standout features include its pay-on-demand feature, which allows employees to access their earned wages before their next official payday. I thought this was a modern functionality. It's also convenient that expense management, scheduling and time tracking, and employee experience monitoring are all also available in the platform.

Integrations include several other tools for wage and salary verification, expense management, employee wellness, certified payroll, and FMLA. Key software systems to note include Certify, ESR, Payfactors, and WageWorks.

Pros and cons

Pros:

- Mobile app allows for payroll management on the go

- Live and on-demand product training and industry webinars

- All-in-one solution well suited to enterprise businesses

Cons:

- UX can be a little clunky at times

- Time cards are a bit simplistic

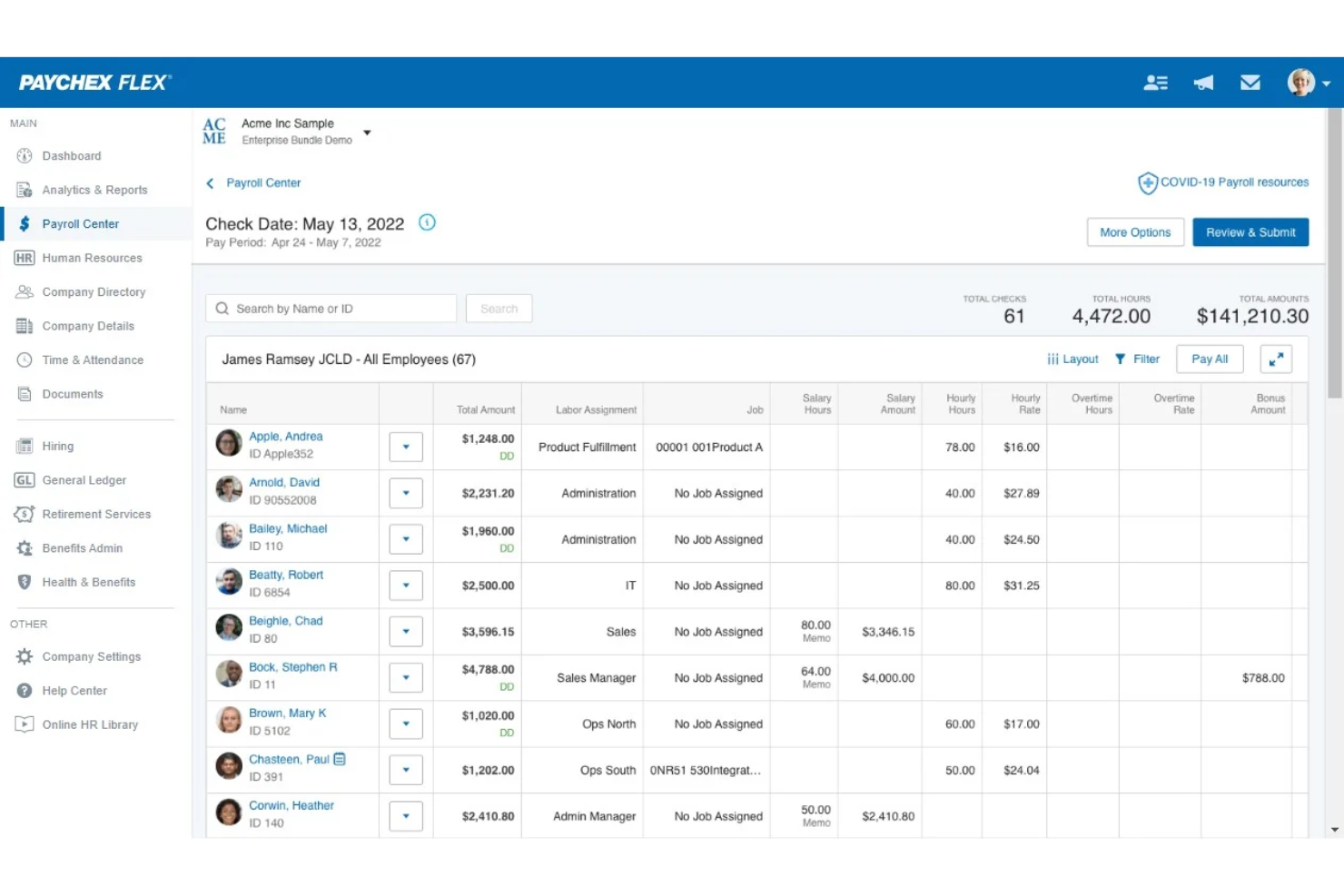

Best for streamlining payroll processing with accuracy, compliance, and ease

Paychex Flex is a cloud-based payroll and human resources management software designed to help businesses of all sizes manage their payroll processes, employee benefits, and other HR-related tasks. It's a comprehensive solution that aims to simplify and streamline the entire payroll process, making it easier for businesses to stay compliant with tax regulations and ensure their employees are paid accurately and on time.

Why I picked Paychex Flex: Paychex Flex enables you to track your team’s daily hours, manage time sheets, approve PTO, and oversee benefits in one place. The solution offers a self-service portal where employees can access digital copies of their pay stubs, see their contributions, and manage their retirement accounts, making it easy for them to access their data.

With Paychex Flex, you can schedule your payrolls and approve them before payday with ease. You can schedule multiple runs in the same pay period, and you can oversee your work on the mobile app. The solution also gives you access to extra HR features as add-ons for additional fees.

Paychex Flex Standout Features and Integrations

Features include payroll processing, payroll tax filing, a garnishment payment service, paycheck preview and approval, new-hire reporting, and a mobile app.

Integrations include Ashby, BambooHR, Clover, Deputy, HIREtech, iCIMS, Indeed, Oracle Netsuite, QuickBooks Payroll, and others.

Pros and cons

Pros:

- Helps you save time with payroll filters and saved views

- Knowledgeable representatives

- 24/7 specialized service for US clients

Cons:

- Automatically creates multiple subfolders, making it difficult to find the right files at times

- Adding pay categories could be easier

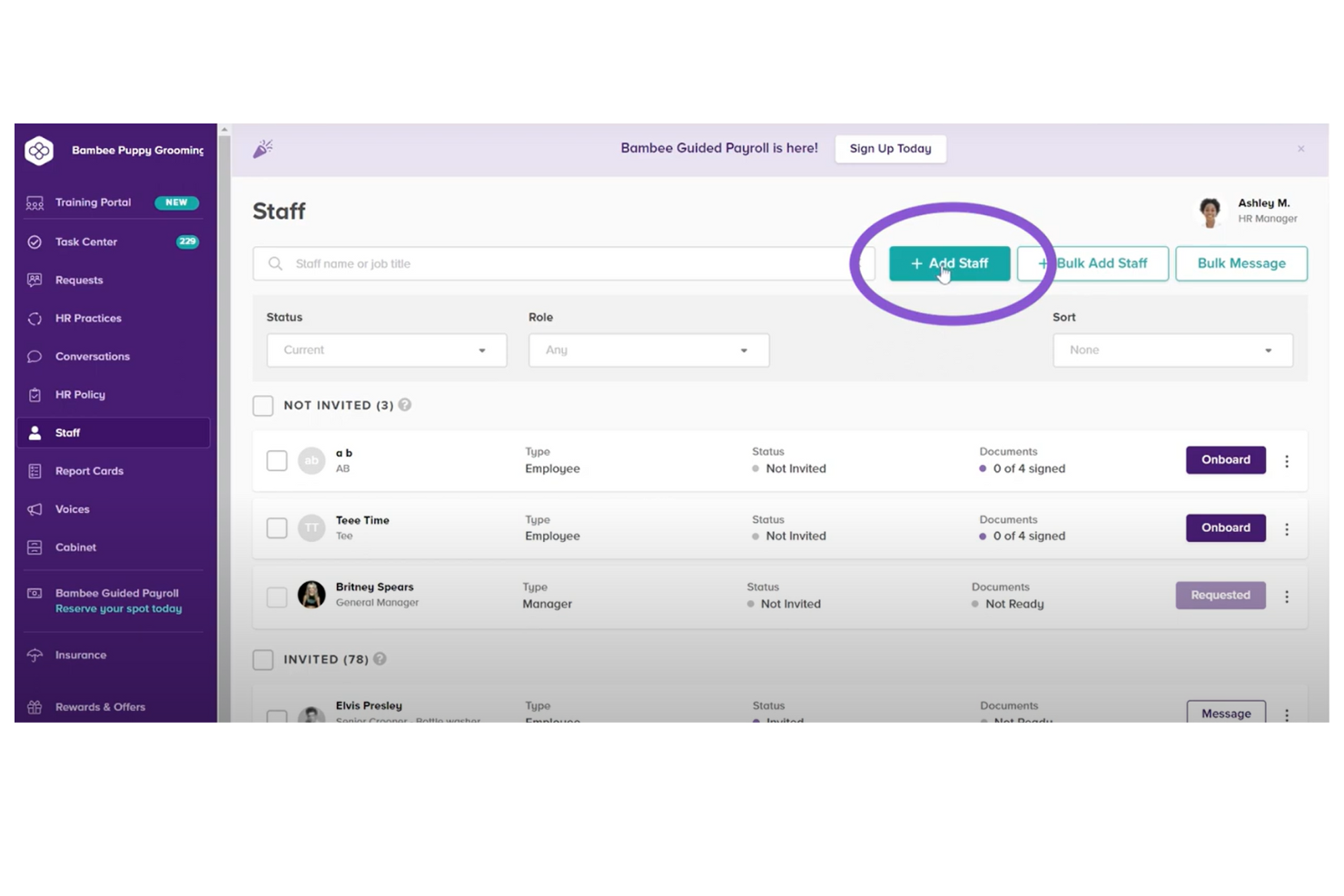

Bambee's cloud-based HR software is specifically tailored for small and medium-sized businesses. Their software covers a wide range of functions, including onboarding, compliance, and employee termination. They also offer a guided payroll service, which is available as an add-on.

Why I picked Bambee: I included Bambee's combined payroll software and expert services because of its ease of use and affordability. Their services cover a comprehensive set of payroll functions, including 2-day direct deposit, tax filings, and year-end reporting. In addition, Bambee also offers personalized support from HR experts, as well as a dedicated HR manager for every client, making it easier for businesses to navigate complex payroll regulations.

Bambee Standout Features & Integrations:

Features include 2-day direct deposit, integrated compliance monitoring, and automatic federal, state, and local taxes. They also provide businesses with guidance on payroll-related compliance issues, such as minimum wage requirements and overtime rules too. Their employee self-service portal also allows employees to view their pay stubs, manage their personal information, and request time off, all without having to contact HR, saving businesses time and resources.

Integration details are currently not available.

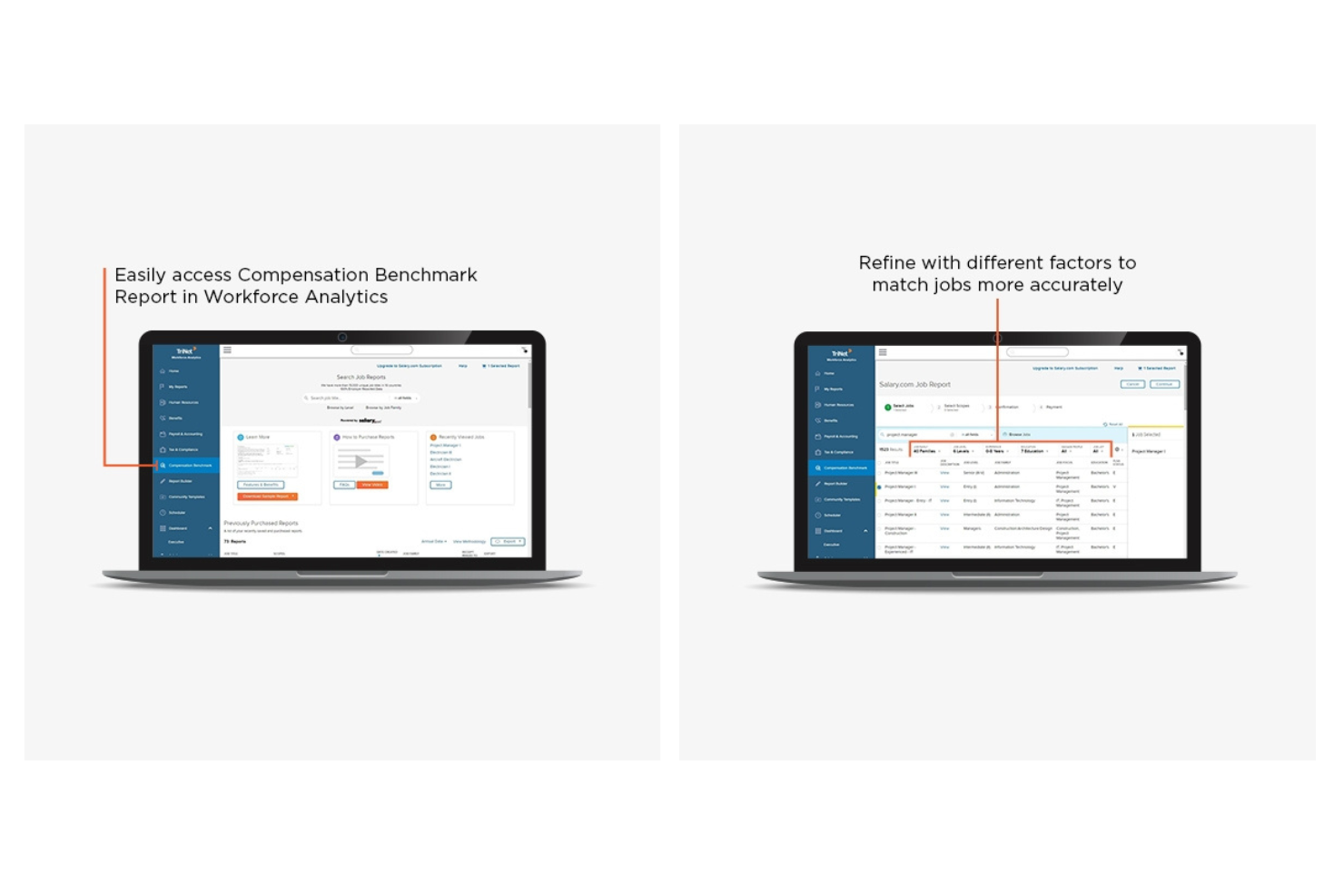

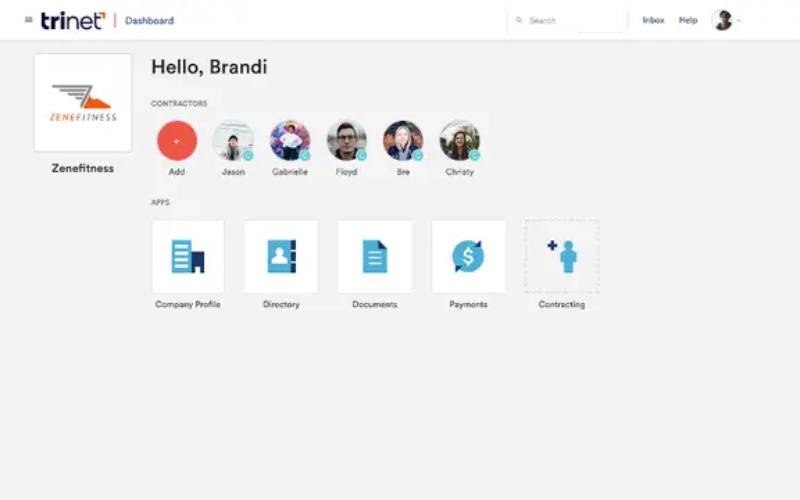

Trinet is a global payroll and HR software and service provider. It can help your organization manage various HR operations including payroll and employee benefits administration, performance and learning management, and risk mitigation.

Why I picked Trinet: I picked this platform because its payroll capabilities can handle complex regulations in several countries, making it suitable for global organizations or businesses operating in multiple locations. It can also manage worker's compensation claims, retirement plans, and employee benefits packages. Time tracking is included, which connects exact employee hours with their pay.

Trinet Standout Features and Integrations:

Standout features are definitely the software's compensation benchmarking capabilities, which stood out to me in my testing. The data is verified by Salary.com and covers 15,000 different job titles and 225 industries, helping you craft a better, more competitive compensation structure.

Integrations include QuickBooks, Oracle NetSuite, Sage Intacct, BambooHR, Lattice, Greenhouse Software, Carta, and Xero.

Pros and cons

Pros:

- Company provides HR consulting as well as software

- Centralizes all of your HR processes in one platform

- Global payroll management for multinational businesses

Cons:

- Full functionality may not be needed

- Robust system, comes with a learning curve

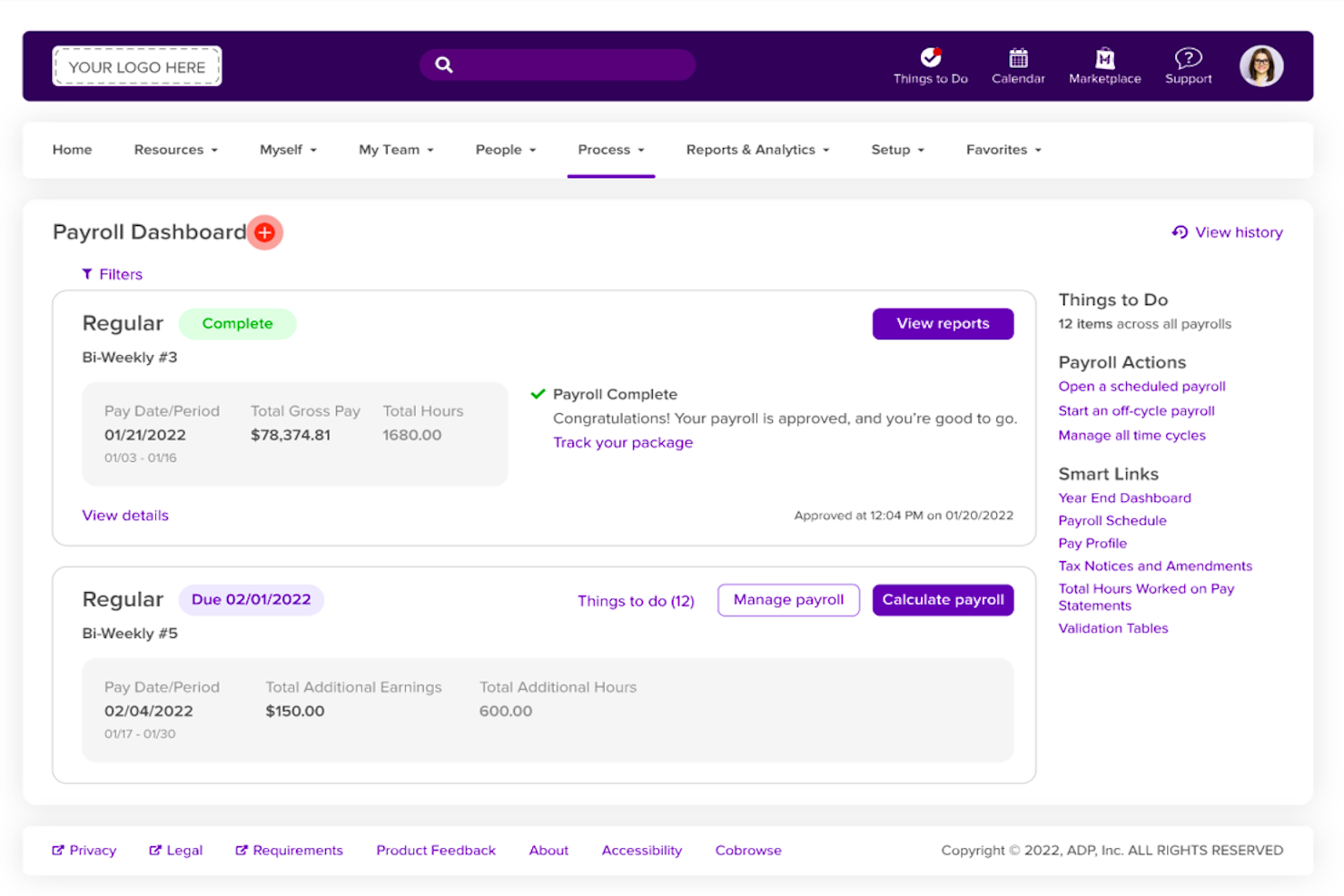

ADP Workforce Now is a human capital management software suitable for small- and medium-sized businesses (SMBs). ADP is a well-known and trusted HR software company with over 70 years of experience.

Why I picked ADP Workforce Now: This cloud-based software covers both payroll processing and benefits management as well as more general talent management functionality. I chose it because of its scalability, which makes it suitable for small- and medium-sized businesses. Payroll taxes are calculated automatically, and year-end tax forms are provided in the software. You can use the software to pay employees either by direct deposit or with physical cheques.

ADP Workforce Now Standout Features and Integrations:

Standout features include an add-on for time and attendance tracking, which links employee work hours directly to payroll. I also like that the software is also fully accessible on all web devices, and includes a mobile app. This means you can view employee pay history and compare pay periods side-by-side from any device.

Integrations include Absorb LMS, ClearCompany, ClockShark, Deputy, JazzHR, QuickBooks, Replicon, Sage, SAP SuccessFactors, Sapling, Workday, Xero, and ZipRecruiter, among others.

Pros and cons

Pros:

- Well-suited to SMBs compared to ADP TotalSource

- Highly customizable to suit your unique business needs

- Straightforward, easy to navigate interface

Cons:

- ADP offers multiple products, which can be confusing

- Some integrations are a bit clunky

ADP TotalSource is an all-in-one HR platform that offers payroll capabilities as well as benefits administration, hiring, and onboarding. HR services are also provided with the software from a team of experienced professionals.

Why I picked ADP TotalSource: It's nice when both employees and managers can easily gain access to the right payroll information, which is why I picked this software. Employees can access their paystubs and change personal information such as home addresses and direct deposit details from their self-serve portal. Managers, meanwhile, can monitor employees’ time and attendance, view current leave balances, create project codes for work activities, enter payroll data, and generate reports on overtime hours. The payroll module helps you process payroll and ensures compliance with local tax laws with a dedicated team of HR specialists.

ADP TotalSource Standout Features and Integrations:

Standout features include its automation capabilities for the entire payroll process, which I see as a real time-saver. You can calculate employee wages and taxes, create reports, and ensure compliance with federal and state laws automatically. The system can even send you automatic reminders when new laws are enacted or taxes are due, helping you stay up-to-date and compliant with the latest legislation.

Integrations include ClearCompany, ClockShark, Deputy, JazzHR, Lever, Microsoft Teams, NetSuite, QuickBooks, Sage, SAP Success Factors, Slack, Workday, and Xero, among others.

Pros and cons

Pros:

- Robust functionality suitable for enterprise businesses

- Friendly, easy to use interface for employers and employees alike

- Admins can make adjustments to information as needed

Cons:

- ADP offers many products, which can be confusing

- Setup can be time consuming

Other Payroll Software

Here are a few more options that didn’t make the best online payroll software shortlist. If you need additional suggestions for software to help you process payroll, check these out:

-

OnPay

Best payroll software for niche industries

-

Patriot Software

Best basic payroll software for US companies

-

Eddy

Best full-service payroll software including hiring and onboarding

-

PrimePay

Best payroll software for early wage access through paycards

-

UZIO

Best payroll software with integrated HR and benefits

-

Namely

Best all-in-one payroll software solution for SMBs

-

FinancePal

Best payroll management software for outsourcing

-

Wagepoint

Best payroll software for Canadian-based small businesses

-

Knit People

Best payroll software for startups

-

Remote

Best payroll and benefits for international teams

-

Buddy Punch

Best payroll software with integrated employee time-tracking

-

BambooHR

Best payroll software for employee self-service

-

Oyster HR

Best payroll software for hiring in 180+ countries

-

Insperity

Best payroll management software and services combined

-

Humi

Best solution designed by Canadians for Canadian SMBs

-

QuickBooks Payroll

Best payroll software for small businesses

-

Justworks

Best payroll software for both salaried and hourly employees

-

WebHR

Best global payroll provider with add-ons for applicant tracking and performance reviews

-

Epayroll

An Australian web payroll and employee management software provider with features for employee self-service included.

-

BrightPay

Easy-to-use payroll software that is desktop-based and is available for both Microsoft Windows and Apple Mac OS X.

Related HR Software Reviews

If you still haven't found what you're looking for here, check out these other tools that are related to payroll software, that we've tested and evaluated.

- HR Software

- Recruiting Software

- Employer of Record Services

- Applicant Tracking Systems

- Workforce Management Software

- Learning Management Systems

Selection Criteria for Payroll Software

Selecting the best payroll software for this list required a thorough understanding of how common pain points can be alleviated by choosing the right software. My approach to selecting the best systems for this list is grounded in thorough research, recent payroll software market data, and my personal experience maintaining payroll details within a human capital management system for numerous years.

Here’s a summary of the selection criteria I used to develop this list of the best payroll software:

Core Payroll Software Functionalities (25% of total score): To be considered for inclusion in my list of the best payroll software, each solution had to offer the following functionalities first:

- Automated calculation of wages and taxes

- Payment processing including direct deposit for employee paychecks

- Compliance with federal, state, and local tax laws

- Tools to generate and distribute employee pay stubs and tax forms

- Digital pay stubs that are accessible to employees through a self-service portal

- Integration capabilities to sync data with time tracking and other HR systems to reduce manual data entry

Additional Standout Features (25% of total score): To help me uncover the best payroll software out of the numerous options available, I also took note of any unique features, including:

- Sophisticated features, such as pay-on-demand or earned-wage-access

- Advanced analytics and reporting capabilities

- Customizable payroll workflows

- Integration with a broader range of HR and financial systems, including bookkeeping systems and benefits administration systems for health insurance

- Enhanced security features, such as multi-factor authentication

Usability (10% of total score): To evaluate the usability of each payroll system, I considered the following:

- An intuitive design and user-friendly interface that simplifies complex processes and requires minimal training to master

- Quick access to essential features without overwhelming users

- A user-friendly mobile experience or dedicated mobile apps for Android and iOS mobile devices

- Role-based access control that's straightforward to configure

Customer Onboarding (10% of total score): To get a sense of each software provider's customer onboarding process, I considered the following factors:

- Quick setup processes and clear guidance for first-time users, including customizable templates

- The availability of training materials such as videos or interactive tutorials

- Support systems like chatbots and webinars to guide new users through the initial learning curve

- Support for migrating historical employee data into the new platform

Customer Support (10% of total score): To evaluate the level of customer support each vendor offered, I considered the following:

- The availability of multiple support channels, including email, phone, and chat

- The existence of a self-service knowledge base, FAQ repository, or other self-help resources to speed up troubleshooting

- The overall quality, responsiveness, and helpfulness of the support team during customer onboarding and post-purchase, as inferred from customer reviews

- Whether the company offers a dedicated account manager, full-service payroll services, or any additional HR support services

Value for Price (10% of total score): To gauge the value of each software, I considered the following factors:

- The availability of free trials or demos to test the software before purchasing

- Transparent pricing models that clearly explain which payroll features are included at each level, with no additional hidden costs for training or set-up

- Tiered pricing plans that cater to different business sizes, from small to medium-sized businesses (SMBs) up to large businesses and enterprise-level organizations

Customer Reviews (10% of total score): Evaluating customer reviews is the final element of my selection process, which helps me understand how well a product performs in the hands of real users. Here are the factors I considered:

- Whether a product has consistently high ratings across multiple review platforms, indicating a broad level of user satisfaction

- Specific praises, criticisms, or trends in customer feedback that indicate the software's strengths or areas for improvement

- Whether customer feedback specifically mentions issues with ease of use, customer support responsiveness, or lacking features

- Any testimonials that highlight how a platform solved a particular challenge or adapted to changing payroll needs

By using this assessment framework, I was able to identify the payroll software that goes beyond basic requirements to offer additional value through unique features, intuitive usability, smooth onboarding, effective support, and overall value for price.

Trends in Payroll Software for 2024

If there's one aspect of people management that absolutely everyone cares about, it's making sure that payroll is working properly. Therefore, staying aware of the latest payroll software trends is crucial.

These trends not only streamline operations but also address key concerns for HR professionals, from ensuring compliance with various labor laws to offering flexible payment methods to employees. Here are four emerging trends that resonate with the needs and challenges of payroll professionals:

- AI-enhanced payroll processes: Many payroll systems now use artificial intelligence (AI) to automate routine tasks, detect anomalies, monitor compliance, reduce errors, and save time. This advancement in payroll technology is a response to the increasing complexity of payroll regulations and the ongoing need for precision, helping to make payroll processes more efficient.

- Integration with financial wellness tools: Another growing trend in payroll software is the integration with financial wellness tools that help employees track their earnings and receive personalized financial advice. This trend underscores the shift towards providing a better experience by helping employees enhance their awareness and knowledge of personal financial management practices.

- Global payroll management abilities: As businesses become more global, the need for payroll software that can manage multi-country payroll across different currencies has become crucial. Tools like Papaya Global and Deel have emerged as leaders in this space, offering solutions that simplify the complexity of global payroll, tax, and compliance issues.

- Enhanced data security features: As new cybersecurity threats continue to emerge, payroll software providers have added enhanced data security features to help organizations protect sensitive employee data, such as two-factor authentication, or biometric identification features.

- Mobile accessibility: The shift towards mobile accessibility in payroll software caters to the increasing trend of remote and hybrid work environments. Despite seeming like a small detail in the grand scheme of your business, making payroll software accessible from mobile devices is an important part of improving the user experience for your employees and your HR team.

These five trends in payroll software reflect the ongoing challenges and needs of HR and accounting professionals, including compliance monitoring, providing a better employee and user experience, improving payroll efficiency, and managing a global workforce.

What is Payroll Software?

Payroll software is a tool that allocates employee pay based on hourly rates or annual salaries. It's used by HR and finance teams to track employee work hours, pay rates, vacation accruals, paid time-off, payroll taxes, payroll deductions (like federal and local taxes), and more.

The primary purpose of payroll software is to streamline paying employees accurately and on time while ensuring tax compliance.

Features of Payroll Software

Here's a list of the standard payroll software features you can expect to find in modern payroll systems:

- Automated payroll processing: The software must be able to process your employee’s pay, including automatically calculating wages, deductions, and taxes. This eliminates manual errors and saves time, making the process more efficient.

- Direct deposit: Pretty much all payroll software allows employers to pay their staff directly into their bank accounts. This eliminates paper-based processes and provides a better experience for employees and payroll staff.

- Tax compliance forms: Compliance requirements require payroll software to prepare year-end tax forms for employees, such as W2's or T4's.

- Customizable payroll reports: The ability to customize your payroll reports to track payroll taxes, employee deductions, and other expenses can help with budgeting and financial forecasting.

- Data management: Payroll software typically includes an employee database to store key details such as salaries or hourly rates, position levels, emergency contacts, social insurance numbers, and other employment details.

- Unique payment options: This might be unlimited payroll runs or pay-on-demand options to make payments between designated pay days.

- Time-tracking: Especially for hourly workers, having timesheets and scheduling built into your payroll system can really streamline your processes.

- Compensation management: This includes being able to track different pay rates (salary, hourly, overtime, vacation pay, PTO, etc.). It can also mean tracking salary increases over time.

- Self-service employee portals: These portals allow employees to proactively access and update their own personal information, access pay statements, and submit time off requests or expense reports. This is an important feature since it simultaneously empowers employees and reduces demands on your HR staff.

- Analytics: Dashboards, graphs, and reports to analyze payroll data to gather insights about your staff. These analytics support your organization’s workforce planning efforts.

Benefits of Payroll Software

Payroll software offers several benefits for organizations as a whole, and for those who use the software regularly to manage payroll processes. As you're evaluating the different options for payroll software, understanding these main benefits is key to making an informed decision.

- Time and cost efficiencies: Since payroll software automates many elements of the payroll process, it can significantly reduce the amount of time and effort required to complete payroll tasks, especially if your staff are currently relying on manual calculations for some aspects. This efficiency then translates into cost savings, as it reduces the amount of manual labor required.

- Improved compliance monitoring accuracy: By automatically updating with the latest tax rates and regulations, cloud-based payroll software reduces the risk of compliance-related issues due to incorrect payroll calculations.

- Enhanced data security: Payroll software offers secure data storage, encryption, and role-based permissions to restrict access to sensitive employee data to only those who need it, which is a significant improvement over manual payroll processes or paper-based data storage.

- Integrated reporting & analytics: Payroll software is often one module within a larger HR management system, allowing users to generate reports on more than just payroll data. For example, you may also be able to run reports to assist with financial planning, budgeting, and decision-making, or monitor details such as employee hours worked during key times to predict future demand.

- Employee self-service portals: By empowering employees to access their pay statements, tax documents, and personal information, you'll reduce the administrative demands on your HR staff, freeing them up to work on other tasks. Employee portals also give your staff more control over their personal details, providing a smoother experience for simple tasks such as changing addresses or updating bank account details.

For more details on each of these benefits plus others, read our detailed breakdown of the benefits of payroll software.

Costs & Pricing for Payroll Software

As you explore the different payroll options on the market, it's important to understand the range of plans and pricing structures that are available. Payroll software varies in price depending on the type of payroll services and features that are included. Often, you’ll pay a monthly base fee and an additional fee for every active employee on your payroll register.

Plan Comparison Table for Payroll Software

| Plan Type | Average Monthly Fee | Average Price per Employee | Common Features |

| Free | $0 | $0 | Basic payroll processing for a limited number of employees, basic tax calculation, and limited reports. |

| Basic | $10 - $25 per month | $2 - 4 per employee, per month | Payroll processing for a limited number of employees, basic tax filing, standard reports, employee self-service portal |

| Professional | $25 - $40 per month | $4 - $6 per employee, per month | Multi-state or province payroll, additional reports, HR features, compliance report + all the features in Basic. |

| Advanced | $40 - $60 per month | $5 - $8 per employee, per month | Customizable reports, advanced HR tools, integrations, enhanced security + all the features in Professional. |

| Enterprise | Custom pricing | Custom pricing | Scalable for a large number of employees, dedicated support, advanced analytics, custom integrations + all features in Advanced. |

| Global Payroll | Usually priced per employee | $199 - $500 per employee, per month | Ability to pay employees in multiple currencies, international direct deposit, international compliance monitoring, dedicated support + required Basic features or higher. |

Some software also has a one-time set-up fee ranging from a couple of hundred to a couple thousand dollars.

If you’d like to explore this in more detail, take a look at my breakdown of payroll costs including hidden fees.

New & Noteworthy Product Updates

Below, I've summarized the most recent release notes and product updates for my top payroll software recommendations. Discover what’s now possible through new feature releases, improvements, and updates for web, desktop, and mobile apps. Learn what’s new, if it’s hot—or not, and why it matters for payroll.

April 2024: Payroll Software Updates

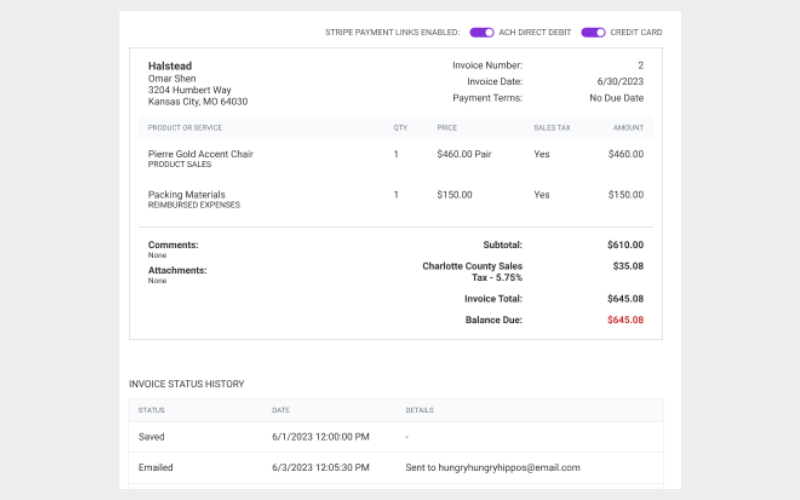

Patriot Software Update Notes

On April 15, 2024, Patriot Software introduced a new integration with Stripe ACH for payments on client invoices. This update allows users to offer an ACH payment option directly on invoices, simplifying the payment process, enabling faster processing times, and reducing transaction costs associated with ACH payments compared to other methods.

This integration not only enhances user experience by making payment processes more efficient but also helps in managing cash flows more effectively, since invoice payments are updated in real time.

Verdict: Hot! This is a helpful and flexible new payment option for businesses that invoice clients frequently.

March 2024: Payroll Software Updates

Deel Update Notes

On March 4, 2024, Deel announced its largest acquisition yet—PaySpace, a cloud-based payroll and HR platform from Africa that serves over 14,000 customers in 44 countries. This acquisition is part of Deel's strategic move to strengthen its service offerings across various international markets, helping Deel facilitate smoother operations for global companies.

The acquisition not only expands Deel's geographical footprint, but also enhances its product stack, allowing the company to offer more comprehensive and integrated HR services. This strategic move is expected to bring significant benefits to Deel's existing and new clients by providing a more robust platform capable of managing diverse workforce needs efficiently.

Verdict: Hot! This acquisition gives Deel direct control of legal entities and local teams of legal and HR payroll experts across more countries, expanding their coverage.

February 2024: Payroll Software Updates

ADP Update Notes

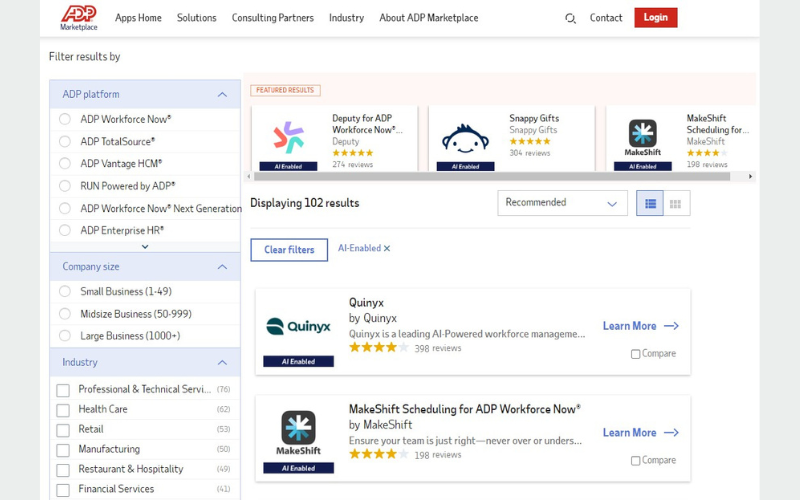

On February 22, 2024, ADP announced an upgrade to its ADP Marketplace, their digital HR storefront with over 800 partner solutions. With this update, ADP Marketplace now offers AI-enabled partner solutions, with all partners required to commit to ADP's responsible AI principles to be included.

The new features uses machine learning to help companies easily identify best-fit partner applications according to their specific HR needs. All partners featured in ADP Marketplace must agree to abide by the same AI principles as ADP, including guidelines around human oversight, monitoring, explainability, and mitigating bias.

By integrating with AI-enhanced solutions, ADP Workforce Now users can access solutions covering core HR functions, including recruiting and onboarding, compliance, time and attendance, performance, and more. In addition, ADP's strict partner participation policies gives users peace of mind knowing that the integrations offered are stable and secure.

Verdict: Hot! ADP users can comfortably extend the reach of their ADP products and leverage the power of AI-backed tools with confidence that the integrations are high quality.

Rippling Update Notes

On February 12, 2024, Rippling established a new headquarters in Sydney to expand into the Asia-Pacific market, supporting growth and local business needs through its integrated platform.

To support its expansion into this new market, Rippling enhanced its features to match the Australian regulatory framework, ensuring compliance with local HR standards like Modern Awards (a document that states the minimum entitlements Australian employees receive) and superannuation (workplace pensions, and other tax-related aspects specific to Australia).

For Rippling's users, this expansion into the APAC region provides localized support and services and signifies their commitment to catering to global business needs.

Verdict: Hot for Australian-based businesses! With this update, Australian companies will find it easier to achieve compliance while benefiting from a local support team.

Paycor Update Notes

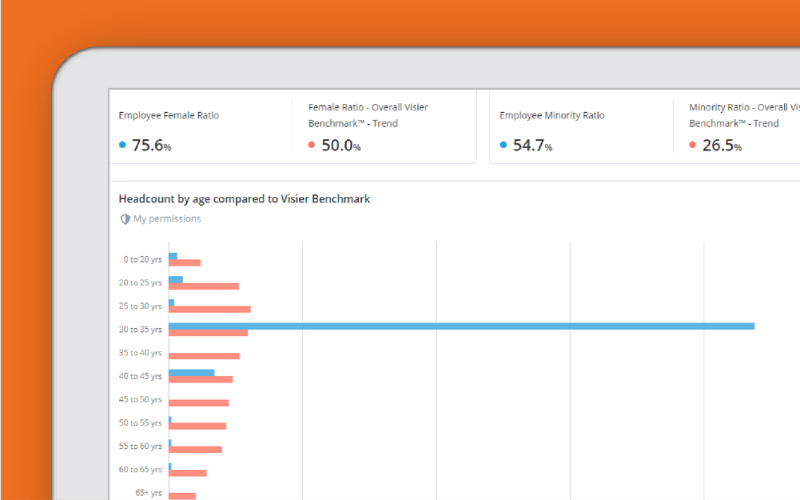

On February 6, 2024, Paycor announced the launch of two innovative tools: Pay Benchmarking and Labor Forecasting. These tools are designed to aid HR and business leaders in making more informed decisions around compensation and workforce planning.

Pay Benchmarking helps leaders base compensation decisions on up-to-date market data and industry standards, ensuring fair and competitive pay rates. As part of this update, Paycor regularly refreshes salary data for approximately 10 million jobs across the US, with data acquired through a partnership with Visier. In addition, the new Labor Forecasting tool helps businesses create optimal staffing schedules that align with anticipated business demands, improving operational efficiency and customer service.

By incorporating these tools, businesses can achieve pay equity, and optimize labor management, which are both critical to maintaining a competitive edge in today's dynamic market environment.

Verdict: Hot! These new additions to Paycor's software will help leaders arm themselves with information and make better decisions as a result.

Paychex Flex Update Notes

In February, 2024, Paychex Flex introduced a new product to supplement their payroll software called HR Analytics Premium to help teams transform their HR data into actionable insights. This new product feature specifically provides guided analysis on workforce distribution and costs, turnover, retention, and pay.

This new product is designed to assist HR professionals with data-driven decision-making, providing users with a deeper understanding of their workforce dynamics. As a result, users will gain the knowledge needed to optimize their HR operations while staying competitive in the market. (Note that compensation benchmarking data will be introduced later in 2024.)

Verdict: Hot! While this product doesn't directly impact payroll processing, gaining the ability to analyze key metrics, including payroll costs, is always a good thing.

January 2024: Payroll Software Updates

Trinet Update Notes

In January 2024, Trinet announced a new Contractor Payments feature for Trinet PEO clients, making it possible to process payments for independent contractors. As part of this update, clients can also onboard independent contractors, store their tax documents, set payment schedules, and generate Form 1099-NECs through this new module.

Specifically, the update introduces an optimized workflow for initiating, tracking, and processing payments for independent contractors. It includes a more intuitive user interface that simplifies navigation and makes it easier to access essential functions like payment status tracking and contractor information updates. Furthermore, it integrates additional payment methods and currencies to cater to a global workforce.

This enhancement significantly adds value to users by reducing the time and effort required to manage contractor payments. It improves accuracy and compliance with financial regulations, and the expanded payment options make it more convenient for users to handle international transactions. This update ensures a more efficient, flexible, and streamlined payment process, supporting better management of a diverse and global team of contractors.

Verdict: Not hot. While this is a good feature, the scope is also narrow — paying US-based contractors — which won't be useful for all businesses.

Payroll Software Frequently Asked Questions

Do you have general questions about how payroll software works or how to choose the right system for you? Take a look through these answers to frequently asked questions to get yourself oriented.

Who uses payroll software?

Payroll software is considered both an HR solution and a form of finance and accounting software. It’s designed to simplify payroll workflows for both accounting and human resource departments. As such, it’s commonly used by both payroll administrators and HR professionals in tandem.

For a more thorough analysis, read our explanation of who should handle payroll.

What is the most popular payroll software?

It’s hard to gauge the most popular payroll software overall, but cloud-based payroll software and global payroll software are definitely on the rise. According to Deloitte research, 74% of companies are currently using cloud-based payroll technology. In addition, the global payroll market was valued at $5435.88M USD at the end of 2021 and is expected to reach up to $8,447.91M USD by the end of 2027.

If you’re interested in finding out which systems have the highest user adoption rates, the big names like ADP, NetSuite, QuickBooks Online, or Xero always stand out due to their large user base and strong brand recognition. However, all the payroll providers in this list are also worthy of consideration. Sometimes the biggest isn’t always the best.

If you’re interested in drilling into specific companies, take a look at my best payroll company recommendations as well.

Which payroll software is best for small businesses?

Are you a small business owner looking for a payroll system that works with a tight budget? If so, don’t fret! Plenty of software providers have multiple pricing tiers to cater to the needs of businesses of all sizes. Many also offer free trials and some even have free plans so you can try before you buy.

If you’re looking for payroll software for a small number of employees, take a look at my recommendations for the best payroll software for small businesses as well.

What is same-day payroll?

Same-day payroll (also known as pay-on-demand, on-demand pay, or real-time pay) is a new style of paying employees that shortens the traditional waiting period between their work day and pay day. It rose to popularity during the COVID-19 pandemic as millions of workers suddenly needed access to their earnings in order to cover their basic household expenses.

While many payroll providers can support this type of flexible pay, additional fees may be charged to the company or employee. Companies may choose to put restrictions on any same-day payment services to limit their financial risks and liabilities.

What's the difference between cloud-based vs. on-premise payroll software?

The terms “cloud-based” and “on-premise” refer to how a payroll system is set up and hosted. Cloud-based payroll software is hosted on external servers and accessible through the internet. It is the preferred software configuration for most organizations. However, on-premise payroll software may be a better fit for an organization with proprietary data concerns or other restrictions that require more control. With on-premise systems, the software is installed and run from a server within the organization’s offices.

Cloud-based payroll software is generally easier to use. You can access it from anywhere, including mobile devices. Software updates and data backups are handled by the hosting payroll provider. They will keep your software up-to-date, and you can lean on their customer support for additional support as needed. It is suitable for businesses looking for flexibility, accessibility, limited maintenance, and lower initial costs.

On-premise payroll software requires more internal resources from your organization, including installation on each computer that needs access, and dedicated IT staff to troubleshoot any issues that arise. Your organization would be responsible for updating the software as needed, and ensuring your payroll data is sufficiently backed up. It is more appropriate for organizations that prefer having direct control over their data systems and have the necessary IT infrastructure to maintain it internally.

What integrations are the most important for payroll software?

Based on my personal experience reconciling and updating employee data for payroll, the most important integrations for payroll software are:

- HR Management Systems: If your payroll software is separate from your HRIS, HRMS, or HCM system, you’ll want to ensure your employee data is deeply integrated. That means, if you make a change to an employee’s compensation level in your HR management system, it will automatically update your payroll system as well.

- Time Tracking Software: Many payroll systems have time-tracking features within them, which is the new gold standard. However, I can tell you from personal experience, it is very problematic if your timesheet system doesn’t automatically integrate with your payroll tool. I’ve been in this position, and it required many hours of manual data reconciliation between each system prior to each payroll run. Avoid this situation at all costs!

- Benefits Administration Software: Since the monthly costs of some employee benefits can change, having an integration set up between your benefits administration system and your payroll system is also very helpful. I’ve experienced a world without this integration, and it required a lot of manual cross-checking as well.

- Expense Reporting Software: If your organization deals with a lot of employee expenses, you’ll want to push for an integration with your expense reporting software too. This will also cut down on manual data entry and allow you to incorporate your expense reimbursements into your next payroll run easily.

What data security features are included in payroll software?

Payroll software houses a lot of personal identifying information (PII), including your employees’ names, addresses, contact information, social security or SIN numbers, and personal bank accounts. Here are some of the security features in place to safeguard your payroll data:

- Data encryption: This includes encryption for data that is transmitted as well as stored.

- Multi-factor authentication (MFA): This requires users to complete two or more verification steps to ensure their identity.

- Role-based access control (RBAC): This feature allows system administrators to restrict system access to specific user-based roles within the organization (e.g., payroll administrator, payroll clerk, HR administrator, etc.).

- Regular software updates and patches: These are initiated by the payroll software provider to ensure their software is always up-to-date.

- Secure data backups: Cloud-based backups should be captured regularly in case your information needs to be restored after a data loss event. Off-site data backups can also offer added security too.

- Audit trails: This is a running record of all changes made to payroll data, in case of future discrepancies or unauthorized changes.

What kind of compliance monitoring features are built into payroll software?

Payroll software offers many built-in tools to manage compliance with regional employment laws and regulations. Here’s a list of the most common compliance-related features you can expect to find within payroll software:

- Tax withholdings and filings, including at the federal, state, and local level

- Overtime payment calculations that comply with federal, state, and local laws

- Employee classification tools to determine if a worker should be an employee or independent contractor

- Accurate historical record-keeping for payroll and benefits administration, as required by laws

- Wage garnishment and deduction tools that comply with legal limits

- Equal pay and anti-discrimination monitoring tools

- Leave entitlement accrual tracking that complies with legal requirements

- Year-end tax reporting tools

- Compliance with data security and privacy regulations, e.g., GDPR and others

- Compliance with government bodies like the IRS or CRA

- Workers’ compensation requirements

To learn more, hop over to our comprehensive guide on payroll processing.

How does payroll software accommodate different employment types?

Many payroll software providers accommodate different employment types through features like variable pay structures, customizable deductions, and contributions for each type of employee. For example, they might offer the ability to set different pay rates for full-time versus part-time employees, manage contractor invoicing and payments separately from regular employee payroll, and automate the calculation of overtime, commissions, or bonuses based on predefined rules.

These functionalities cater to businesses that employ a mix of permanent, temporary, and freelance staff, ensuring accurate payroll processing while complying with varying tax and employment laws. This flexibility is particularly beneficial for companies with diverse staffing models, enabling them to manage payroll complexities efficiently.

Can payroll software handle multiple currencies for global teams?

Some payroll software is capable of handling multiple currencies offers features like automatic currency conversion, compliance with local tax regulations, and customizable payroll elements for each region. This is essential for businesses with employees in different countries, allowing them to:

- Pay salaries in the local currency

- Adhere to regional employment laws, and

- Manage tax obligations accurately.

Such software simplifies the complexity of international payroll, making it easier for companies to expand globally while ensuring that their payroll operations are compliant and efficient across various jurisdictions.

Additional Payroll Software Reviews

Want to check out our other reviews related to payroll software? Here are a few more:

- Automated Payroll Software

- Payroll Software for CAD Businesses

- Payroll Software for Small Businesses

- Payroll Services for Small Businesses

- Free Payroll Software

Modernize Your Payroll Process

There are plenty of payroll software options available, and each one is a bit different from the next. That's why understanding the core functionality of these platforms equips you to pick the right one for your business needs.

Your payroll software will be a foundational pillar in your suite of HR tools, so it's important to choose wisely. As John Boitnott, Inc. journalist, said:

"Money isn't the only thing that motivates someone to perform well at their job, but it certainly factors in heavily."

That's why it's worth it to invest in advanced payroll software that satisfies all your business needs, including compensation and salary benchmarking features.

Stay in Touch

Before you go, stay in touch by subscribing to our People Managing People newsletter. We cover everything from how to master your payroll challenges, to how to develop modern compensation packages to retain your top talent. Plus, it's delivered to your inbox for free each week.

If you're interested in taking things one step further, consider joining our People Managing People community. By signing up, you'll join a community of like-minded people leaders who are passionate about building happy, healthy, and productive workplaces.